Finding the best tech on the ASX 🔍

Technology IPOs are booming on the ASX, but with mixed results....

Since 2018, the technology sector on the ASX has grown to over 250 companies and $200bn of market capitalization, now comprising almost 10% of the entire index.

2019 was the biggest year to date, adding 18 new technology companies to the ASX.

With strong valuations and increasing access to markets by investors - it’s no surprise that there is a growing pipeline of local and international companies wanting to list on the ASX, and 2021 is likely to be the biggest year yet.

Max Cunningham has led the incredible growth in building out the ASX as the junior tech exchange. We met in San Francisco at Joe & the Juice (good vibe, overpriced juice) while I was building Sapling.

While Sapling was too small for the ASX at the time - he was set on capitalizing on the demand for technology companies from ASX investors, knowing that many growing software companies doing single-digit millions in revenue would be of sufficient size in just a couple of years.

Great technology companies, mixed results

Since then, another 53 technology companies have been added to the ASX with an aggregate market capitalization of ~$11bn.

Results for these IPOs have been mixed - with 25 in the green 🟢, and 28 in the red 🔴 at the time of writing.

If you had put $10,000 into each one of the 53 tech IPOs on the ASX since 2018, your $530,000 investment would be worth $593,254 today. A decent result, but savvy investors on the ASX should be able to achieve more than 12% over three years (the ASX200 advanced 22% with much less volatility).

