Deep dive: Product-led Growth at Ansarada

How Does Product-led Growth Really Work? A real case study

This analysis is a deep dive into the listed Software-as-a-Service company Ansarada, with a special focus on Product-led Growth.

Product-led Growth is pushed and popularised by the tech industry as the best way to build software companies. Product-led Growth, in simple terms, is where the product itself drives the sale. The most common example of this is products you can sign up for for free, try them out ,and then the product itself moves you towards paying with your credit card. Product-led Growth as a strategy, motion, or tactic (whatever you want to call it) has a substantial, popular movement behind it as it’s often seen as the holy grail because when done right you have almost $0 customer acquisition costs, no sales team and your product automates conversion to revenue.

The theory sounds nice, but the big questions relates to whether product-led growth actually works.

Ansarada is a great company to look at when it comes to Product-led Growth.

Ansarada publishes a relatively large amount of public information on its strategy, company, product, and sales efforts. It’s also been performing relatively well with revenues that continue to grow and decent profitability.

Let’s dive into all things Ansarada.

If you just want key insights on Product-led Growth from this analysis, then scroll straight to the end.

About Ansarada

Ansarada was founded in 2005 by Andrew Slavin, Sam Riley, Rachel Riley, and Daphne Cheng. The company is named after the first two letters of the founders’ names.

Ansarada provides a specialised file-sharing service for deals, procurement, and governance. Ansarada’s Software-as-a-Service products go beyond uploading, downloading, and sharing files, providing workflow management, analytics, and other features that matter for their specialised use cases.

Ansarada raised $1.4m in 2008 and then $24 million in 2018.

In 2020, Ansarada then merged into ASX-listed company TheDocYard (ASX:TDY) with a market capitalisation of approximately $125m.

