Mopoke Cloud - November 2021

We look at the biggest winners and decliners, as well as some things we found interesting for specific companies.

The Mopoke Cloud Index - made up of 93 emerging technology leaders on the ASX - was down -5.0% in November, well below the ASX 200 which slid -1.6%.

November's rundown:

Vection (+71%) is helping industrial companies enter the metaverse

Janison (+15%) acquires another assessment business for $17m

Damstra (-39%) reflects on M&A strategy and lowers future guidance

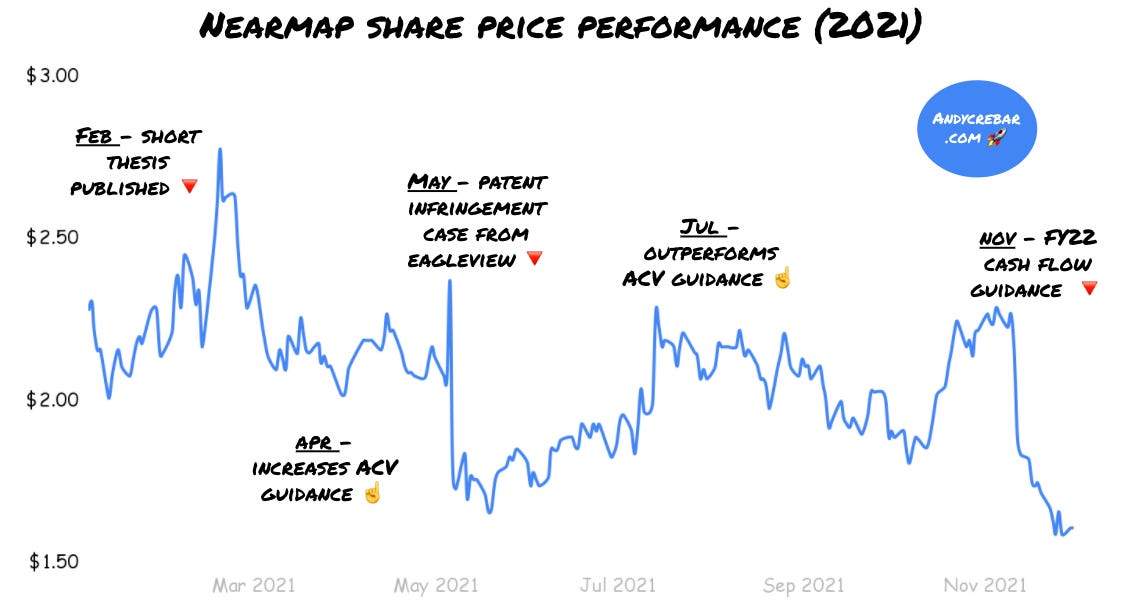

Nearmap (-29%) warns investors that growth will be expensive

This monthly update is brought to you by Alternative Assets - the largest alternative investing community. Also, if it’s your first time here, subscribe so you don’t miss further insights on ASX tech 🚀.

Top 10 Gains in November

Vection (+71%) is helping industrial companies enter the metaverse

The $240m company focuses on VR for B2B use cases like architecture, engineering, and construction

Several exciting announcements this month covering new contract wins, 80% contract growth in two months, Cisco partnership updates, expansion into the metaverse and a $15m capital raise

What we like? 👍

Cusp of major adoption? Meta believes the internet will soon support persistent virtual environments and Vection is helping industrial professionals get there too (like a B2B player vs. Zuck’s B2C). The market is going bananas - valued at US$26bn and expected to reach US$464bn in 2026 and Vection could play a major role in framing the industry’s future

What are we watching? 👀

VR under-represented on ASX: Vection was backdoor listed in 2019 and along with Indoor Skydive Australia (soon to be xReality Group) remains the only way for ASX investors to get VR exposure in the metaverse

Webex partnership: management have set high expectations for their Webex marketplace listing which puts their product in front of Webex’s 40 million users. ASX listed Dubber is seeing big success from something similar, although unlike the Dubber deal - Vection’s partnership with Webex isn’t exclusive

… elsewhere in tech-enabled services, most companies took a battering with the segment down 8% for the month.

Janison (+12%) acquires another assessment business for $17m

The $300m company provides online assessment and learning platforms for educators

Management has been busy in 2021 executing their strategy of acquiring analog businesses and taking them digital - Academic Assessment Services (AAS) is the latest and investors should expect more to come

What we like? 👍

Clear BHAG in a big market: Janison has a clear vision for the next few years to grow to ‘$80-100m revenue with customer mix towards SaaS’. Market size shouldn’t be an issue - the world’s $6 trillion education spend is only 5% online and most schools are at the start of their digital journey

What’s interesting? 👀

Buying vs Building: big education providers can be slow to make decisions, and Janison has figured out it is easier to buy smaller, traditional players with existing relationships than procure themselves. AAS adds another 200 schools off the back of QAT acquired last month (2,800 schools)

Public market caution on ed-tech: Many ASX-listed companies are trying to ride the online education wave, but remain unloved by investors. Janison is the highest valued education company in the Mopoke Cloud Index which all trade below the broader average. This isn’t unique though - key publicly listed education players in the US (2U, Chegg and Stride) also struggle on valuations

Top 10 Declines in November

Damstra (-40%) reflects on its M&A strategy and lowers future guidance

The $90m workplace management solutions provider lowered guidance for the second time in as many months

What we like? 👍

Founder ownership: we like founder-backed businesses. The Chairman (Johannes) and CEO (Christian) have been building the company together for 10 years and own 10% each. No doubt they are aligned with shareholders to build value

M&A Reflections: it's (refreshingly) rare to see a management team reflect on M&A learnings from the battlefield. Damstra has acquired seven companies in four years and learnt that balancing the speed to market of acquired products versus the integration cycles is key (read: code is easy to scale, but hard to repurpose)

What are we watching? 👀

Customer Retention: it's hard to get a read on Damstra’s unit economics. Net dollar retention was 120% in Q3 2020, 100% in Q4 2020 and hasn’t been reported since as acquisitions likely muddied the waters

Nearmap (-29%) warns investors that growth will be expensive

The $700m aerial mapping company told shareholders to expect cash burn of $20m - $30m this year as they continue investing in the US

What we like? 👍

US Growth Story: 24 companies in the Mopoke Cloud are pursuing US growth strategies, and normally take a few iterations to get it right. Nearmap’s US revenue has grown to 46% of their total base and gross margins (50%) are improving…. but still far from Australia levels (92%)

Nice comps: the ASX is also home to Aerometrex and Pointerra in the aerial imaging and technology ecosystem, with another player - Innovaero - expected to list soon (the founder sold his last business to Eagleview, Nearmap’s main US competitor)

What are we watching? 👀

Revenue retention: Nearmap needs to run hard to stand still, with ~10% of Annual Contract Value (ACV) churning each year - eventually this will become a bigger drag as contracted revenue gets larger

Wild ride: J Capital’s short thesis released earlier this year had people spooked, and the jury is still out on if Nearmap can make their US business as profitable as Australia. It's been a wild ride for Nearmap investors in 2021 - up 20% to start the year, and now down 43% YTD

Interested in staying up to date?

Thanks for reading. Up next - we’re releasing a deep-dive on a ASX-listed cybersecurity business we like. Subscribe so you don’t miss it.

We’d also love your input so that the newsletter can continue to improve - share your feedback here or send an email to andy@andycrebar.com.