Metrics for evaluating ASX Tech: Part 5/5 - Customer Retention 📊

Many companies in the US showcase +150% net dollar retention. We compared the leading companies on the ASX, and take a view on why they're so far behind....

Welcome to Part #5 of the series on Metrics for evaluating ASX tech.

You can find Part #4 on Growth Efficiency here

Subscribe so you don’t miss further insights on ASX tech

#5. Customer retention: how it works and how the ASX 🇦🇺 compares to the US 🇺🇸

Successful customers are the building blocks of successful businesses - so being able to attract, retain and grow customers is critical to long term success.

This is especially important for subscription based businesses that want to deliver:

Customer Growth: adding new customers that start using the service

Logo Retention: retaining as many customers as possible

Net Dollar Retention: increasing cohort revenue (comprised of logo retention, gross churn and up-sell)

Dollars are the most important, and companies can have low customer retention with great business models (see Life360 👍 ).

Some other fundamental things to know when looking at customer retention are:

Logos vs dollars: Many companies have logo retention <100%, but maintain >100% net dollar retention as some customers expand to more than make up for the lost ones

Capital efficiency: Due to CAC, companies with higher logo churn go through more capital to grow (i.e. less efficient)

B2B vs B2C: Retention in B2B is normally higher as business commitments to new vendors are not made lightly. Retention in B2C is normally lower, and small businesses often act like consumers.

How customer retention stacks up on the ASX?

Customer counts and retention numbers are not required disclosures on the ASX, but should be (at least for subscription-based companies).

While we respect some reasons for management teams being guarded, only 32% of companies we follow in the Mopoke Cloud Index report it. 🤦♂️

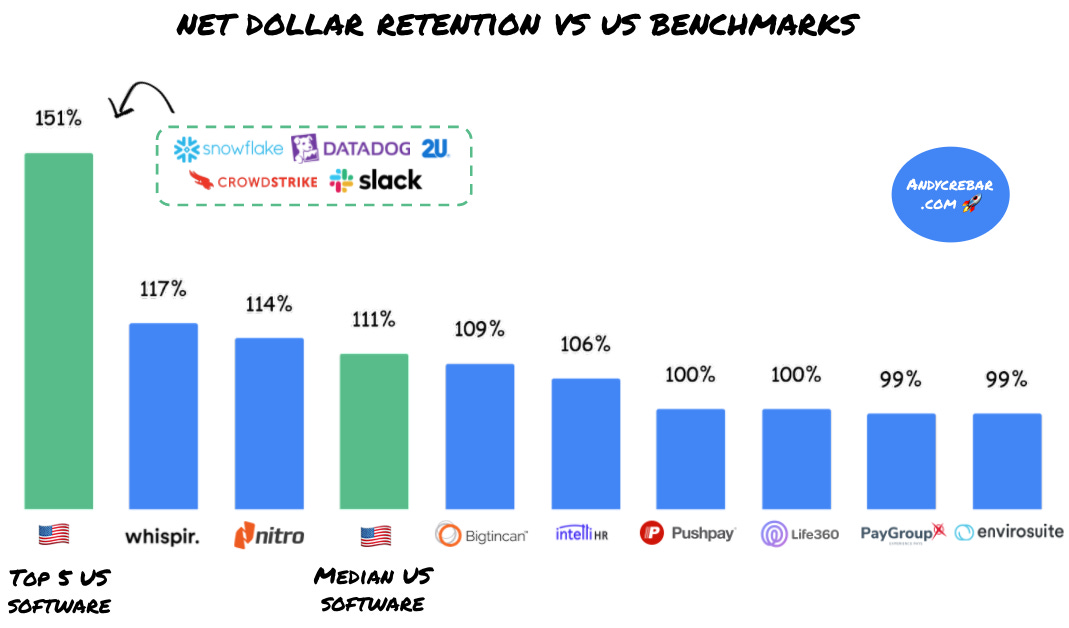

Looking at the ones that do report it, we found they have much lower net dollar retention compared to US leaders, with only a handful operating at >100%.

In the US, the median net dollar retention is 111% and top performers are well above 120% (the top 5 averaged 151%).

The disparity in retention likely contributes to the valuation premiums seen in the US, where incredible software companies like Cloudflare, Snowflake, and SentinelOne trade at >70x forward revenue (and all have net dollar retention >125%).

Comparing the highest software trading multiples in the US to those in the Mopoke Cloud also shows the disparity in multiples and disclosures.

Not one of the top 5 in our index reports net dollar retention (NDR).

The role of Product Lead Growth 🚀

At an index level, a big part of the retention difference is the lack of ‘product-led-growth’ (PLG) companies, which account for less than 10% of companies in the Mopoke Cloud Index.

PLG companies bring a much higher focus on user acquisition and expansion (‘land and expand’), whereas sales-led companies often ‘land higher’ on initial revenue, but might not see significant uplifts from there.

PLG is rapidly growing in both private and public markets, which we will cover early next year.

Series Summary - what are we really looking for?

That wraps up the five-part series on Metrics for Evaluating ASX-technology Companies.

We’ve covered PMF, Growth, Unit Economics, Efficiency & Retention - but there are many more factors that influence a company’s long term prospects (read: stories go with spreadsheets).

What we are really looking for is a company with a product that customers love, selling into a big market, can get the product into new customers hands quickly, and can keep these customers for the long term.

Thanks for reading! One last thing….

We’ve been seeing growing wage inflation in 2021, and many companies are missing hiring goals from the scarcity of talent.

Up next - we’re going to see how this is impacting ASX technology companies and which companies are most at risk. Subscribe so you don’t miss it.

We’d also love your input so that the newsletter can continue to improve - share your feedback here or send an email to andy@andycrebar.com.