Mopoke Cloud - December 2021

We look at the biggest winners and decliners, as well as some things we found interesting for specific companies.

The Mopoke Cloud Index - made up of 94 emerging technology leaders on the ASX was down (1.1%) in December, behind the ASX 200 which finished the month +3.0%.

December's rundown:

Plexure (+24%) announces wins at the SCG & SFS

OneView (+17%) cancels their underwater SPP

BNPL investors shift focus with Zebit (-15%), Openpay (-12%) and Sezzle (-10%) tumbling

DigitalX (-18%) sinks as crypto prices weigh on treasury and funds management

First time here? Subscribe so you don’t miss further insights on ASX tech 🚀.

Top 10 Gains in December

Plexure (+24%) announces wins at the SCG & SFS

The $145m company provides mobile engagement experiences for global brands, focusing on the Quick Service Restaurant and Grocery verticals

The diversification of revenue story is improving, however the company has flagged two supply issues constraining their growth - hardware and peopleware

What we like? 👍

Proving customer diversification: McDonalds has been massively successful with Plexure’s platform and historically accounted for >90% of revenue. This is both a blessing and a curse, and recent new wins on Gloria Jeans, Starbucks and Pita Pit have been strong signals of improving diversification and broader use cases

Misunderstood? A community member flagged Plexure to us, highlighting the significant valuation disparity with US peer Olo. The pandemic has made operating results particularly muddy in restaurant-related software so growth rates are hard to compare, however Olo trades at ~30x sales versus Plexure at <4x. If you have a view on why, we’d love to hear it!

What are we watching? 👀

Supply chain disruptions: Despite strong growth, Plexure’s headcount went backwards in late 2020 as the company struggled to recruit engineers and data scientists - critical roles for a company whose software touches over 200 million people. Plexure said ‘The biggest risk to our business is not being able to hire the staff to execute on our plan’ and their November market update introduced further supply challenges on hardware impacting sales and follow-on software revenue

Integration: Plexure acquired TASK in August (two weeks after a CEO change) for $120m, and announced an operational restructure in November. The goal of the acquisition was growing their customer value proposition and we expect the short term to be bumpy while they bring the businesses together

OneView (+12%) cancels their underwater SPP

The $148m business operates a digital platform for hospital patients that provides relevant goals and education to get them home faster

The company seems to have built a great product, however cash investment has been significant with investors waiting for revenue growth to catch up

What we like? 👍

Industry: we’ve written about healthcare before and several companies in the Mopoke Cloud Index are having success in the UK and US markets. Cracking the nut on distribution is key and OneView’s US strategy has decent foundations with three of the top 20 ranked hospitals in the US as customers

Product-led: the user experience of the product looks strong with clear benefits on both the patient and administrator side. Selling multi-year contracts with purpose-built hardware, high margin recurring software revenue (+75% GMs) and strong customer retention (98%) are great ingredients for success

What are we watching? 👀

Active bed numbers: with such a big market and long run way penetrating the US hospital system, it’d be worrying if active bed growth numbers stalled out…. which seems to have happened in the last 18 months. OneView had 9,259 active beds in December 2020 versus 9,121 in June 2021. We hope that the delay is pandemic related and active bed growth will quickly return