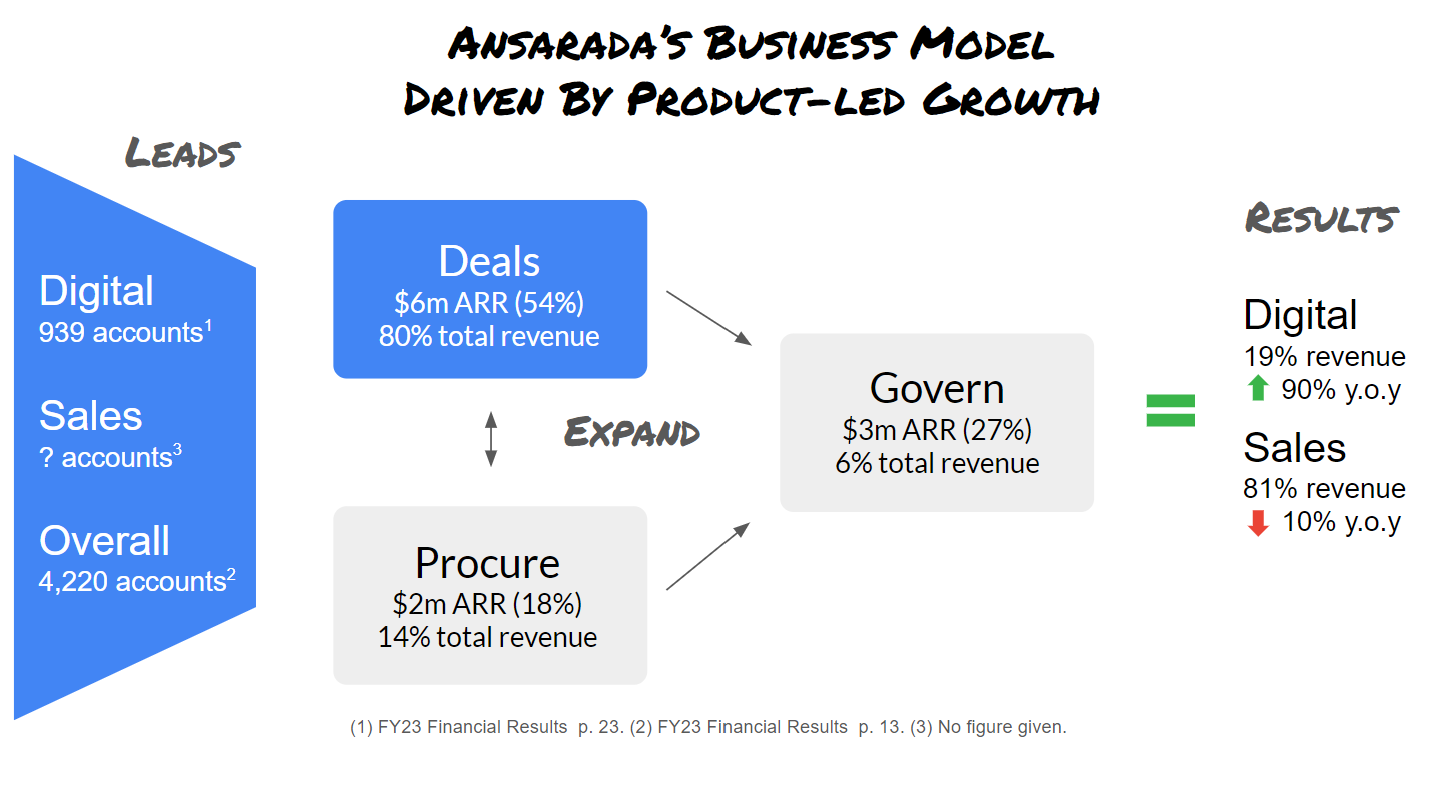

Business Model: Land by freemium, then expand to other products and higher tier subscriptions

Ansarada’s business model is to use digital channels to get potential customers to sign up for the free version of their virtual deal room or procurement product. Then, Ansarada encourages users to expand to their other products and more recurring services like their Governance product. Sales seems to be the primary method they use for doing this.

Ansarada’s results show that their digital channel is driving faster revenue growth than their sales-led channel but sales still accounts for 81% of revenue.

Product: File Sharing For Critical Information

Ansarada’s primary product has been the virtual data room for M&A deals. Over time, Ansarada has expanded into managing information (essentially files) for Governance, Procurements, and ESG. Ansarada also assists with managing the workflow for each of these situations, particularly for M&A deals.

Across each of these product lines, the common features are:

Upload and share data with other parties

Each party needs multiple users with different abilities (upload, edit, view, etc.)

Tracking versions of uploaded files and usage

Viewing what other parties are doing in the data room

Restricting and controlling how files are viewed and used

Customer Value Proposition

The customer value proposition is similar for both customers executing a deal and customers managing sensitive information for their board or a procurement. We can simplify this to providing controlled information sharing for information and decisions with critical consequences.

When looking to do an M&A deal, you need to share information with potential parties. A company looking for investment or to be acquired needs to share sensitive information with potential investors or acquirers.

A company or fund looking to invest needs to do due diligence and track the information they are receiving. There is also coordination or “workflow” that needs to take place as well to bring it all together.

With procurements, it’s a similar story.

For Boards and Governance, it is similar once more but with minimal differences. It’s similar in that you have sensitive information you need to keep track of. And if you’re listed or require a high level of governance, then you need that additional rigour and discipline that Ansarada can help with.

The difference lies in that it’s ongoing rather than a one-off like an M&A deal. It’s also different because if you’re private or have a small board then you don’t feel the pain or benefit of additional features to improve discipline, governance, sensitivity, and rigour.

Market

Ansarada is going after a broad number of markets:

M&A Deal file, information, and workflow management

M&A Deal integration management

Company Board’s file management

Procurement file and information management

ESG governance information management

Each of these markets, while somewhat overlapping, are different.

Ansarada views M&A Deals as the “landing” that they can expand from. So, let’s look at this market first.

M&A Deals Market

There have been around 20,000 to 50,000 M&A transactions per year globally for the last decade. Excluding COVID, this number has been relatively constant but is now showing possible signs of decline or depression over the foreseeable future.

20,000 is taken from the London Stock Exchange’s Data & Analytics Group (LSEG). The 50,000 comes from the Institute for Mergers, Acquisitions & Alliances (the IMAA).

