Dropsuite: secret sauce to low-cost, global distribution 🌏

We take a closer look at Dropsuite, a $120m cybersecurity company listed on the ASX.

We like companies with secret sauce - something that’s hard to replicate and gives a defensible advantage versus competitors.

Dropsuite enables businesses to backup, recover and protect their cloud information. The secret sauce is their partnership network of managed service providers (MSPs) that manage IT for end-market SMBs.

This gives them low-cost, global distribution - and we’re optimistic they’ll be able to introduce new products and continue their strong growth endurance.

In conjunction with this, there are many things we like about the $120m company:

✅ Product Market Fit: 575,000 users and clear customer love

✅ Big Market: Strong market tailwinds from data security and regulation

✅ Incredible Unit Economics: CAC Payback of 5 months and strong revenue expansion

✅ Strong Growth: ARR growing at 80% with strong endurance

✅ Insider Ownership: CEO owns 5% with board and management an additional 11%

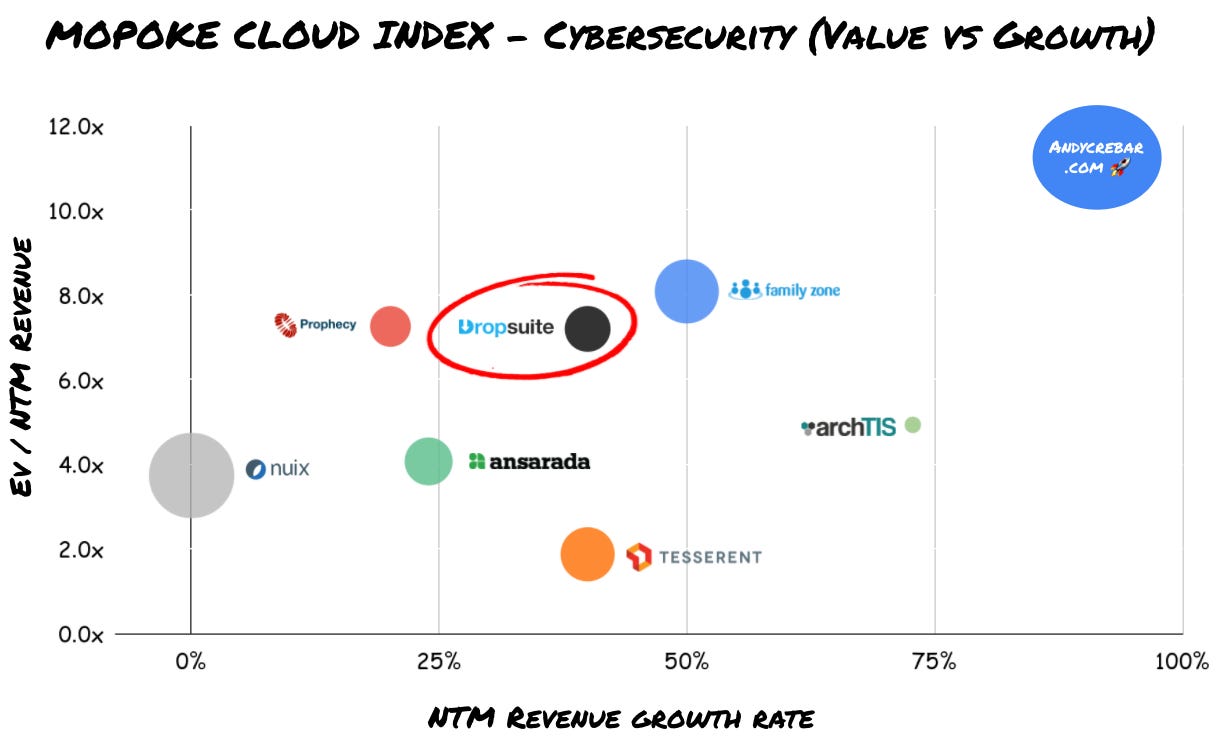

Dropsuite is one of eight cybersecurity software companies in the Mopoke Cloud Index, which tracks 93 emerging technology leaders on the ASX.

