Cosol: Compounding Machine

A technology-driven company combining M&A and organic growth

Cosol is a technology company that is a compounding machine, built around acquisitions, partnerships and, somewhat surprisingly, professional services.

It’s one of just five technology companies we track on the ASX tracks that has grown revenue, profit and free cash flow over the last 3 years.

Summary

Cosol provides asset management technology and operations solutions to larger organisations with significant assets.

Through acquisitions and organic growth, Cosol has built a holistic and somewhat differentiated solution offering that is a combination of professional services, managed services and software.

Cosol looks set to keep growing and acquiring.

In this deep dive, we’ll follow the usual format and look at:

About & History

Business Model

Market

Competition

Customer Value Proposition

Product / Solution

Go-to-Market

Finances

About Cosol

Cosol was founded in 1999 by Brad Skeggs and Mark Cooper. They were later joined by Ron Fredericksen in 2002. The three led Cosol through two decades of private ownership.

The goal was to help organisations maintain their assets.

Cosol was then listed on the ASX in January 2020, with Brad and the team stepping back and Geoff Lewis, Steve Johnson, and Scott McGowan stepping forward to lead Cosol as an ASX-listed company.

Geoff Lewis has had previous success building listed IT services organisations, having founded and listed ASG Group. ASG Group was ultimately acquired for $350 million.

Scott McGowan is the current CEO and his appointment says something notable about their culture. He worked with Cosol early in his career then left for stints elsewhere in executive and leadership roles, only to return to Cosol.

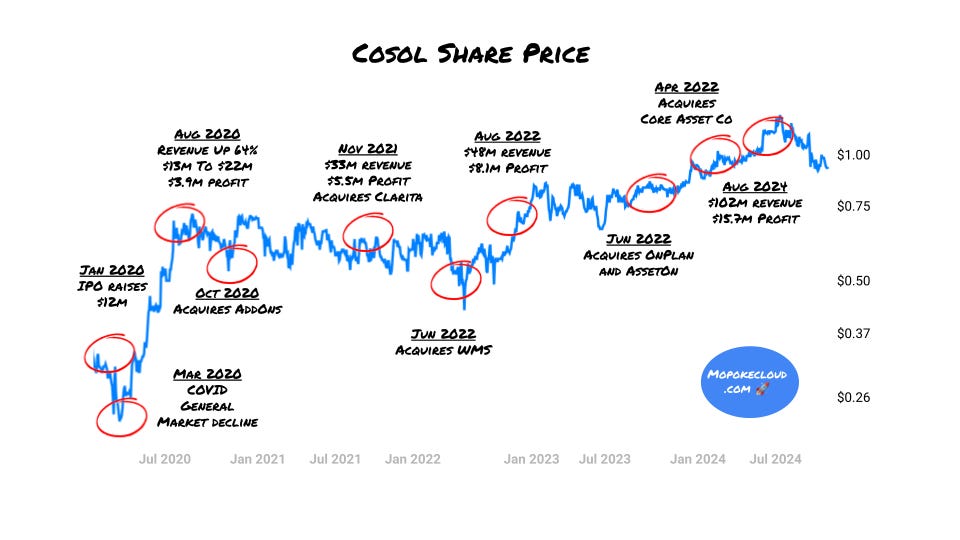

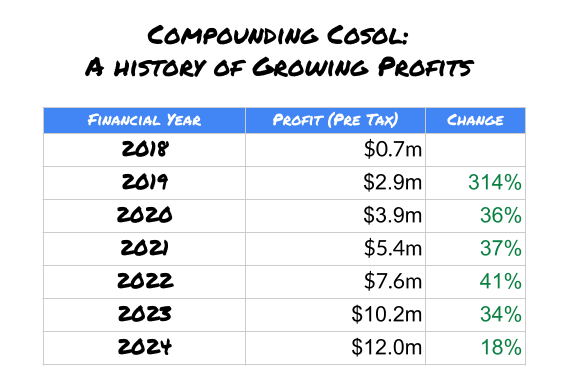

Since listing Cosol has consistently posted revenue and profit growth while making a string of accretive and strategically valuable acquisitions.

Business Model

Cosol wins business through its partners and sales team. Many of their new, material contracts are attributable to one of their technology partners like IBM Maximo, SAP and Hitachi.

From there they sell these types of offerings:

Advisory & Professional Services: consulting projects for clients

Product & Product-led Services: licensing IP and consulting work resulting as a direct result of IP.

Managed Services: managed support, hosting services and related services.

The margin on the Product & Product-led services being 37% margin says that this is mostly consulting revenue. Gross margins where you are purely licensing your own IP, such as in pure SaaS, are usually above 80%.