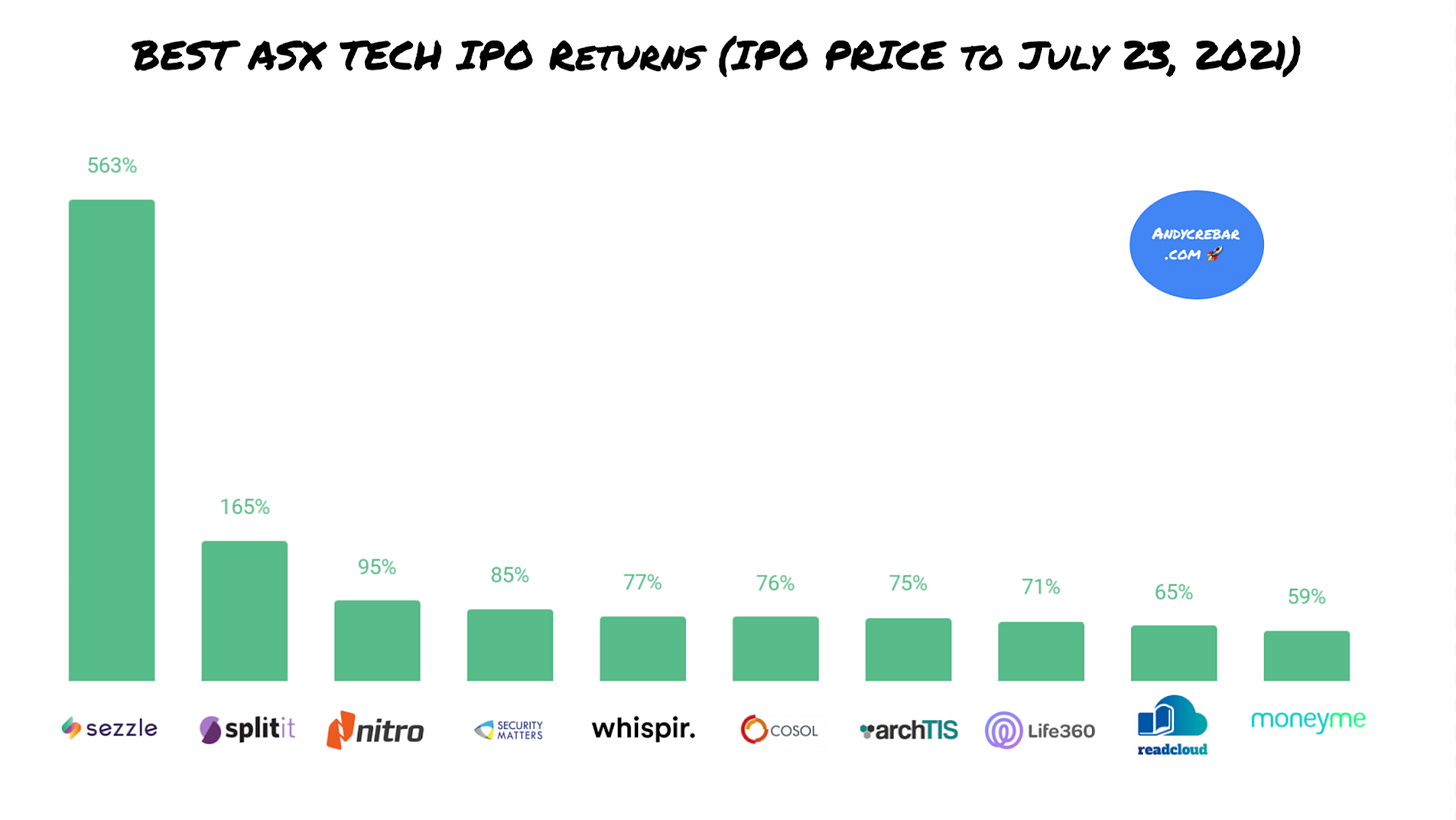

There have been some big winners including Sezzle and Splitit (buy-now-pay-later), Nitro and Whispir (productivity) and cybersecurity (Security Matters and Archtis).

As for the losers (at the time of writing, hopefully not in the future), 28 of these technology IPOs are underwater - some by more than 90% in the case of Tymlez (blockchain) and DXN (IT services).

Nuix just skipped this list and has been the 12th biggest decliner so far for investors since IPO (down 47% 🤦♂️).

Why care?

With mixed results, technology investors on the ASX have reason to be cautious - losing 90% of your investment is not great for your capital base - but there are big rewards for picking winners given the scalability of software products and better ability to access global markets than classic industrial companies.

It's significantly easier to sell and support access to online software than distribute tractors around the world.

Australia’s buy-now-pay-later poster child, Afterpay, listed in May 2016 with investors up 35x at time of writing.

Their innovation on existing payments software with a new business model has created billions of dollars of value for Australian investors and the service is now available in more than 40 countries around the world.

What’s exciting is that the recently listed technology IPOs only cover 20% of the investable universe of the 250 technology-based companies on the ASX.

It would be foolish to think that we’ve seen the last global success story from Australian software.

While many of Australia’s fastest growing and sizable tech companies may still be in the private market (Cyara, Canva, SafetyCulture etc.) - no doubt there are some great opportunities listed on the ASX already, investible right now.

Not only are there great Australian technology companies being built locally - the ASX has become a destination for technology companies that need capital but may be too small for other exchanges.

ASX investors have already seen great success in predominantly US-based businesses including Life360 (mobile-based family safety), Bigtincan (sales enablement software) and Keypath Education (online post-graduate programs).

Defining the best place to look

Companies that compete with software products typically operate in new, dynamic, fast moving and evolving markets.

With today’s ecosystem of tools and infrastructure (AWS, Github, Atlassian etc.), companies can build and iterate on software faster than ever….. this means that competition, differentiation and changes in market dynamics can transform company prospects quickly, both on the upside and downside.

That said, with the right understanding and experience, many technology companies on the ASX provide ample opportunities for investors to bring informational, analytical and time horizon advantages to find winning investments.

My mum first got me interested in the sharemarket in high school and today (as I live overseas) still receives my buying confirmations from CommSec which go to my parents place - “I saw you bought more Life360, the price has gone up too much.. why do you like them?”.

She manages her own superfund and loves a good punt on the ASX, and I’ve seen many investors like her that want to learn more and find emerging software companies for their portfolio but don't have the best filters or understanding of how these companies will evolve.

Life360 has many of the characteristics of what we look for in an investment:

Strong product market fit

Attractive unit economics

A big addressable market

Strong insider ownership

We’re creating an index to analyze and track ASX-listed software companies like these that have the most opportunity. Expect more in the next update 👍.

Interested in staying up to date?

Enjoyed this content. Great - I have a few asks:

Share any feedback so that the newsletter can continue to grow and improve

Send it to friends/colleagues to subscribe that might find it interesting

Got a question or data set you’re interested in ASX tech - ask me here

Last thing - I take care to ensure this content is accurate, however market data can be tricky and constantly changing so it's likely an unintended error or two slipped through – let me know here.