ASX Acquisition: $28M for Beta-Stage AI Start-up

Why Audinate Paid $28M for 6-12 Employees and AI Technology

Another AI acquisition on the ASX with Audinate’s purchase of early revenue, beta-stage startup Iris Studio for $28m.

Audinate’s acquisition of Iris Studio is interesting because:

AI Product Acquisition: this is an acquisition of an early-stage AI product with little to no revenue by a public company that is looking to use the startup’s technology to deliver better products and ultimately grow revenue.

Mostly upfront: 71% of the transaction is cash up-front (compared to last week’s acquisition deep dive that had almost nothing up-front).

I’ll give a brief background on the companies involved and share the terms of the deal itself. Then, I’ll look at how it’s going to improve the financial performance of the buyer and how the acquisition fits their strategy (or not).

Company Backgrounds

Audinate replaces traditional audio and video connections with a computer network. There are over 4,000 products and 600 manufacturers using Audinate’s technology. They appear to be a leading global player in professional audio and video.

Audinate did $62m in revenue in FY25, down from $91m in FY24. The revenue is a combination of software (43%) and hardware (55%). They are sitting on $109m in cash. EBITDA went from a $20m profit in FY24 to essentially breaking even in FY25.

Iris Studio is a startup, still in beta, with 6 employees (inclusive of the 2 founders) according to LinkedIn and “about a dozen” according to an investor call. Iris provides software that automatically controls cameras for professional video situations like live events, broadcasts and recordings.

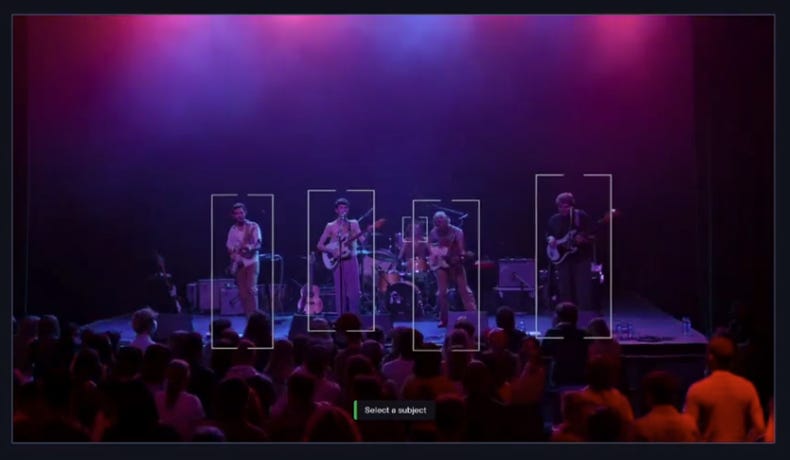

There isn’t anything public about Iris’s early investors, revenues or earnings. But there are cool pictures of their technology in action:

The Deal

The deal is US$28m Total Consideration. Iris is certainly loss-making and has minimal revenue (nothing is published, meaning it is immaterial) so this is likely in the realm of a 25-28x revenue multiple. The Total Consideration is broken down into Upfront Cash, Performance Payments and Vested Audinate Shares.

Let’s look at each component.

The Upfront Cash is US$20m.

Performance Payments of US$4m tied to achieving certain revenue goals and “service-based” objectives (most likely product milestones) over 3 years. The payment will be paid after the three years is up.

Vested Audinate Shares of US$4m in equal tranches at each anniversary, over 3 years. This means that $1.33m in Audinate shares are released every July for the next three years. These are tied to the “service-based” objectives for, it seems, individual people.

Financial Impact

The expected revenue from Iris isn’t clear and isn’t shared publicly. Given Iris’s website says it’s still in beta, it is understandable why they aren’t making revenue commitments. It’s hard to know what revenue will be from new launches accurately, and it likely isn’t material in FY26.

The acquisition reduces cash by ~A$28m to A$72.8m.

This acquisition comes with additional operational costs as it needs further investment. Audinate will “invest in go-to-market and product development” in FY26 (from their FY25 Investor Presentation). Iris related costs are bundled in with their overall forecast of an FY26 cost increase of 25%, which equates to an A$13m increase in costs.

Audinate is intending to generate positive cashflow from Iris in the next 3 to 4 years. That implies it’s a revenue, growth play more than an expectation of directly returning the capital invested.

Strategic Rationale

The acquisition is in what I call a Product Acquisition. Audinate isn’t buying a business. Audinate is buying a product, with product/market fit that they can sell and grow.

Iris is currently integrated with 14 camera brands like PTZOptics, Marshall and Telycam, across 1.5m devices. Iris has exclusivity agreements with some of those brands for as long as 5 years.

Iris’s initial use case, where they have found fit, is in the remote production of live events. Audinate probably sees it can expand to other use cases given the broader situations Audinate caters to.

Cost of Development Case

One way to justify a Product Acquisition like this, with immaterial revenue is to consider the alternative that Audinate has, which is to develop it themselves.

It took Iris ~2.5 years of 6-12 engineers to develop their product so the total development cost of somewhere in the range of US$4m to $7.5m. This might seem high but with strong AI/Machine Learning engineers in the team, it’s not unreasonable to have a salary bill of US$1.5m to $3m per year. Once you factor in some overheads of doing it in a larger organisation like Audinate then you are likely at a $5m-$10m price tag to develop the product.

Then you need to allow for risks like misreading the market, developing the wrong product, internal distractions, time-to-market and more.

In this context, if you can get the product you want by paying slightly more than your planned development costs then you are probably ahead.

Final Thoughts

Development Cost Multiple: The implied development cost multiple, using my back of the napkin math, is somewhere between 3-7x. On the lower end, it is fairly reasonable. On the higher end, you could say there might be a premium being paid to get in market with a forward-looking AI-based product.

New go-to-market channel: the riskiest part of this transaction and the area that I’d be thinking most about how to deal with is that Iris sells directly to end-customers, while Audinate sells to manufacturers. Launching a new product to customers you know well is risky enough. Launching a new product to a new set of customers adds extra risk to the equation. I would want to experiment around this a bit to see where we have the best chance of success and double down there (probably looking at our existing customers). This is easy to say at a distance, harder in practice.

Nice pay day: There is a good chance the two founders just made $8m each and the employees are getting a nice pay day of a few hundred thousand each. Not bad for 2 years of work.

Overall performance: Audinate broke even in FY25 and must have some confidence in revenue returning over FY26 given their desire to increase operational expenses. I’m not close enough to stock levels and movements to know how the chaos of tariffs while drive revenues back to where they were in 2024 and thus bring Audinate back to profitability or whether larger losses are ahead. That being said, they’re sitting on a pile of cash so they can go for it if they want.