Deep Dive: Car Group (Carsales.com.au)

Australia's international success story faces a big challenge from a big disruptor

Car Group presents an impressive story of an Australian market leader using its strength in cashflow and operations to expand internationally.

Carsales.com.au, now known as Car Group, started out in Australia and has grown this foundation into the dominant Australian marketplace for cars, boats, farm machinery, and more. Carsales is miles ahead of its nearest competitors.

Car Group’s success doesn’t stop there. The group has been able to take this model globally by acquiring leading digital vehicle sales marketplaces across multiple countries, including Australia, Korea, Chile, and the United States.

It’s a great Australian success story, but it might be about to face its biggest test yet in the form of a massive US disruptor called Carvana.

Let’s get into this deep dive on the business formerly known as Carsales.com.au.

What we’ll cover:

About Car Group

Business Model

Customer Value Proposition

Market

Competition

Go-to-Market

Finances

I’ll finish, like usual, with some key insights.

About Car Group (formerly Carsales.com.au)

Car Group (ASX: CAR) was founded as Carsales.com.au in 1997 by Greg Roebuck and Wal Pisciotta in Melbourne, Australia with what was at the time just a small idea: moving print classified advertisements for motor vehicles onto the internet.

Early Acquisitions and IPO

Prior to its IPO, in October 2005, Carsales began to build its acquisition muscle, acquiring ACP Magazines' online classified businesses, including Carpoint.com.au, Boatpoint.com.au, Bikepoint.com.au, Ihub.com.au, and statistics company Equipment Research Group. In exchange, ACP’s parent, which would go on to become Nine Entertainment, took a 41% stake in Carsales.

This transaction was followed by the acquisition of Red Book in 2007, a provider of new and used car specification and value information.

In 2009, Carsales listed on the Australian Securities Exchange. The company raised up to A$248.7 million ($205 million) in the nation's biggest initial public offering that year, with a market value of A$812 million.

In a rare misstep, Carsales made an acquisition of Quicksales, a general classified and auctions site, in 2010 that was shut down in 2018.

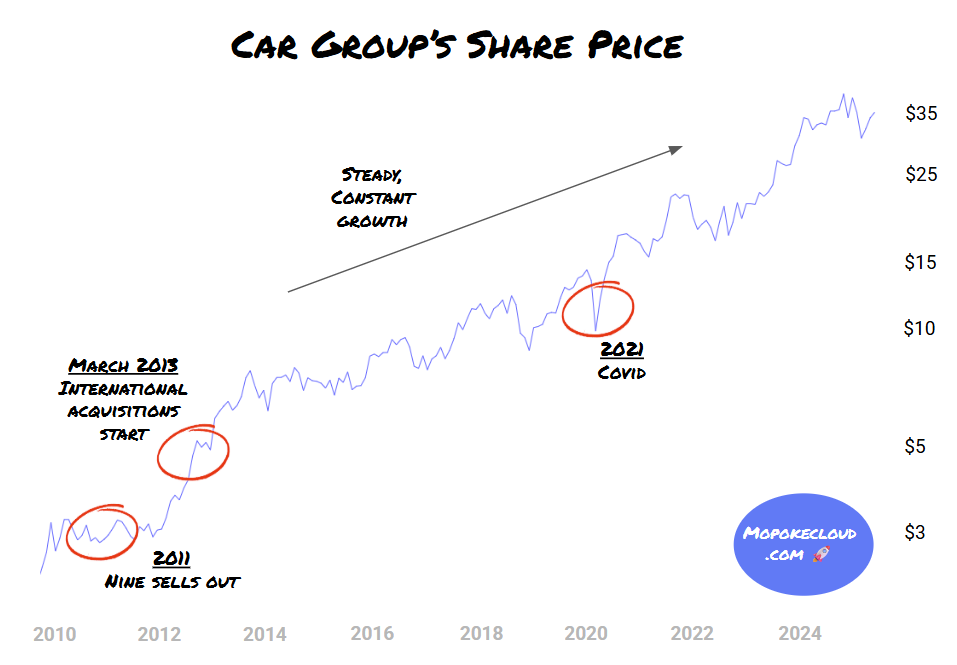

Nine Entertainment sold out of Carsales in 2011.

International Expansion through M&A

This didn’t stop them, however. A few years later, starting in March 2013 and occurring like clockwork every 2-3 years, Carsales made acquisitions for whole or partial stakes in international marketplaces.

From 2013 to 2023 Carsales purchased stakes in iCar Asia, Webmotors in Brazil, SK Encar in Korea, Soloautos of Mexico, Chileautos of Chile were purchased, and Trader Interactive in the United States. The remaining 51% stake was acquired in 2022. Some of those stakes were increased and some became complete acquisitions.

This transformed Carsales into Car Group, the owner of leading global vehicle marketplaces.

Business Model

Car Group’s business model is fundamentally a marketplace. But Car Group has gone beyond taking a cut of the transaction to monetising the data and audience they have.

Car Group sells access to its audience and data to dealers, car manufacturers, insurers, and others.

The metrics that matter are:

Active listings

Page views and unique users

Leads delivered to dealers

Customer Value Proposition

Car Group’s value proposition is “to make buying and selling [vehicles] a great, seamless digital experience”.

This makes sense. A great, seamless digital experience is what will retain and grow their audience, which allows them to monetise.

For the most part Car Group’s properties give people the ability to easily list their car or boat, search, and browse. The dealer experience is of a high standard as well.

However, the focus on digital, rather than the complete experience, misses the necessary physical interactions. The hassles of messaging to negotiate a sale and the need to interact with strangers in person to get the car sold creates some friction.

You can argue this is somewhat countered by the ability Car Group provides to sell immediately but this seems somewhat more of a hassle than just going to a dealer.