Summary

Our view: growth of backup product will continue to shine in the MSP market, and new growth engines will be spawned by introducing new products into their reseller network

What the market is missing: strength of customer acquisition strategy and strong unit economics, with the business reaching break even and now able to further invest in R&D and partner acquisition

Key risks: indirect relationship with end users, competition from other MSP-focused backup providers, partner concentration and failure to build an enduring competitive moat

Bull case: ARR continues to grow rapidly and horizontal acquisitions plug more products into their partner network, enabling the company to grow past $100m ARR in the coming years

Bear case: MSP market faces challenges and competition limits growth, MSPs bundle alternate products, and margin profile fails to prove out operating leverage

First time here? Subscribe so you don’t miss further insights on ASX tech and remember that this is not financial advice 😀.

Overview: $13m ARR business growing rapidly

Dropsuite is a data back-up business with partners and customers in over 100 countries with 60 staff. They primarily focus on resellers who bundle their core product with a managed service offering.

The company was founded in 2012 by John Fearon and originally focused on website backups. They backdoor listed on the ASX in mid-2016 through a shell company (‘Excalibur Mining’ ⚒️) at a $20m valuation, raising $8m new capital.

Excluding a small blip in October 2018, the shares traded sideways from 2017 to 2020 while the business quietly compounded its underlying value through partnerships and ARR.

Over the last 18 months, ARR has been accelerating and they’ve gotten on the radar of many investors, with their valuation increasing from $20m to $120m. 👏👏

Market: $22bn in backups and 10x bigger in helping MSPs deliver

Dropsuite plays in the $22bn global data backup and recovery market, which is growing >20% annually.

While they can sell directly to end users, the majority of revenue and strategic focus is partnering with MSPs who then bundle their product to their end customers.

End customers are typically SMBs with 20 - 200 people that are overwhelmed in IT. Complexity continues to accelerate and most established businesses have realized that an internal IT team just won't do.

MSPs provide the critical resources that SMBs lack - the total market for this is $200 billion and is growing faster than the overall global IT market of $1.2 trillion.

Why back it up?

Most businesses are increasingly digital and cyber security is one of the biggest risks that businesses face. Human error is the main cause of data loss and email is responsible for 94% of malware.

Backups allow:

Data to be restored from an earlier point in time

Help businesses recover from an unplanned event - like a hack or cyber incident

Archiving of important data for record keeping

Insights on usage patterns of data and emails footprints

The market demand for backups and recovery is growing from:

Digital transformation: acceleration to the cloud from on-prem back-ups

Increased cybersecurity: growing cybercrime and organisations improving data protection strategies

Regulation: new data privacy regulation in the EU and beyond that covers data security and retention

Dominance of the big three

Microsoft, Google and Amazon dominate the cloud hosting market accounting for 58% of cloud spend.

The cloud operations of these companies are beasts 🐲.

AWS (Amazon): US$64bn run rate, growing 39% YoY (accelerating growth from 37%)

Azure (Microsoft): US$40bn run rate, growing 48% YoY (accelerating growth from 45%)

Google Cloud (includes GSuite): US$20bn run rate, growing 45% YoY (decelerating growth from 54%)

Why don't these vendors just offer back-ups? Answer: They offer production data, are not responsible for loss and encourage third party providers.

For example, Microsoft’s terms of service “recommend[s] that you regularly backup Your Content and Data that you store on the Services or store using Third-Party Apps and Services.” These vendors will fix their own mistakes - but they’re not responsible for the variety of ways individuals can lose their data.

So for companies that need redundancy and data protection under their data service agreements - back-ups are non-negotiable and provide the ability to separate the data, store it and analyze it, and meet their requirements.

The role of Managed Service Providers (MSPs)

Dropsuite leverages MSPs for the distribution of their product. They have 395 direct IT reseller partners, and then hundreds of MSPs transacting via IT Distributors.

