Mopoke Cloud - September 2021

We look at the biggest winners and decliners, as well as some things we found interesting for specific companies.

The Mopoke Cloud Index - made up of 88 emerging technology leaders on the ASX - was down 3% in September (versus the ASX 200 down 2%.)

September’s rundown:

Pureprofile (+100%) builds momentum in consumer insights and reiterated their strategy

Pointerra (+23%) joins Nearmap and Aerometrex in helping US utilities with 3D data

OpenLearning (-21%) is selling the shovels for online education, but needs to find more growth

Humm (-10%) investors remain skeptical if they can make the jump from leasing to BNPL

First time here? Subscribe so you don’t miss further insights on ASX tech.

Top 10 Gains in September

Pureprofile (+100%) builds momentum in consumer insights and reiterated their strategy

The $66m company - which helps companies make better decisions through their online survey community that rewards people for sharing their thoughts - released an investor presentation to market on the 9th reiterating their business strategy

While one of worst performers when we backtested the Mopoke Cloud Index from 2018 -2021 (losing 67% of its value), the business is showing renewed momentum

What we like? 👍

Big growing market: Like many other companies in the Mopoke Cloud Index, PureProfile is competing in big global market where brands are increasingly focused on better understanding their customers - Woolworths shelled out $223m last year to take control of data science firm Quantium to make better decisions on pricing, store layouts and promotions

Loved product: Survey tools are everywhere, but Pureprofile differentiates itself through 1) access to large audiences with 2) multi-dimensional data (i..e lots of data attributes) and 3) ability to target certain people in these large audiences - customers love it with an NPS of 82

What are we watching? 👀

Partnerships and gross margins: Big companies have audiences, but don't have the capability to effectively survey and analyse large swaths of data… PureProfile has the tools, but not the audiences (the company paid out $6m in incentives in FY21 - 20% of revenue!). Their partnership model is changing this and early results from FlyBuys are promising and should help improve longer term gross margins from their 56% today

Capital Investment: While the turnaround began in FY19 and saw benefits in FY20, can the business continue it’s strong growth without significant capex? Annual software investment (which they capitalize) has decreased from $4m in FY18 to $2m in FY21. Short term cash flow is great, but given the global market size - we hope the capex is enough to build a big, defensible business in the long term.

Pointerra (+23%) pursues vertical integration and US growth strategy in 3D data

The 3D Data as a Service (DaaS) provider is creating sector specific data solutions, with a valuation of $310m and annual revenue crossing $10m, they are getting onto the map for more investors

Pointerra’s solution gives customers the ability to analyze 3D data in high fidelity (check out their product here)

What we like? 👍

Big market: 3D cloud software is exploding and costs are rapidly decreasing (lidar sensors and data storage costs have declined 90% in the past decade). Coupled with an increasing need for remote visibility and regular monitoring, lots of companies are moving into this space from different angles, even on the ASX where NearMap and Aerometrex are developing their own software products to interpret the data they collect themselves from the sky

US growth story: while the three ASX-listed players have different levels of growth, vertical integration, margins and product sophistication, the US utility sector is the key growth engine for all of them. Nearmap is the most progressed with US$44m of US revenue and Aerometrex is just getting started with their first customer (Google)

What are we watching? 👀

Margin evolution: Pointerra purchased one of their data suppliers Airovant (automated drones) in 2021 for $5m, giving them a ‘soup to nuts’ data offering. This provides more control of data supply, but clouds their margin outlook which we would expect to decline from the current 92% (one of the highest in the Mopoke Cloud Index)

Valuation: in conjunction with world-class technology, a great team and big market - Pointerra management have pointed out a ‘Modest Entry Valuation’ as one of their investment highlights. Expectations are high for the company, trading at 21x NTM revenue (the 3rd highest in the Mopoke Cloud Index). If Pointerra’s margins or growth don’t deliver - there might be some downside risk

Top 10 Declines in September

OpenLearning (-21%) is selling the shovels for online education, but needs to find more growth

The $13m online learning platform gives institutions and companies tools to roll out co-branded learning and development programs online

It’s been a bumpy ride since their IPO in 2019, with the share price recently declining below listing price

What we like? 👍

Selling the shovels: the conventional learning path of a college degree is being disrupted by shorter courses delivered online - both colleges and new entrants are competing and the market is highly fragmented - especially for new skills (see courses for solidity). These courses are gaining acceptance in the job market and OpenLearning is providing the tools to both sides of the arms race; helping traditional institutions keep up and enabling new providers to build their own online courses

