82 ASX Tech Companies Have Under 12 Months Runway

It’s a good time to look at the cash runway of ASX-listed tech companies.

Now that most companies have published their results for the financial year, we can see where everyone is at after a fair bit of turbulence.

Get analysis like this in your inbox. Insights to help you invest and manage.

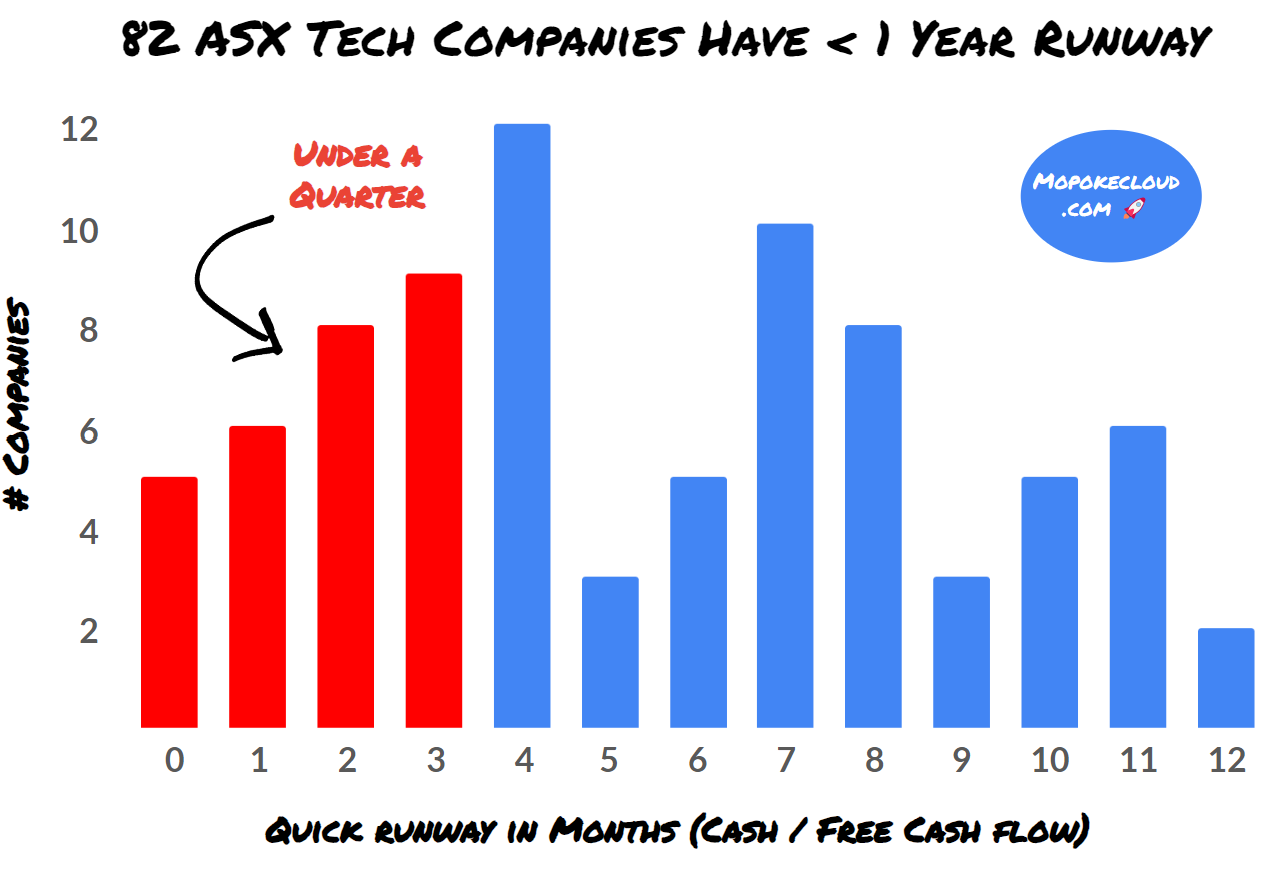

Surprisingly, 82 tech companies listed on the ASX have under one year of runway, and 22 of these might not have enough cash to make it through a quarter. Of these:

90% are making losses

31% of these are running at a loss with declining revenue.

58% have growing revenues but are making losses.

Let’s take a look at this cohort of low-runway companies.

We will cover:

What is Runway?

Breakdown of Low Runway Companies

By Revenue Growth and Profit

By Customer Segment

By Industry

Let’s get into it.

What is Runway?

Runway is a term used in venture-backed startup land to express how long a company has until it needs to get profitable or raise another round. It’s typically measured in months.

The simplest way to look at it is to take your cash at the bank and divide it by how much net cash goes out each month (“monthly burn” for the tech bros). I call this “Quick Runway”.

Quick Runway skips debts, receivables, and other income you might have. It also doesn’t look at future income. However, it still gives you a quick way to see how much runway you have. It works for tech startups in particular because they often have little debt.

By not looking at future income you also take a conservative view. This helps with early and scaling companies because forecasts aren’t always reliable. For example, the go-to-market activities may not produce consistently or the business model may be undergoing change.

In general, venture capitalists advise startups and scaleups to have more than 18 months of runway This timeframe allows you time to raise your next round and work through your strategic objectives.

It’s this measure that we will use to quickly assess ASX-listed tech companies. We’ll apply the simple formula of Cash divided by Free Cash Flow.

Breakdown of Low-Runway Companies

In this section we’ll look at the low runway companies from a variety of angles.