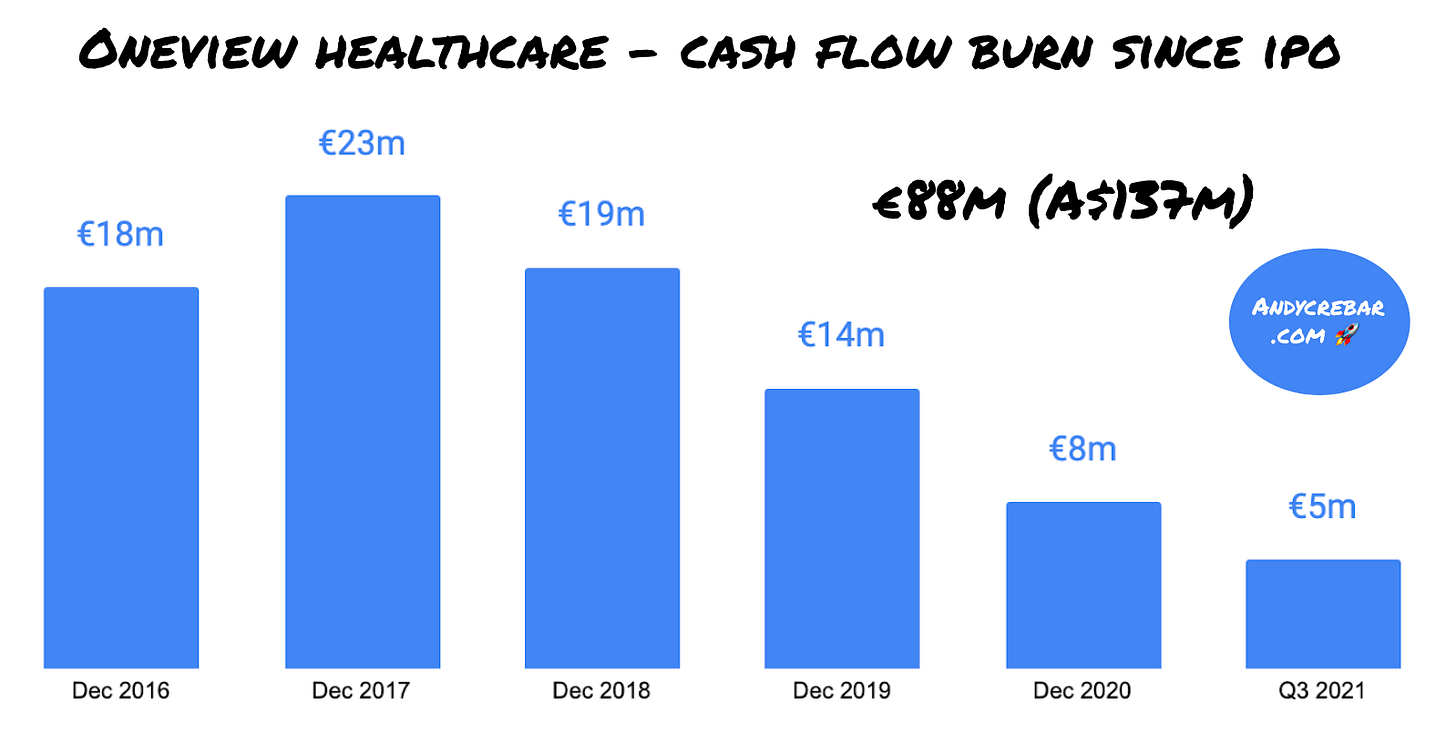

Land grab or slow burn: the recent ‘land grab’ focused capital raising gives OneView firepower to chase the 80% of beds in the US that don't have a digital solution. The business seems to be approaching a cash flow inflection point, with a total of A$137m of shareholder funds invested in the business since listing in 2016 compared to a market cap today of ~$135m