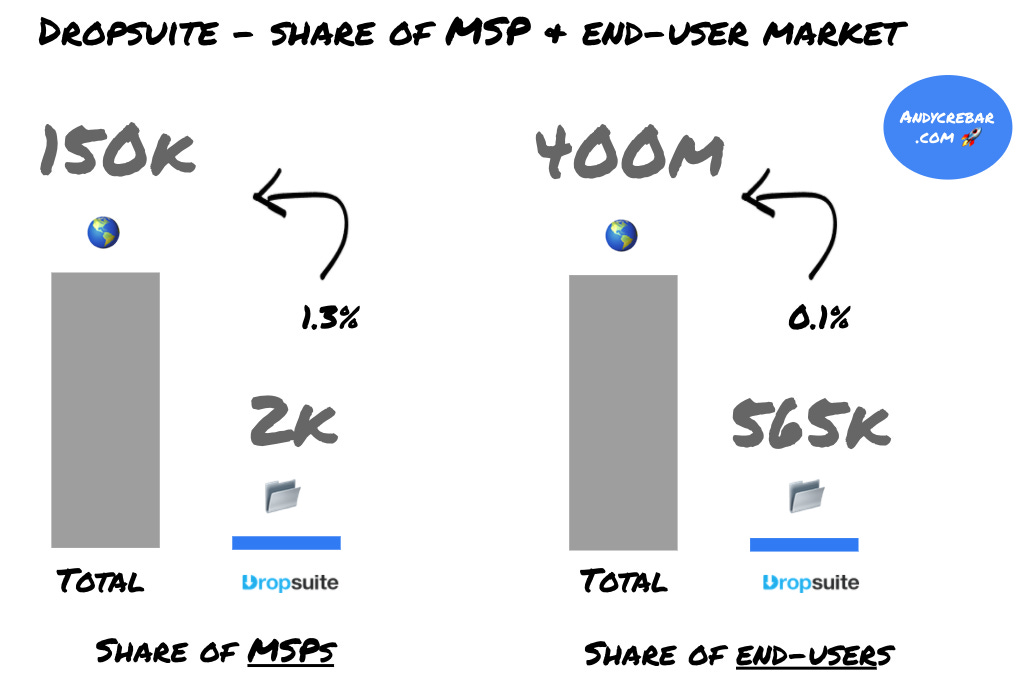

This market is booming and highly fragmented, with over 150,000 MSPs globally and predictions the share of the IT market will double to $400 billion by 2027. An estimated 90% of Fortune 1000 companies already use MSPs to provide at least part of their IT infrastructures or services.

These end market dynamics give Dropsuite strong tailwinds.

End-user market for back-ups is growing ✅

MSP market is taking share ✅

As end clients grow, they add more seats ✅

While Dropsuite continues to add MSPs ( ✅ ) - today they are a drop in the ocean, with 565k end users giving them a 0.1% share of the 400 million Microsoft and Google Workspace end-user accounts globally.

Product: single to multi-product offering in email & productivity

Dropsuite’s current product vision is to be the one‐stop‐shop for backup and archiving solutions for email and productivity applications.

Today, the business is heavily focused on email back-ups - with a core focus on Microsoft 365 and Google Workspace. The application is available in multiple languages, with multiple public and private cloud data centers spread around the world.

Dropsuite’s technology has been built in-house by an experienced team including Charif El Ansari (CEO), previously at Google and Dell, and Ronald Hart (CTO) and Ridley Ruth (COO).

What makes Dropsuite unique?

It's important to remember that the IT reseller handles the customer relationship and Dropsuite is one of the services that they provide to the end-user.

By using Dropsuite’s APIs and plug‐ins to integrate Dropsuite into their infrastructure, they then provision, onboard, manage and bill the end-user.

Like most technology companies, IT resellers are super focused on building for differentiation, and buying commodities - and backups are a component that IT resellers don't need to build and support themselves and instead just offer it with Dropsuite.

So why do they choose Dropsuite?

Focused offering: increasingly sophisticated MSP stacks offer ‘best of breed’ versus all-in-one

Integrability: with any partner infrastructure and delivers streamlined provisioning, billing and support

User Experience: Simple intuitive interface with powerful features, including insights and analytics

Cloud native: Built for the cloud from day one, secure and deployed globally

Will this endure? With the wealth of tooling available, software as a service can be very competitive and we’re watching how Dropsuite will expand on these to build a sustainable competitive advantage through their roadmap.

So what’s on Dropsuite’s product roadmap?

Dropsuite is part of the digital infrastructure for MSPs, offering a component they bundle to support end customers more effectively.

Dropsuite’s product council works with MSPs to guide their roadmap, with two clear paths to expanding product coverage:

Depth: offering adjacent cybersecurity products or more back-up products (i.e. Salesforce and Slack)

Breadth: expanding into different types of stacks for MSPs, such as regulatory compliance, IT management, general business services and productivity

Backups are inherently sticky, and by increasing the depth and breadth of services that Dropsuite offers to MSPs we’re optimistic will be defensible against competing offerings.

Business Model: distribution, hosting and leverage

Dropsuite’s business model is simple to understand.