Cosol typically works with larger organisations with engagement budgets in the hundreds of thousands of dollars.

In a business like this, you often see high customer concentration with a few clients accounting for large segments of revenue. However, Cosol has a relatively diverse customer base for a business model like this with the largest 2 customers accounting for only 15% of revenue between them for the year ended 30 June 2024..

Market

Cosol thinks about their market as Public Infrastructure, Utilities, Natural Resources, Government & Defence, and “Other”. Organisations with assets that represent a significant part of their cost base and assets that, if managed well, can unlock opportunity.

Geographically Cosol focuses primarily on Australia and the United States, but they’ve also picked up customers in a smattering of customers across the globe.

Cosol has a large market to pursue. In the United States for just two of their target markets, they have 500-1400 possible customers and each customer is worth hundreds of thousands or potentially millions.

Competition

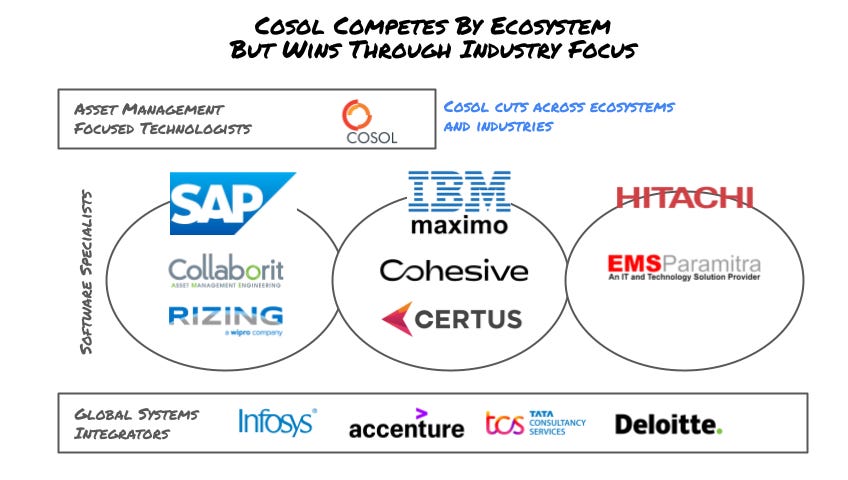

Competition for enterprise asset management technology comes from partners to the software platforms as well as the global systems integrators and consulting firms.

In technology, organisations tend to go in one of two directions:

They will often go with a specialist partner the vendor recommends or that has specialist expertise in the software the organisation needs to install. Or,

They will go with a global systems integrator as it is seen as the less risky option.

Cosol brings what seems to be a unique edge in that it has the specialist skills in the software and the industry expertise that you may only find in a large consulting partner. This helps reduce risk for organisations.

Customer Value Proposition

There are a few value propositions that Cosol offers its customers, but their strategic focus is on the “Enterprise Asset Management as a Service” offering.

Enterprise Asset Management as a Service is the combination of their various offerings, that helps clients with significant asset management needs think strategically about their asset management technology, then implement, support, extend and the technology.

Cosol looks to be extending beyond technology and into advising on the performance of the assets themselves.

Solutions

Cosol has a suite of interlinked solutions centered around asset management in larger organisations. They can be summed up as:

Asset Management as a Service: outsource complete end-to-end asset management operations. Mostly focusing on the software used to manage the assets.

Application Managed Support:

Implementation Services: implementation of asset management software (e.g. SAP, IBM Maximo, Hitachi).

Data Migration: software and services to help migrate data from one asset management system to another.

Advisory & Consulting: advisory and consulting around asset management software and operations.

Cosol has a solution roadmap based around acquisitions, investment and organic growth to continue to build out complementary solutions around enterprise asset management.

Go-to-Market

Cosol’s recent major engagement wins are an even spread with their partners:

In addition to the partnerships you can see that they also pursue:

Content: downloadable material on various aspects of asset management technology can be found on their website. This is often combined with ads. They also rank reasonably well on google for various searches around enterprise asset management services.

Events: you can see they attend and sponsor various trade shows and conferences.

Direct sales: salespeople networking and directly contacting potential customers.

There is limited information around the specifics of their go-to-markets in their public reports so most of the above is gleaned from reviewing their website and social media.

Finances

Cosol is in a healthy position overall. A strong history of growing overall revenue and profits, combined with a healthy cash balance.

Here are Cosol’s key financials:

Key Insights

There are a few insights from Cosol:

Acquisitions, when done right, can be a driver of success.

In enterprise, partnering with large and established solutions provides a path to market that gradually allows the development of your own intellectual property.

Patience. Cosol didn’t start being able to provide “asset management as a service”, it gradually built towards it over 6 years.