Jaxsta: a listed startup searching for a business model in music

Will the acquisition of Vampr unlock growth or be a costly distraction?

Summary

Jaxsta is a startup in the true sense of the word, a company searching for a business model. The twist is that they’re listed on a public stock exchange.

Jaxsta has some good ideas and interesting signs of a scalable future, but nothing is sticking yet, and they have less than 18 months to figure it out.

The greatest hope for Jaxsta appears to be in marrying the viral scale of Vampr’s user base with Jaxsta’s core subscription product offering. They’ve also launched a website for selling Vinyl but this just looks like a loss-making distraction (it has no revenue of note on the financial statements).

If Jaxsta can drive Vampr’s 1 million+ users to their product, then they might be able to outsell competitors with more advanced products.

Let’s take a closer look at Jaxsta.

About Jaxsta

Jaxsta was founded in 2015 by Jacqui Louez Schoorl and her husband, Louis Schoorl.

Jaxsta raised around ~$5m via a backdoor listing through Mobilarm Limited in 2018.

Market: fragmented sources of music revenue

There isn’t a “music revenue management software industry,” so we need to construct an understanding of Jaxsta’s market from the ground up.

The data to feed into constructing Jaxsta’s market comes from:

(a) global music revenue, and

(b) global music management

With this in hand, we can define the shape of Jaxsta’s market.

Global Music Revenue Is Fragmented

Music revenue comes from a wide range of sources. Spotify is the single leading source with about 20% of global music revenue. After Spotify, almost every source of music revenue barely gets over 10%.

On the surface, the category of Physical Performances - like live events or public venues - has 17.5%, but this itself breaks into what is likely thousands, if not millions, of smaller sources.

Sources:

Music Revenue Management

For Jaxsta, the people who might take up their product are people who care about revenue management. These could be musicians, their managers, rights holders, agents, and labels.

Spotify provides a window into this world, especially considering it is the leading source of revenue. Spotify’s Loud&Clear report indicates there are “around 200,000 professional or professionally aspiring recording acts globally” on Spotify. These acts generated 95% of the revenue, meaning there are 200,000 people globally who care about music rights revenue.

Another perspective on quantifying this market comes from the Australian government. It reports 8,500 music professionals through its Labour Market Insights research and ~40,000 “live music workers” from a different agency. The former is more in line with Spotify’s statistics and the latter represents a group of people that are not necessarily interested in music rights revenue (i.e. they might be the Saturday night cover band at your local pub).

We can probably rely on Spotify’s numbers with an assumption that the market is probably somewhat larger but likely not by orders of magnitude. If you’re serious about monetising your music, then you’re probably on Spotify.

Digging into the Spotify data, there is a power law at play, with only 1,060 artists generating over $1m in revenue. There are also 57,000+ generating over $10,000, and this number has doubled over the last five years. So there is growth in the smaller artists.

For the remainder of this analysis, for ease of reference, I’ll refer to musicians and the interested parties (managers, agents, labels, rights holders, etc) as Music Revenue Managers.

Market Opportunity

Stitching the globally fragmented music revenue market together with a small number of potentially monetisable customers sets a challenge for Jaxsta. On one hand, the fragmentation is Jaxsta’s opportunity, a clear structural problem they can help solve. On the other hand, 228,000 potential Music Revenue Managers at Jaxsta’s pricing is a total market size of between $11m and $230m annually.

There are two points worth addressing that arise from Jaxsta’s published reports that challenge this market assessment:

This number is lower than the 1m+ users that Vampr reports. However, it is unclear Vampr monetises its users users and only clear how Jaxsta monetises.

In their words, Jaxsta has entered the consumer market with Vinyl.com. Selling vinyl to consumers is a substantially different business to selling software. This newly launched business has little to no revenue. It’s a new concept addressing a new market and offering. So it has been excluded for now.

Competition in Music Royalty Software

Jaxsta competes in a niche software market for managing music royalties. In this niche there is a mix of players solving the problem in different ways.

Jaxsta has strength in data enrichment and verification but is weak against its competition in managing contracts and publishing music.