Here is the IMAA’s data:

If you overlay these with Ansarada’s revenue, you can see the market effect:

Interestingly, Ansarada’s performance seemed tied to the market up until 2022, when their revenue grew while the deal volume went down. The number of Ansarada customers followed the market, though. This could be a sign of Ansarada’s customers taking up Ansarada’s other offerings versus the transactional nature of deals.

Governance, Board Files and Procurement Market

For Ansarada’s other services (Board files, procurement, and, to a lesser extent ESG), the market is broadly any organisation with enough size to need to do any of these activities with a certain amount of rigour. You can then add not-for-profit organisations and government agencies onto this as they often require rigour due to the way they are funded and governed.

It’s somewhat challenging to get a straight global picture of this because of the differences in the way countries measure and classify companies, but here are some key data points:

In the United States, there are 115,000 businesses with over 100 employees (Small Business Council / US Census).

There are an estimated 16 million businesses in the world with more than 10 people (OECD). If we use the US’s proportions, this means there are something like 304,000 businesses with over 100 employees.

1.54m Not-for-Profits in the US (NCCS) and an estimated 10 million Not-For Profits world wide.

In Australia, there are 1,327 Government organisations. If this is extrapolated globally based on Australia’s share of the global population, then we would estimate ~402,000 Government agencies globally.

All this indicates that Ansarada’s total global market is likely under 10 million total firms.

Even a 100-person company doesn’t need Ansarada to run its board or procurement. Within this are subsegments that likely need the product more, such as listed companies, those that have taken substantial funding, and those with high governance requirements.

Going deep on these is a bit beyond the scope of this market analysis.

Competition

When it comes to managing deals or sensitive information like a board file, organisations can just use email or their current, broad cloud file storage systems, like Microsoft OneDrive, Google Drive or Dropbox.

However, if they want something more fit for purpose, then Ansarada and the other deal-focused software services provide gains and solve pains that the broad solutions or plain old email services simply can’t solve.

By going beyond just deals, Ansarada provides a product that is superior for board information and procurement. However, Ansarada is up against the broad reach and incumbency of the broad cloud storage offered by Microsoft, Google, and Dropbox.

Ansarada’s broad reach could be said to spread focus and finances compared to their deal-focused competitors. On the other hand, it might give Ansarada a stickiness and higher customer lifetime value that the focused competitors don’t have while giving it a fit-for-purpose advantage over broader cloud storage solutions.

Board, workflow, ESG, and Procurement each have a somewhat similar landscape of the same broad providers and a different set of narrowly focused providers with a mix of sales and self-service.

Go-to-Market Comparison

The key theme we’re also exploring here is Product-led Growth. So, let’s go deeper into comparing the go-to-market strategies of Ansarada and some of their competitors around product-led growth.

A few notes on how this table was built:

To evaluate Google ads, I searched for high-intent terms like “virtual data room” and “data room software” to see who was advertising against these.

Search traffic came from Semrush

Dropbox’s DocSend stands out in the product-led growth motion. DocSend has significant search traffic (low-cost acquisition), is running ads, has public pricing, and has a low starting price point. Their sign-up experience let me sign up with my Google account, and I was ready to do a deal in minutes.

Of the more narrowly focused product players, Ansarada stands out as one of the few with a genuine self-service sign-up process. The pricing was a little too hard to find for self-service sign-up though since the link was not easy to locate via the menu bar. Additionally, Ansarada doesn’t allow for the faster sign-in/-up with your Google or Microsoft login.

iDeals pushes you to speak to a salesperson, but if you look hard enough, you can find the sign up for a free trial link. The self-service workflow isn’t great as it sends you an email instead of letting you straight in. I did get a follow-up phone call from a salesperson within 30 minutes. They’re also running live Google ads.

Dealroom requires you to get a product demo before you can use the product.

Go-to-market: Product-led Growth and Enterprise Sales

Ansarada’s go-to-market has primarily been sales-led but over the last few years Ansarada has invested heavily in Product-led Growth and views this as their way to get to $100m in ARR.

