The Mopoke Cloud Index 🚀

A prioritization framework for emerging technology leaders on the ASX, and some initial observations on Healthcare, HR & Vertical software.

In our last edition we looked at Finding the best tech on the ASX following the mixed IPO results from technology companies since 2018, with more than half of them trading below listing price.

While trading down on listing prices might not be a great, the growing diversity of tech companies is a win for ASX investors, and we’re much more focused on the underlying businesses of these companies that will drive long term returns.

But researching the underlying business and developing the conviction to make an investment takes a significant amount of time, so it’s important to have the right prioritization framework.

To do that, we created a simple model to:

Identify companies that we believe have the most potential for multi-decade success stories;

Help us prioritize what individual companies we want to be diving deep into understanding; and

Frame what companies you can expect to learn about when you subscribe to this newsletter 👍

First time here? Subscribe so you don’t miss further insights on ASX tech.

What companies are we looking for?

From the ASX technology universe of 250 companies (including the 53 added since 2018), we defined a set of filters to help us focus on a subset of companies with the following characteristics.

☁️ Software or cloud-based products: this may seem like a moot point, but much of what is defined as ‘technology’ on the ASX isn’t necessarily software, but can be things like hardware or technology services. We want to focus solely on software products with high gross margins and scalability.

🖥 Clear Product Market Fit (PMF): the company has built a software product or service that sells - typically because it is cheaper, faster or better than existing solutions. The real test of PMF is unit economics which we’ll be digging into in another post, but PMF can be time consuming to assess and few companies will tell investors that they don't have product market fit. To keep things simple, we define PMF as having greater than $10m of expected revenue in the next-twelve months (NTM).

💵 <$10bn market cap: the best investment opportunities are likely under-followed by brokers and institutions, and the law of large numbers is difficult to escape. We want to increase our chances of finding companies that could grow to be 10x bigger in the next few years.

📈 Revenues growing >20% annually: technology investing is mainly focused on growth, so we want to find companies with momentum (normalizing for any COVID-related disruptions).

🌎 Global market opportunities: On the world stage, Australia is a small market of 25 million people and 2.4 million businesses (most of which are small operations). We want to focus on companies that are not limited by local borders and can grow globally either now or in future.

Applying the filters to create the index

The filters are not meant to be perfect and no doubt there are many great investment opportunities that sit outside this scope, but our goal is to narrow down the ASX technology sector into where we see the most opportunity.

Having advised, worked, founded, sold and invested in software businesses, this is a space where we have experience and we are big believers in Buffett’s Circle of Competence.

Here is how the filters work out:

The end result is 87 emerging technology leaders on the ASX, named the Mopoke Cloud Index.

While these companies pass the filters we apply, few will turn out to be enduring companies and achieve high returns on capital over the long term.

So while the index is helpful to prioritize where we want to be looking, the real value comes from understanding the outlook for the individual businesses in the index, and finding differences in market perceptions and realities.

Some initial observations on Healthcare, Human Capital and Vertical Software

To get a sense for high level valuations across the different segments, we can compare growth rates and valuations based on Enterprise Value / Next Twelve Month Revenue (EV / NTM Revenue).

Ultimately all companies should be valued on their ability to generate future cash flows, so revenue multiples can be misleading as many of these segments and companies will have different long cash flow profiles.

That said, NTM Revenue multiples are commonly used to shortcut the process and provide relative valuations - so we used it to provide some context on how the market is currently ascribing value.

Here are some of the first things that stood out.

1. The Price of Healthcare

The healthcare segment of the Mopoke Cloud Index (five companies) has highest valuations, with only one company (Doctor Care) trading below 10x NTM Revenue.

Healthcare takes up more than 10% of GDP in most developed countries and the burden of introducing new technology systems can be so high that once established, solution providers can be highly sticky and difficult to displace.

The healthcare segment includes the most expensive company in the index - Pro Medicus- which at a $6bn market cap, trades at 70x NTM Revenue of $84m!

The company's Visage software enables radiologists to view reports and X-ray image files from their mobile devices so diagnostic decisions can be made remotely. They have been highly successful signing big, multi-year contracts in the US Health System (a US$3.8 trillion market) with the share price up 50% in 2021.

At this valuation, expectations are high.