Top 10 declines in December

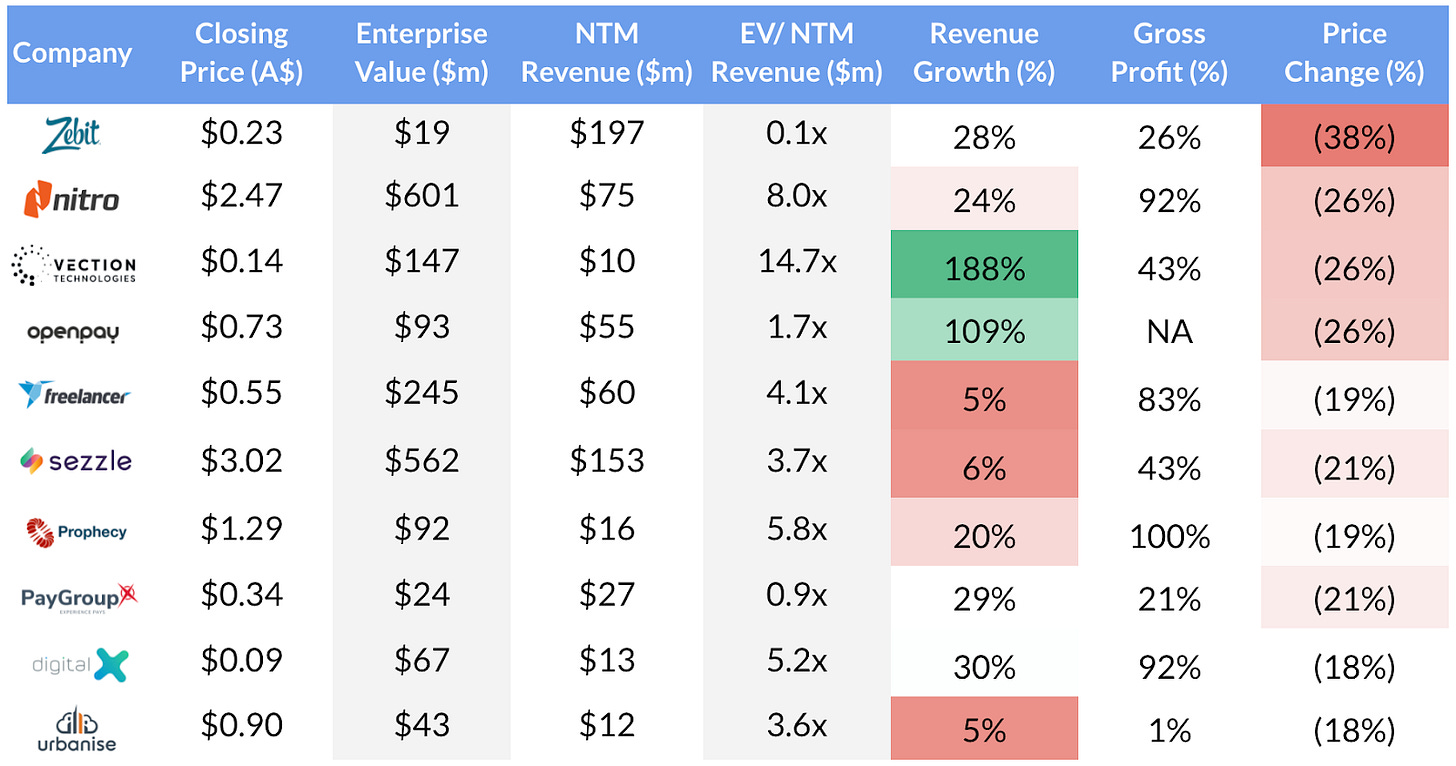

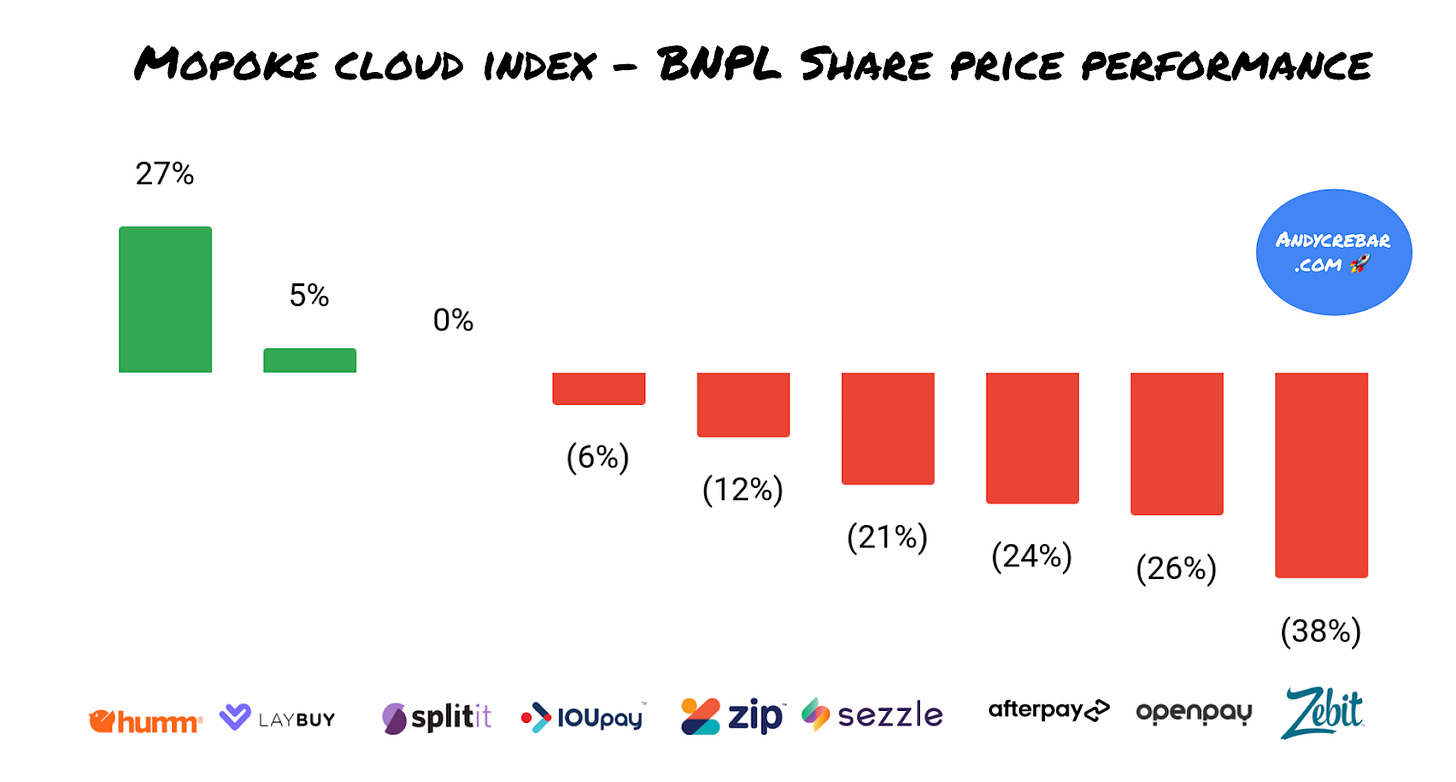

BNPL investors shift focus with Zebit (-15%), Openpay (-12%) and Sezzle (-10%) tumbling

The ASX is home to 10 buy-now-pay-later (BNPL) companies and the sector is seeing increased scrutiny on regulation, growth and competition

What are we watching? 👀

Regulation: the US is a key growth market with regulation from multiple, complex consumer credit regulations. In mid-December the Consumer Financial Protection Bureau (CFPB) started seeking information from Affirm, Afterpay, Klarna, PayPal and Zip on the risks and benefits of their products

Growth: institutional investors didn't take the BNPL space too seriously until the pandemic saw e-commerce take off. The battle is now taking place between several payment giants including Paypal and the sector is facing a test on delivering sustainable, profitable growth

Competition: with more and more entrants in the space, market saturation could negatively impact future customer and merchant growth rates. The most established and funded players (Afterpay and ZIP) should be able to outspend in customer acquisition, and the US and other markets are still early compared to Australia

DigitalX (-18%) sinks as crypto prices weigh on treasury and funds management

The $80m ‘blockchain ecosystem’ company announced new leadership and has multiple narratives underpinning its investment story

We explored the growth of DeFi and how it could be more disruptive than bitcoin last month