Their go-to-market is driving nice growth in new accounts, but these aren’t necessarily converting to paid accounts.

Let’s look at how they are doing product-led growth and sales-led separately, then tie it together.

Product-led Go-to-Market

Ansarada is pursuing acquisition through social, paid, and SEO (search organic traffic).

This approach has led to a significant growth in new accounts, appearing to be the main driver for adding 4,220 new accounts over FY23.

Some key highlights:

YouTube channel with 120,000+ views on a number of videos, 1,000,000+ on others, and regular posting each month.

Paid ads across Google and LinkedIn (didn’t analyse Facebook).

Meaningful search traffic

Interestingly, organic social media (i.e. posting on LinkedIn or X) didn’t appear to be meaningful. X had ~1500 followers and LinkedIn had 16,000 but relatively low engagement of 20 likes per post on one or more posts per week.

There is a lot of promise in this go-to-market given the share of revenue it has driven and the new accounts (leads) it is creating. However, it’s unclear if the additional expense will result in the revenue growth Ansarada wants.

A thought is that if they weren’t running ads and incurring the people costs of managing those ads, perhaps they would have seen similar paying customers come through at a lower cost (as no salesperson is needed).

Another is that the increase in digital as a portion of overall revenue is possibly digital ‘cannibalising’ what was historically sales-led revenue. This is good because it theoretically drives the cost of sale down.

Finances

Given our focus on Product-led Growth, we’re going to zoom in on the digital channel to see how it is performing financially.

To understand this table:

Accounts: a company or similar that signs up for an account.

Customer: an account that is paying

Digital Customers: customers that are attributed to digital as the channel that drove the sale and sign up.

ARPA: Average Revenue Per Account.

Digital Marketing: the spend on digital marketing (estimated based on FY22 percentage of revenue given)

There are a few callouts:

Product-led Growth is clearly driving new accounts. The growth since FY21 is significant and Ansarada managed to grow accounts even while the M&A market was cooling.

Customers coming from digital have doubled every year however this hasn’t been enough to fight the market forces. So, even though free accounts are up people actually paying overall isn’t.

Average Revenue Per Account is up but reading between the lines this seems to be driven by sales rather than Product-led Growth. This is a hypothesis based on a comment in the annual report about sales leading enterprise contracts that meant larger revenue per customer but I couldn’t properly validate it.

Overall, for a relatively small percentage of revenue compared to the sales team, Product-led Growth does represent a possibly more efficient and faster growing future for Ansarada. It will be interesting to see how this plays out.

Customer, Subscription or ARR?

Ansarada’s naming conventions for their accounts, customers and revenue could be more accurate and usable.

Ansarada’s product is often only used for 3-6 months. This type of transactional usage isn’t separated out as well as it could be from genuine recurring revenue that runs for years.

They also call free accounts “customers” and customers “subscribers”. A customer, in my book, is someone that pays you. A free sign up isn’t a customer.

Key Insights on Product-led Growth

Here are some insights and observations from analysing Ansarada:

Patience: it is taking time for Ansarada. Digital acquisition was launched and became a focus in February 2020, after a year it accounted for 5% of total customers. After three years it accounts for ~19%.

Market pull: Ansarada had the right offering and go-to-market in the right market at the right time. The hot M&A market drove demand for Ansarada and, despite their efforts that worked in the hot market, the reduced M&A has clearly slowed demand for their product.

Login with your service: users must have the ability to easily sign in with their tool of choice. I ended up not trialling Ansarada (even though I’ve purchased it before) and using DocSend for an upcoming M&A transaction because I could login in seconds with my Google account.

Pricing visibility: you must have pricing easily available, ideally as a top menu item. I could not easily find the Ansarada pricing but I could find Dropbox DocSend and some of Ansarada’s competitor pricing. If a customer can’t see pricing then how can they buy?

Distraction: Ansarada says deals are their key ‘landing’ to expand from. Their multi-platform offering gives them the ability to cross sell and improve customer lifetime value. However, Ansarada’s multi-platform offering distracts from their primary funnel for first time customers.