Market

The market for Car Group is any transaction for a boat, car, farm machinery, campervan or other vehicle in the countries they operate in.

In Australia, beyond cars, they sell farm equipment, tyres, and construction vehicles. In the US they do RVs, motorcycles, and commercial trucks.

This doesn’t have to be a consumer selling directly, it can be a consumer listing through a broker or a dealer selling a car. It can also be businesses buying or selling vehicles or equipment.

Geographically Bound

The interesting structural characteristic, just judging by how Carsales has evolved, seems to be that digital vehicle sales are geographically bound.

That is, unlike Airbnb, which scaled the marketplace for hotels globally, Carsales (and some of its competitors we’ll look at later) has had enough time to demonstrate that vehicle sales seems to end up with winners in each country or region. In a way, the reasons for this are beside the point because this is just how it is.

So it’s through the lens of geography, mainly by country, that we need to think about Car Group’s market.

United States: A Different Entry to the Norm

Car Group has entered the United States, giving them access to one of the largest markets on the planet but they have entered differently to what has worked historically for them.

In every other market, Car Group has done well by acquiring the leading car marketplace. From there they’ve been able to use this dominant position to expand to other types of vehicles. But in the United States, Car Group has entered through Trader Interactive which doesn’t sell cars. It sells RVs, Trucks and other vehicles.

There is merit in getting into the US market, given how geographically bound this business seems to be. But, it appears to be somewhat of a compromise. This compromise was likely necessary because of the market cap (unaffordability) of the dominant US players.

It’s an interesting play to watch, to see if this variation on the model will work.

Australia: Is There Room for Continued, Meaningful Growth?

Given the 41% contribution Australia makes to Car Group’s revenue, the Australian market needs consideration.

Carsales is dominant with 78% ‘share of time against category competitors’, according to independent Ipsos research. This is ~8.6x more than the nearest competitors Drive and CarsGuide.

The key question in the Australian market is whether there is room for continued, meaningful growth. Australia will continue to play a key role in Car Group’s performance over the short to medium term.

A sensible starting point here would be to expect Car Group to track the vehicle sales market generally. So any future growth prospects are essentially derived from your views on the market for cars, boats and other vehicles in Australia.

Going deeper on this market is beyond the scope of this deep dive.

Global: Acquisitions a Must for More Market Share

It seems the only way to access more growth is to access more of the global market for vehicle transactions, which means acquiring leading marketplaces in other countries. It’s noticeable that they don’t have representation in Europe, Africa, India, or China.

Any further analysis of market share potential would need to look at the likelihood of acquiring dominant players in each of these regions.

Competition

Car Group is almost equal to its global peers, Cars.com and Auto Trader, in terms of revenue. It’s a strong position to keep acquiring market leaders in other countries and to continue growing profitably. Right?

Maybe not. Carvana has just switched on its profitability, and it can’t be ignored.

While Car Group and its peers have around $720m in revenue each, Carvana did $13.7bn around the same period.

Now, you could argue that Car Group is focused on “#1 digital marketplaces for vehicles around the world” (their words in their Annual Report) while Carvana is in the market for second-hand cars. But, if you look closer, both are going after “making buying and selling a car a great experience” (Car Group’s Purpose).

Having sold a car and a boat recently, there is a strong argument for the end-to-end experience that Carvana provides winning.

While Car Group is focused on “building a seamless digital experience” Carvana is focused on the entire experience of buying and selling a car.

Here is a slide from a recent Carvana investor report that shows the innovation Carvana is bringing to the entire experience with car vending machines and car deliveries.

Go-to-Market

Audience

Car Group is reaching its audience through, for the most part, fairly typical channels for a digital marketplace.

SEO: They have a strong SEO score, with plenty of backlinks and content, however they surprisingly didn’t rank as well as expected versus their competition for terms that people wanting to buy a car were likely to search for (e.g. “what to look for when buying a car” featured others above them including competitors, the same with “buy a second hand toyota”).

Search Engine Advertising (SEM): They were one of the top links for many relevant paid search terms sampled.

Socials: They have active and strong social accounts

Other Media: They run ads on streaming services, do press, and pay for other media.

What was interesting to discover was the shift and investment the Car Group is making in Youtube and the growth it is seeing in video content. Ben Tyers, Head of Content at Carsales, says, "More car buyers are turning to video to research and compare, and our YouTube channel growth is reflective of that.”

Finally, given their dominant position, word of mouth and brand awareness likely plays a major role in their audience.

Advertisers & Dealers

For advertisers and dealers that pay to be on one of the website or advertise through it Car Group appears to have a fairly typical business development organisation.

Finances

You can see the general trend of Car Group with compounding growth year on year. Behind this is strong free cash flow.

What’s interesting about Car Group’s financials is that, except for 2023, Operating Income and Net Income were largely the same. The difference in 2023 is a an upwards revaluation of Car Groups interest in Trader Interactive (they refer to it as a “net gain on step acquisition of associates” in their financial statements).

Key Insights

What can we learn from this

Marketplaces may not be so globally scalable: In theory, and often in pitch decks, a marketplace is globally scalable. But Car Group seems to show the opposite is the practical reality. They didn’t expand to Korea or South America by growing into these markets; they acquired. This says each of their marketplaces is geographically bound and they need to acquire to enter a new country. This isn’t necessarily an issue, but it’s an interesting insight in considering marketplaces more generally.

End-to-end customer experience: It’s one thing to be the market leader in one slice of the customer experience, but you need to be aware of how someone else might focus on the end-to-end customer experience and disrupt you. The battle between Carvana and the marketplaces will be interesting to watch.

Year on year compounding is a beautiful thing: Slowly but surely Car Group improved revenue and operating income each year. By small increases initially and then, eventually, the improvements unlocked significant growth and the ability to acquire.