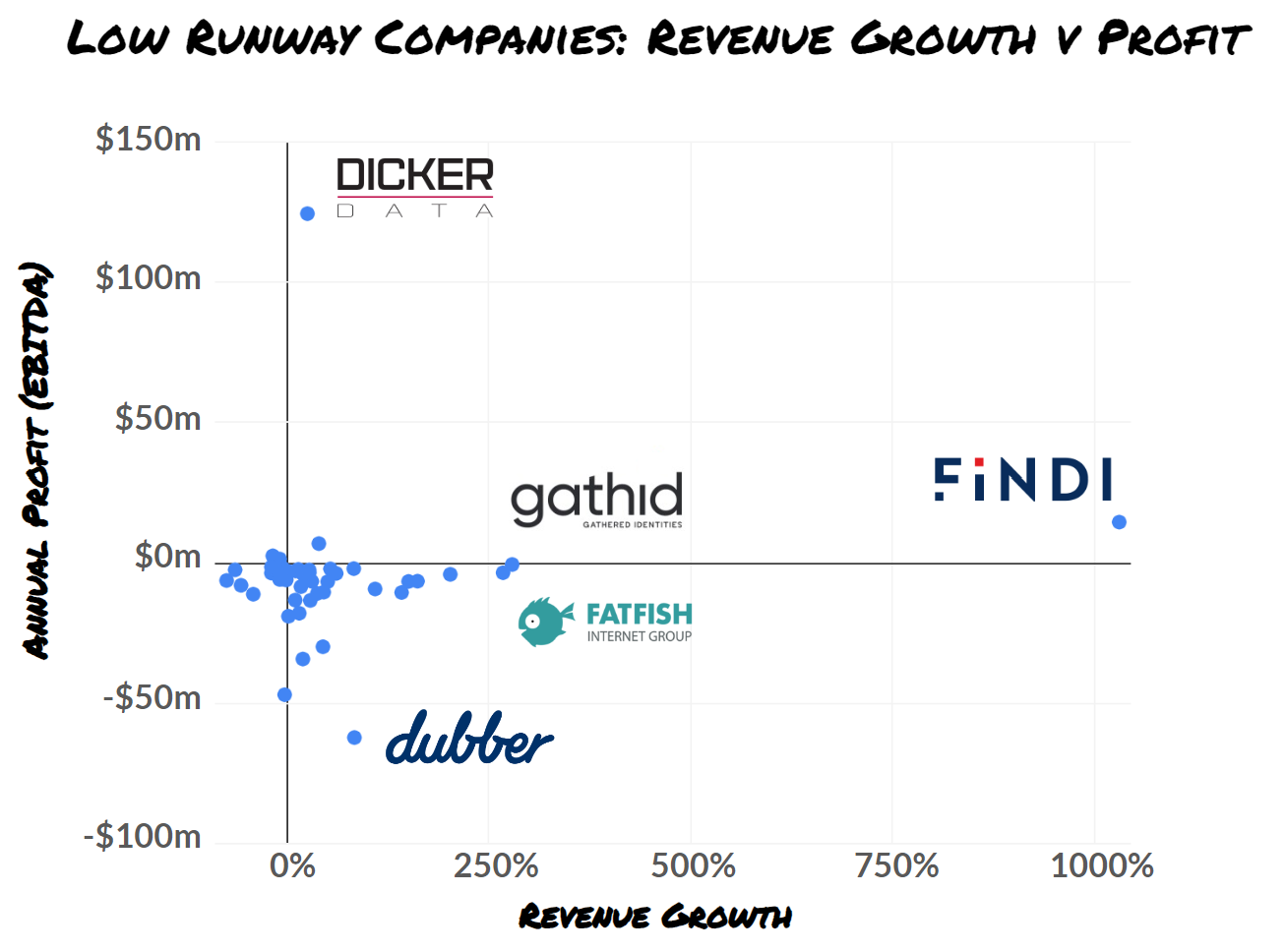

Revenue Growth and Profitability

You can often balance out poor runway through standout revenue growth and profitability. If your revenue is growing strongly and you’re profitable then runway shouldn’t matter so much. If you have strong revenue growth but aren’t profitable, then you can probably attract investors or grow your way out of the problem.

On the other hand, if you have declining revenue, you aren’t profitable and you have little to no runway then you’re in a difficult situation.

So how do our low runway companies look?

You can see there are some high-growth companies with low runway. Findi, Gathid, Fatfish, and Dubber have experienced revenue growth of 1030%, 278%, 267%, and 83%, respectively.

Dicker Data is somewhat of an anomaly with strong profits, revenue growth, and strong trading history. It appears to have some nuances to the business that mean it has negative free cash flow.

However, dubber’s growth, and a few companies like it, is coming with risk given its significant losses and low runway.

Low Runway and Losses

Let’s zoom in on the riskier part of the cohort, the bottom half. Those with low runway that are making losses. In this segment of companies there are those with low runway and losses but strong growth.

Then there is the most worrying quadrant, which is of companies with low runway, and losses as well as declining revenue or low revenue growth.

By Broad Customer Segment

It doesn’t seem to matter what type of broad customer segment a company is targeting with regards to low runway.

There were companies with low run way targeting businesses, consumers, defense, government, and health.

By Industry

Looking at the low runway companies by the industry they are in gets a little more interesting.

Companies operating in the IT, Health and Finance industries emerge as industries with low runway. The Finance industry is particularly interesting because a number of the companies in the cohort have shut down or been put into administration over the last 12 months (e.g. IOUPay and OpenPay).

If we wanted to see if industries themselves were more susceptible to low runway and underperformance, then we would need to do comparisons to the Mopoke Cloud Index, the ASX generally and global indexes. But that is beyond the scope of the analysis for now.

Closing Thoughts

Being listed, unprofitable and declining revenue with low runway is not a great situation to be in. It looks like there is still more turbulence to come for ASX listed tech companies.