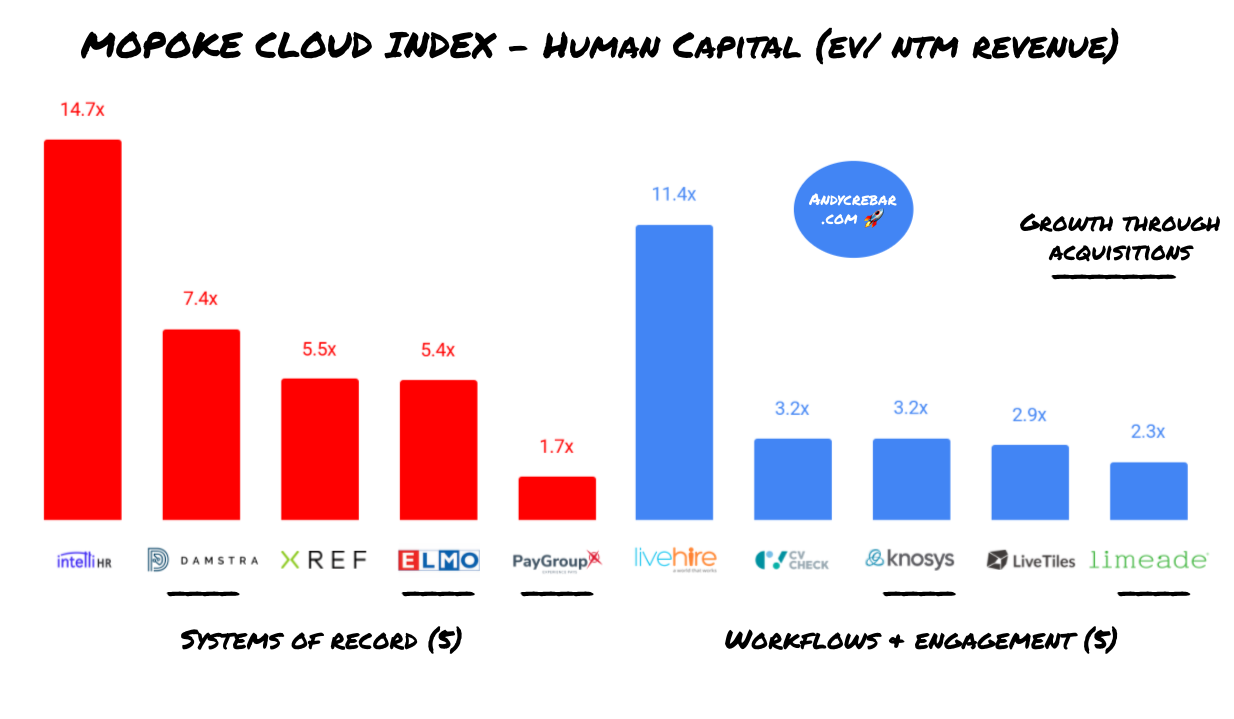

2. Differentiating growth through acquisitions in Human Capital

The number of Human Capital companies with scale on the ASX has grown substantially in recent years with four companies joining the ASX (intelliHR, Paygroup, Damstra and Limeade) and many others having built scale through organic growth (Xref, LiveTiles) and acquisitions (Elmo, Knowsys).

Interestingly, five of the twelve companies in the Human Capital index are using acquisition strategies to drive growth by buying smaller players and offering the products as up-sells to their existing base.

B2B software can be a crowded space and the winning acquisition strategies are going to be from those that have a platform - being a critical piece of infrastructure or system of record - and can then layer on value added services over time (such as learning and recruiting).

Companies that offer periphery products (i.e. surveys and intranets) eventually become features of a larger suite by core players, so there can be little long term value created from jamming these types of products together.

While there is no substitute for strong organic growth (Intellihr and XRef), with the above acquisition lense - Damstra, Elmo and Paygroup are the most interesting as they have established system of record platforms from which growth through acquisitions make clear sense.

3. The dispersion of multiples in Vertical Software

The largest segment in the Mopoke Cloud Index is vertical software which consists of 16 companies and $11bn of enterprise value.

Vertical software solves the needs of specific industries such as resources, insurance providers or governments. Healthcare (covered above) is also vertical software, however it is different enough that we broke it out in its own group for more clarity.

With so many companies building software in the larger ecosystem, many companies have started to define themselves as specialists in a particular industry. There are often fewer direct competitors and early leaders can dominate their field as they go deep on industry specific workflows and regulations, and become hard to displace.

In the Mopoke Cloud Index, Utilities and Mining software make up a largest portion of companies followed by a mix of other verticals.

What stood out to us was the dispersion in valuation multiples between Pointerra (3D data management software), Altium (printed circuit board software) and Objective (government tech) versus the rest of the index.

Altium recently rejected a $5bn takeover offer from Autodesk, Pointerra and Objective have strong growth engines, but the rest of the vertical index trades between 2x - 6x NTM Revenue.

Many of these companies are building industry leading positions which don’t appear to be fully recognized by the market. We’ll cover some of these in the future.

What's next and how to stay up to date?

In our next edition, we backtest the filters to see how they would have performed in recent years and what we can learn from the hits and misses.

We’d love your feedback so that the newsletter can continue to grow and improve and if you have a question or data set you’re interested in ASX tech - ask us here.

Last thing - we take care to ensure this content is accurate, however market data can be tricky and constantly changing so it's likely an unintended error or two slipped through – let me know here or send an email to andy@andycrebar.com.