Newly listed ASX tech companies since Jan 2022

A look at newly listed ASX tech companies to see who makes the Index.

Today we’re looking at the companies that have listed on the ASX since the Mopoke Tech Index since the index was last updated in 2022.

We want to see if any of them need to be included in the Index. Before we look at the new listings a quick reminder on the criteria we use to filter companies.

Criteria

As a reminder, the Mopoke Cloud Index is a prioritisation framework for evaluating tech companies on the ASX.

The criteria for the type of companies we focus on are:

☁️ Software or cloud-based products: this may seem like a moot point, but much of what is defined as ‘technology’ on the ASX isn’t necessarily software, but can be things like hardware or technology services. We want to focus solely on software products with high gross margins and scalability.

🖥 Clear Product Market Fit (PMF): the company has built a software product or service that sells - typically because it is cheaper, faster or better than existing solutions. The real test of PMF is unit economics which we’ll be digging into in another post, but PMF can be time consuming to assess and few companies will tell investors that they don't have product market fit. To keep things simple, we define PMF as having greater than $10m of expected revenue in the next-twelve months (NTM).

💵 <$10bn market cap: the best investment opportunities are likely under-followed by brokers and institutions, and the law of large numbers is difficult to escape. We want to increase our chances of finding companies that could grow to be 10x bigger in the next few years.

📈 Revenues growing >20% annually: technology investing is mainly focused on growth, so we want to find companies with momentum (normalizing for any COVID-related disruptions).

🌎 Global market opportunities: On the world stage, Australia is a small market of 25 million people and 2.4 million businesses (most of which are small operations). We want to focus on companies that are not limited by local borders and can grow globally either now or in future

New ASX Tech Companies

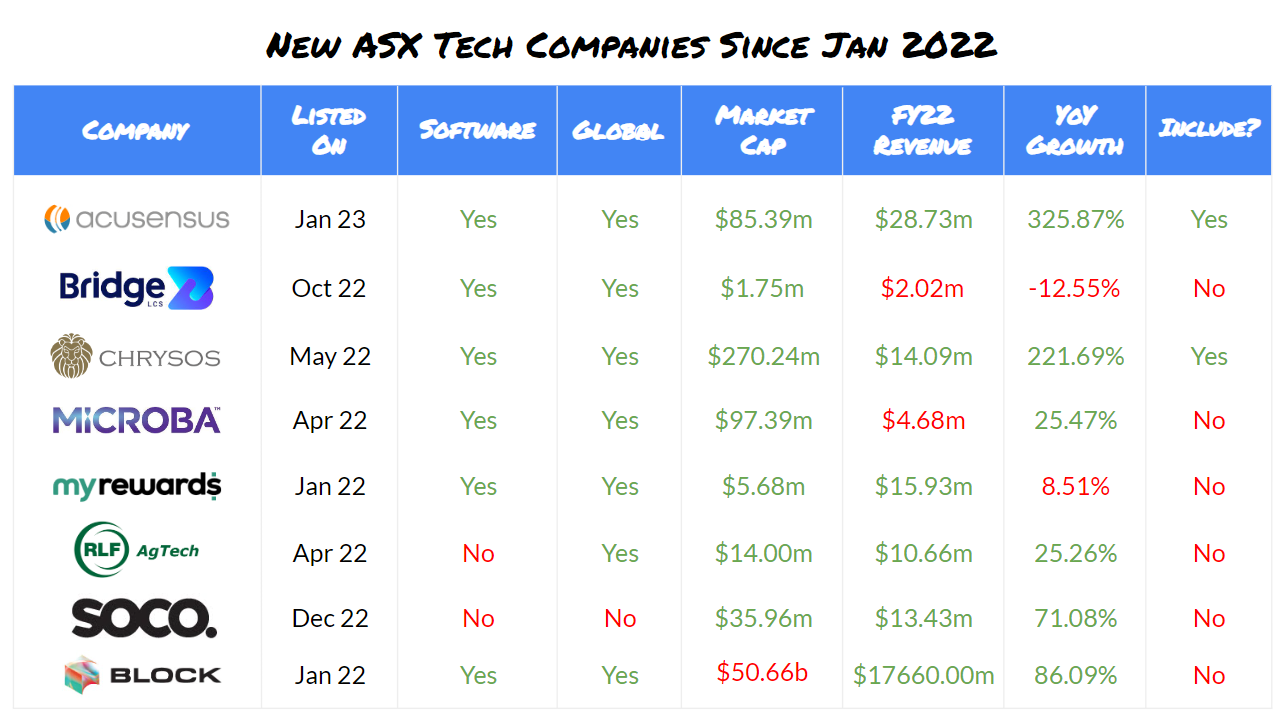

There were 8 companies that listed on the ASX between January 2022 and 4 February 2023 that need to be considered for the index:

As you can see in the table above, 2 made it onto the index. We’ll give a brief outline of each of them in more detail below.

Acusensus

Acusensus has had some outstanding revenue growth, growing at 326% over the last financial year, that they forecast to continue.

Acusensus have technology for detecting mobile phone usage, speed and seatbelt non-compliance. They have multi-year contracts with NSW Government, Queensland Government and ACT Government.

They are now looking to sell it globally into a growing global traffic enforcement market of A$7.57 billion by 2026. They have somewhat real opportunities across 10 countries.

They usually outsource the full detection program. They provide the equipment, technology, a cloud software system and artificial intelligence as well as people manually reviewing some of the images. The revenue is usually multi-year contracts on a fixed monthly fee.

Looking through the financials:

On the balance sheet their current assets essentially held steady over the year. Although they may require more cash to fund their growth.

They were loss making in FY20 and FY21 but then turned to profit in FY22 (EBITDA of $3.7m on $28.65m revenue).

Chrysos

Chrysos provides technology to analyse gold faster and more accurately with plans to expand to other elements and commodities.

The technology is used globally through a combination of on-site and off-site labs with a largely automated process.

Chrysos have multi-year contracts for 49 units with many of their customers representing a significant amount of future revenue. Their key challenge appears to be building an supplying units to meet demand.

Looking through the financials:

They had revenue of $14m in FY22, up 222% on the prior year, and expect this to grow in the future.

They were profitable, with $1.45m EBITDA in FY22.

They have $92m in cash which they say can support the additional units they need to build and deploy although they are looking for debt financing.

What’s next

Going forward we’ll be reviewing new listings each month or so but we needed to do this update to catch up on listings last year.

We’ll be doing a snapshot for February and digging into an interesting trend or company in the Mopoke Cloud Index.