Reprtoir seems to lead the field with features like:

Automation of the publishing of music

Managing the contract and royalties between the revenue source and the artists

Ingesting from 120+ data sources and enrich that data with AI

Tracking and audit royalties

Other insights (e.g. geography, source of revenue)

Reprtoir also offers a range of plans at different price points while Jaxsta jumps from a small amount per month to a relatively larger amount with no increments in between.

There is also likely a number of companies that will do this manually and a number of homegrown, internal solutions that larger organisations have built to address this.

Remember, as well, I can just get my revenue directly from Spotify or Apple and not worry about reconciling. Sure it’s manual and I might miss things, but I’ll still get paid. Also, at the big end of town, there are already administrative staff working this and the revenues justify it (and have done so for a while).

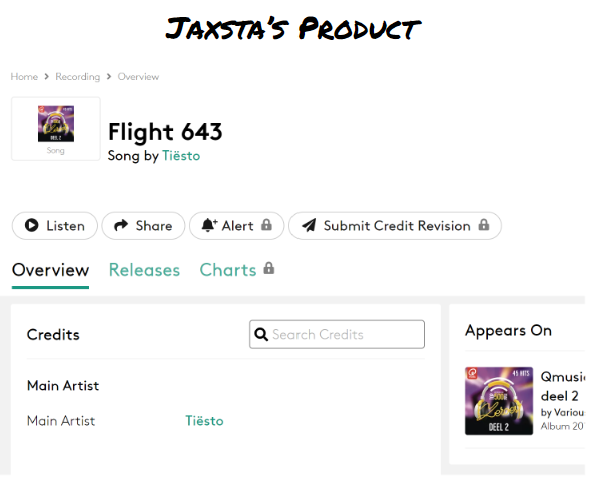

Product: Analyse music credits and do research

Jaxsta lets you search for songs, get alerts on credits and research markets.

Vampr

Jaxsta acquired Vampr. It’s a social network for musicians with functionality to publish and distribute work.

There are plans in the product roadmap to integrate the functionality of the two.

Customer Value Proposition: Those Already Earning That Want More

Jaxsta solves a very specific problem for Music Revenue Managers to find more revenue with less effort.

A key challenge for Jaxsta is that Jaxsta isn’t on the critical path for people to earn revenue. People will need another software solution or manual solution for that and then they would layer on Jaxsta to find unearned revenue or verify that revenue they have earned was correct.

In this light, it’s debatable whether smaller musicians are a target.

Business Model: Social Network and Paid Ads Driving Funnel for Software Subscription Sales

Jaxsta’s ultimately about driving subscription revenue to their software and data platform.

Historically they have done this through paid advertising and sales efforts. With the acquisition of Vampr, they added a viral referral component to the top of their funnel.

Go-to-Market: Searching for a scalable model

Jaxsta has dramatically decreased its marketing spend over the last year or so (from $750k down to $177k). It will be interesting to see if the growth this spend instigated can be maintained. Vampr’s social network may fill the gap.

The go-to-market currently seems to consist of:

Vampr as a social network driving viral referral

Paid ads driving potential sign ups directly to Jaxsta’s software

Sales efforts to convert and close businesses and organisations to paid subscription

Finances

Jaxsta’s finances show a startup with customer concentration and, hopefully for them, just enough runway to figure out their business model.

Less Than 18 Months Runway

Based on financial statements for the year ending June 2023, it looks like Jaxsta has less than 18 months runway (I’m writing this in December 2023).

This is generally an acceptable amount of runway for a startup searching for a business model and product/market fit. However, Jaxsta also has almost $5m in debt.

Customer concentration

Jaxsta has relatively low revenue with high customer concentration. There are 5 customers that are paying mostly in the tens of thousands that make up 70% of revenue.

Vinyl.com is doing better than portrayed here. Over 5000 orders since April and Josh disclosed avg order at $75 USD.

Vampr is a social network, I don’t fully understand the revenue streams but it matches users similar to tinder and like tinder you can pay for premium features, I believe musicians can also publish and monetise music via Vampr, in which Vampr takes a clip.