Patching leaks or changing vessels: The great resignation is forcing companies to increase their focus on education for recruiting and retention. In the US, Forage has been partnering with bigger employers to create learning pathways into their graduate programs. For OpenLearning, delivering online programs like CS101 in partnership with companies could be the rocket fuel they need - Afterpay was OpenLearning’s first ASX20 company and highlights growing educational demand from companies

What are we watching? 👀

Growth and efficiency: The business has raised $14m since the 2019 IPO - adding <$1m of ARR despite burning >$8m. Many investments are starting to bear fruit though, and platform revenue is accelerating…. subscription customers grew 59% last year to 184

Capital raising: with $5.7m in cash and having burned $1.5m last quarter, the clock is ticking and they may need to raise capital to continue to fund their growth ambitions

Growing education peer list: there are now six companies in education tech in the Mopoke Cloud Index following the IPOs of Cluey and KeyPath in the last 12 months. While all growing 20% to 50% year on year, many have lower margins, often driven by the (important) role that teachers play in education - making them look more like ‘Tech Enabled Services’ than higher margin pure-software peers

Humm (-10%) investors remain skeptical if they can make the jump from leasing to BNPL

The diversified financial services group is the only profitable BNPL player on the ASX and crossed $1bn of BNPL volume last financial year

The share price was down 17% mid-month and got on our radar, but recovered to finish only down 10%

What we like? 👍

Cash to invest: having raised $140m, generating cash profits of $68m (mostly from its cards and leasing divisions) and suspended dividends, Humm is investing heavily into its overseas BNPL expansion

Insider buying: the founder and chairman, Andrew Abercrombie, owns 20% of the business and bought $500k of shares in September as the share price approaches 10-year lows

What are we watching? 👀

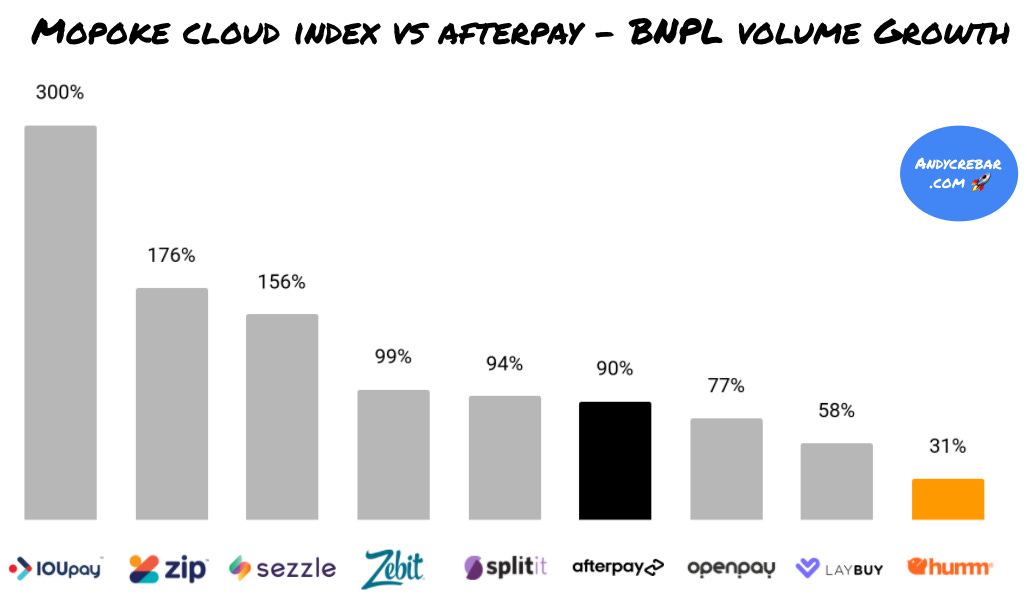

Volume growth in UK & Canada: can Humm execute on their global BNPL strategy to capture less penetrated markets like the UK and Canada? While volume growth has been strong, it lags other pure-play BNPL players in the Mopoke Cloud Index

Interested in staying up to date?

We’d love your feedback so that the newsletter can continue to grow and improve, and if you have a question or data set you’re interested in ASX tech - ask us here.

Last thing - we take care to ensure this content is accurate, however market data can be tricky and constantly changing so it's likely an unintended error or two slipped through – let me know here.