What we like? 👍

Experienced leadership: Lisa Wade, former Head of Digital Innovation and Sustainability at National Australia Bank, was recently appointed CEO. She led Project Atom which was the Central Bank Digital Currency project (CBDC), a collaborative research project between the Reserve Bank of Australia, CBA and Perpetual

$30m of treasury value: the company holds ~216 Bitcoin in their treasury and 12.5m Human Protocol tokens, as well as $7m of cash

What are we watching? 👀

ASX’s DLT: DigitalX is one of key partners in the ASX marketplace for the new distributed ledger technology - Synfini - which is live in production and awaiting the CHESS replacement system scheduled to be released in April 2023

Investor narratives: with three unique businesses being incubated under a ‘blockchain ecosystem’ investment story, crafting clear, compelling narratives will be key as the businesses scale. Today, DigitalX is a mix of funds management, a recurring software business and a volatile crypto-driven treasury value. MicroStrategy in the US has been a interesting case study for this as they turned their investment narrative from software business largely into a Bitcoin ETF with an attached software business

Interested in staying up to date?

Thanks for reading. Up next - we are looking at an ‘Annual Wrap of 2021’ and our ASX technology predictions for 2022.

We’d also love your input so that the newsletter can continue to improve - share your feedback here or send an email to andy@andycrebar.com.