Metrics Of The 25 Fastest Growing ASX Tech Companies

What are they measuring to drive results?

This is an analysis of the metrics used by the twenty five of the fastest growing tech companies that are listed on the ASX.

The metrics a company uses to drive results on its financial statements can tell you a lot about the company or help you better understand or manage similar businesses.

What gets measured matters. It’s what drives behaviour. But, specifically, the metrics give us the levers to pull to ultimately impact financial performance (or not).

If you get the metrics right and know how to impact them then good results will follow. Use the wrong metrics or struggle to know how to impact them and you’re going to have a bad time.

You can’t just magic up “revenue,” you need to do an activity first to make revenue happen (sign a new customer, get a visitor to you website).

Different metrics give different outcomes: An example

Let’s explore a brief example of two fictitious companies that sell software, Company A and Company B. Both sell software to larger organisations. Company A has a focus on sales pipeline or new clients. Company B has a focus on getting existing customers to transact more.

Company A will most likely end up with an organisation and cost base geared towards new business that, hopefully, results in more new customers.

Company B will most likely end up with an organisation and cost base geared towards getting their existing customers to transact more.

A year or two down the track you would expect Company A to have grown to more customers than B and Company B to have grown revenue with existing customers, more so than A.

There isn't necessarily a right or wrong. However, if new business wasn’t the right focus for Company A or focusing on transactions wasn’t right for Company B then problems will emerge. There will also be problems if the organisations of A or B aren’t geared to the metric they are pursuing or need to pursue.

How the Metrics Analysis Was Done

To get to a useful set of metrics, I took the top 25 fastest growing tech companies listed on the ASX, measured by year on year revenue growth over the last financial year.

Then I went through every annual report and listed out the key metrics that stood out. I was deliberately not looking for standard, common financial metrics like revenue, operating expenses, margin or EBITDA. I looked at what metrics were mentioned in the reports or discussed that fell outside financial metrics common to all businesses.

After listing the metrics for each company it became apparent that there would need to be some analysis and categorisation of the metrics.

This resulted in selecting what appeared to be a company’s primary metric in the following categories:

Growth: the metric the company focuses on to grow revenue.

Product: the metric the company focuses on to make their product succeed.

Financial: the metric the company focused on to measure financial success outside of the metrics common to every business.

This was by no means an exact science. For example, some companies had a few metrics for growth or different business units that tracked different product metrics. So, selecting which metrics ended up being a judgement call based on what seemed to matter to the company based in their reports.

Metrics by Industry

Metrics for Software Companies

The first segment we’ll look at are the ASX companies primarily selling software.

Insights

Growth: Sales Pipeline and Customers are the most common primary metric of growth. You could argue these are somewhat different with Sales Pipeline indicating a focus on new business and Customers a focus on existing customers however for our purposes here we take them as a focus on the number of customers they have and growing that number.

Product: Active Users is the most common primary product metric for these companies.

Those not using Active Users had a far more unique measure of success with their product specifically. For example, dubber measures Moments In Conversations which tracks when something is said on a call that a customer might be interested in. Quoria provides safety software through schools and tracks Children Protected.

Financial: Recurring Revenue in some form (whether they call it ARR, SaaS revenue or something similar) is the most common key financial metric.

There are a few companies where recurring revenue is combined with another form of recurring revenue like rewards, transactions or bookings. In these instances, I took the metric they focused most on but in some cases it was hard to choose.

Other:

Dubber and DropSuite are notable in their focus on partners, with metrics geared towards the number of partners.

Credit Clear stood out as having metrics that are unique to their business and business model (e.g. Value of Files Under Management)

8common’s Users With Demand & Elevated Onboarding was a point of interest.

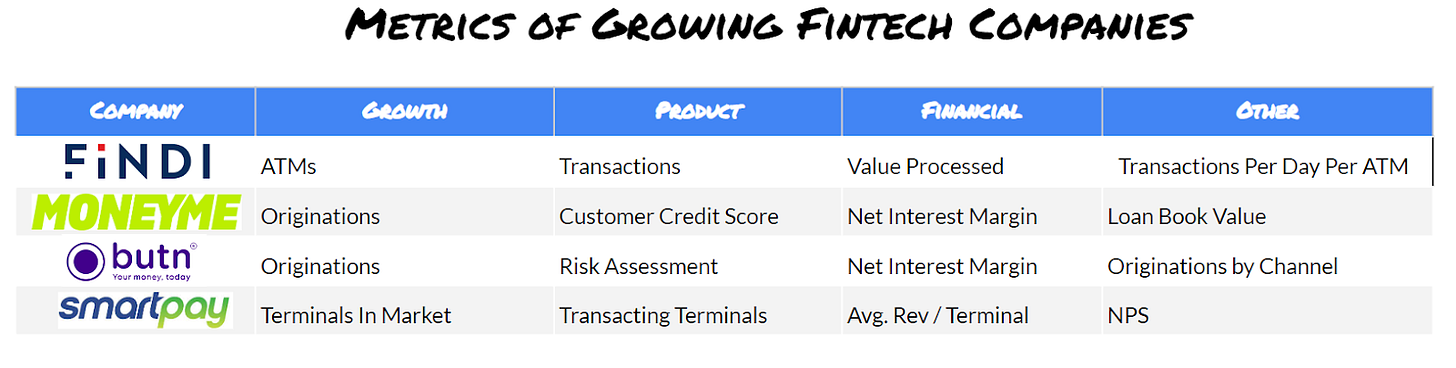

Metrics for Fintech Companies

Here are the metrics of fintech companies:

Insights

Growth: Originations is the clear winner for lending. In payments the transacting device (ATMs or Terminals In Market) is key.

Product: Again it’s split with lenders focusing on risk and payments companies on transactions.

Usually product metrics are focused on the customer or user so it is interesting that lenders use a risk metric which is an internally facing measure.

Financial: Lenders focused on their interest margin (how much interest they make from a customer against their borrowing cost). Payments companies focused on how much volume they were processing overall or by unit.

Other:

Butn’s focus on originations from partners speaks to butn’s channel strategy to reach small to medium businesses.

Smartpay’s use of NPS was unexpected.

Metrics for Online Marketplaces

This section looks at Online Marketplaces, companies that use technology to connect buyers and sellers of different products.

In this section it was a little hard to separate growth, product and other metrics.

Insights

Growth: Customers Acquired was common, but in a small sample size you can’t read too much into that.

What you can take from this table is what a typical funnel might look like:

Unique Website Visits

Customer Acquired / Booking

Try to get a repeat purchase / return

Product: in order to get the booking, you need buyable products or services in your marketplace (e.g. Flights, Destinations, Total RVs on Platform).

Bookings was the metric selected for two of the companies. In a way it summarises the two sides of the marketplace coming together, a customer successfully navigating the marketplace to find the item they want.

Financial: the common thread across each marketplace was that they measured the total value of items transacted on their platform or the average value of each transaction (or booking). They could have chosen their margin, but instead focus on total value.

Metrics for Consumer Software Companies

There was only one software company in the top 25 ASX tech companies that directly targets consumers, that is Life360.

The Paying Circles metric stands out as a unique metric, specific to Life360’s business. A Paying Circle is a family or group of people looking out for each other’s safety.

Hi Scott, have a look at Spenda (SPX) - emerging fintech and payments business