Dropsuite builds and hosts their product

MSPs partner bundle the product with their broader IT offering

Dropsuite sets pricing to the MSP who adds 20% - 30% on top

MSP charges the end customer and delivers share of revenue to Dropsuite

First, the obvious. There is incredible leverage in selling to MSPs.

We see three unique pieces of the story that we like….

i. Changing customer profile

Dropsuite’s partner led business benefits in scaling their sales, support and marketing operations, and brings natural revenue expansion and diversification.

But not owning the relationship with the end-user has its risks.

In October 2018, one large partner from Latin America deactivated 420k paying users (approx $7m of ARR) who were deemed as ‘not actively utilising their email service’, sending Dropsuite’s share price down 60% in one day.

The partner had ‘opted-in’ all their customers into the hosting back-ups, seeing a rapid run up in subscribers which were then turned off.

What’s changed to avoid this in the future? Dropsuite’s core customer profile has evolved from hosting providers (who mainly work for individuals) to MSPs (who work for SMBs).

SMBs provide a more stable end market and support higher MSP revenue retention (more on this in unit economics).

iii. The Hosting Bill

Dropsuite’s hosting costs for storing the backups are running at approx $3m annually today, with gross margins around ~70%.

Their data center operations (which they do not own) are spread across 13 locations globally. This is an important value proposition for fault tolerance, redundancy, and data sovereignty (e.g. having a data center in Canada ensures they can deliver on the Canadian Privacy Act).

With such critical need for strong hosting, are 70% gross margins the max? We don’t think so.

Data storage costs are driven by 1) how much data is stored and 2) how often it is accessed (for example, Amazon’s S3 Glacier is for long-term backups and costs one-fifth of S3 Standard).

As Dropsuite’s customers mature, more of this backup data should be moving into lower tiered plans

Bigger peers such as AvePoint, Commvault and Datto operate at 73% - 86% gross margins

Secondly, it's hyper competitive between the big three players (AWS, Azure, Google Cloud) with data storage costs currently declining 20% - 40% each year.

While gross margin decreased marginally to 67% in 1H FY22 (from 69%) as a result of expanding server and storage capacity in new data centers, we think Dropsuite will expand gross margins in time.

iii. Proving out operating leverage

With only 60 people, Dropsuite is a small team that packs a punch.

As MSPs partners drive end-market distribution, incremental revenue is highly profitable and is proving out in the company’s operating leverage.

Cash receipt growth (which tracks slightly behind ARR) is rapidly outpacing cost growth in the last 21 months.

What will Dropsuite do with this surplus cash?

With such strong market growth - we’re hoping they invest all of it in customer acquisition, product development and acquisitions of new products to plug into their MSP network.

Unit Economics: 5 month payback, high MSP revenue expansion

Dropsuite’s unit economics are a make-up of revenue, hosting costs and customer acquisition costs (CAC).

They don’t currently provide end-user retention numbers so we can’t calculate LTV, but we can look at their end-user unit economics through CAC payback, and MSP economics through revenue retention.

#1. CAC of $7 per user with 5 month payback

Due to the partner distribution, Dropsuite today has spent very little on advertising and marketing with CAC averaging $7.22 over the last two years as they added 260k users.

With Dropsuite’s Average Revenue Per User (ARPU) around $2 and gross margins of 70% - Dropsuite currently recovers their CAC within 5 months (based on all their marketing costs and assuming 20% of their staffing costs are sales related).

That’s strong - typically CAC payback for SMB SaaS is <12 months.

However, with only $20k a month spent on advertising - it’s hard to be confident that this will hold constant if Dropsuite were to 10x the budget.

We’d expect Dropsuite to be testing how they can be more aggressive in their go-to-market activities.

Historically, MSP events and trade shows have been the #1 lead generation activity and the educational resources on their website paints a strong foundational marketing engine.

With vaccination programs underway around the world and travel opening, we’d like to see Dropsuite investing a lot more in sales and marketing.

#2. IT Reseller Revenue Retention of 135%

If an MSP loses an SMB customer, they can migrate the services to another customer - so MSP net revenue retention is a key indicator of MSP performance in the user end-markets.

This means we can look at ARR per partnered IT reseller as a proxy for Dropsuite’s net dollar retention. It’s not exact as it only accounts for the net change in distributors and MSP numbers, and likely understates true revenue retention as new partners would add to the total count before they have material revenue.

Nevertheless, it’s looking good 👍 .

Since pandemic lows in Q2 2020, ARR per IT partner has increased +35% to $33k

Go-to-Market: scale MSPs to diversify revenue

Dropsuite’s go-to-market is driven by their partners bundling their products with their SMB offering.

MSPs (or MSP distributors) like Elytis, Sherweb and Tarsus can use Dropsuite in three ways.

Custom provisioning system: Dropsuite gives them the docs and they build into the APIs themselves

Off the shelf ERPs: Made for MSPs like Connectwise, Autotask that bring pre-built packages

Self-service portal: uses SFTP over public cloud infrastructure to automatically back up files

The first two account for the majority of revenue.

Through these partners, revenue growth endurance has been very strong and accelerating in recent quarters (read: more MSPs, more end-users, higher ARPUs).

Revenue concentration remains a key risk and one of Dropsuite’s growth pillars is diversifying revenue.

It’s working - revenue share from the top 10 partners is down to 66% (versus 95% in 2017).

With the customer base increasingly diversified, the withdrawal of large MSPs should not significantly disrupt the customer base.

Competition: many players, few with MSP playbook

There are a number of players that offer back-ups to MSPs and directly to end users.

With the end market growing significantly, >80% of end-users are coming from people who have never used backups - making Dropsuite’s #1 competitor today non-consumption.

Their value proposition seems to be resonating with great reputations on G2Crowd and SoftwareReviews.

The real competition is with other vendors selling to MSPs, where Dropsuite needs to deliver differentiated and strong partner experience.

These partnerships are non-exclusive - so MSPs can have multiple offerings like Dropsuite in their stack.

While MSPs like to stick to one or two, distributors (i.e. wholesalers) tend to take a “supermarket approach” offering 3 - 4 offerings of each product (i.e. backup, security, productivity).

Acronis and Datto are two of the big dogs in the market, in the EU and North America respectively. Both have rolled out the MSP playbook and have 28,000 MSPs combined.

Dropsuite’s focus is on offering backup to a limited set of applications (email and website) vs. the “open buffet” of options that these bigger companies offer. With API or plug-in integration options, many MSPs get to pick best of breed vendor offerings, while others prefer to get everything from one vendor.

Ownership

Dropsuite’s share registry has surprisingly little institutional ownership with low liquidity - the average daily volume is 800k (approx $200k).

Topline Capital Partners - 20%

Tracy Anne Fearon - 6%

Charif Elansari - 5%

HSBC Custody Nominees - 5%

BNP Paribas Nominees Pty Ltd - 5%

Valuation: cash flow, value per user and cybersecurity peers

If Dropsuite can continue expanding their MSP partner base and share of the back-up market, the business outlook looks promising, and we see data back-ups as Dropsuite’s wedge to play in much bigger markets.

#1. Cash flow inflection point

Dropsuite recently became cash flow positive in FY22, we expect operating leverage to continue to prove out in both gross and net margins. Below are our forecasts on their existing backup business.

#2. Cloud Backup Peers

There are a lot of players in the cloud backup market, with different product offerings, scale, growth rates and business outlooks.

Comparing these across three verticals of publicly listed, venture backed and M&A transactions shows there is upside in the value being ascribed to Dropsuite’s user base which is growing rapidly.

Given Dropsuite increasing growth profile and global exposure, there might be acquisitive interest given the current ‘pure-play’ exposure - but we’d much rather see Dropsuite grow and consolidate other products into their offering.

#3. Cybersecurity Peers in the Mopoke Cloud

Compared to cybersecurity peers in the Mopoke Cloud Index, Dropsuite trades at a deserved premium.

What's next for Dropsuite?

The bull case is Dropsuite uses back-ups as a wedge to build a robust product portfolio for MSPs.

They recently raised $20m which has been flagged to accelerate strategic growth objectives and advance M&A opportunities. We’re hopeful that Dropsuite will use this cash to become a multi-product organization.

This will be a big test and one we’re watching to see how well they can plug a new product into their global network of MSPs to further growth, reduce product/partner concentration risk and build an enduring competitive moat. We’re following the progress closely.

Congratulations to Charif and the team on their success so far. 👏

Thanks for reading!

We’ve been seeing growing wage inflation in 2021, and many companies are missing hiring goals from the scarcity of talent.

Up next - we’re going to see how this is impacting ASX technology companies and which companies are most at risk. Subscribe so you don’t miss it.

We’d also love your input so that the newsletter can continue to improve - share your feedback here or send an email to andy@andycrebar.com.