Outperforming in ASX tech - lessons learned from back testing the Mopoke Cloud Index 📈

The ASX tech index had 88 companies in 2018, of which 54 would have qualified for the Mopoke Cloud Index. We take a look at how the filters captured more of the winners and less of the losers.

In our last edition we built the Mopoke Cloud Index as a prioritization framework for finding emerging technology leaders on the ASX - but do the filters actually work?

Time will tell from here, but from back testing the filters from September 2018 to September 2021 - the Mopoke Cloud Index would have outperformed the ‘All-tech index’ by 73% with much less volatility.

This came from the filters capturing way more of the winners and far less of the losers. From the ‘All-tech’ index, the filters would have:

Captured 33 of the 51 winners (including 7/10 of the biggest): missing a major winner in domestic online retail and two hardware exporters

Avoided 21 of the 37 decliners (including 7/10 of the worst): steering clear of many companies without product market fit and/or lacking global growth opportunities

As a reminder, the Mopoke Cloud Index tracks a subset of companies from the broader ASX ‘All-tech’ index that have the following characteristics:

☁️ Software or cloud-based products

🖥 Clear Product Market Fit (PMF)

💵 <$10bn market cap

📈 Revenues growing >20% annually

🌎 Global market opportunities

You can see the last monthly update on the Index from August 2021 here.

Relative performance of a $1m investment

The returns on $1m, equally weighted and invested across the constituents of the different indices over the 3 years would have got you the following returns:

ASX200: $190k (6% compounded annually)

‘All-tech’ index: $770k (21% ca.)

Mopoke Cloud Index: $1.3m (33% ca.)

Any of these three portfolios would have smashed the returns from sitting in a term deposit or Australia property (which oddly enough is just passing 2018 levels on the capital city residential property price index).

Outperforming the ‘All-tech index’ by 73% over three years is substantial.

Assuming that outperformance sticks and compounded over 10 years would mean you’d end up with 2.5x more from being just in the Mopoke Cloud Index versus the ‘All-tech Index’.

What drove the difference in returns?

The outperformance came from the five filters having a higher ‘capture rate’ on the winners (share prices higher today) and avoiding the majority of decliners.

The total median return was ~2x better in the Mopoke Cloud Index versus the ‘All-tech’ index (44% vs. 23%), which you can see in the dispersion of returns across the ‘All-tech Index’.

Filters captured most of the biggest winners

The Mopoke Cloud filters would have caught the majority of the winners, including 7 of the 10 biggest gainers - missing the #2 performer Temple & Webster, who rode the pandemic wave of online retail, Novonix and Codan, who executed strongly on scaling up manufacturing capacity to meet global demand.

Missed: Online retail and global exporters

Temple & Webster (TPW.ASX), an Australian Ecommerce player for homewares, returned 13x - excluded from Mopoke Cloud index as it did not have clear global growth opportunities.

Backstory: TPW is one of several domestic retailers like JB Hi-Fi (up 77%) and Harvey Norman (up 59%) that have profited from the “lockdown lifestyle” during the pandemic

How it played out: The company was able to grow revenue 4.5x from $73m to $326m since 2018 (with a goal of getting to $1bn in revenue as retail spending shifts online)

Key learning: while the criteria for ‘global market opportunities’ can be a good proxy for market size, big domestic markets with low penetration can also provide significant runways for growth (Australian homeware purchases made online is only 5% of the total market)

Novonix (NVX.ASX) and Codan (CDA.ASX) were both able to rapidly scale up capacity to meet global demand for their battery and communication products.

Novonix (Lithium batteries): was up 6x following the rapid expansion of its battery products and partnerships. They become a market leading producer of batteries for Electric Vehicles (EV) as supply chains saw significant growth

Codan (metal detection and communication products): was up 4x following significant growth in demand for their products (including their entry level product - the Gold Monster 1000) and was able to increase mass market distribution around the world (90% of sales)

Avoiding most of the biggest decliners

The bigger driver of the difference in index returns in the Mopoke Cloud filters came from avoiding the majority of companies that lost value over the 3-year period, largely being filtered out by not having product market fit and/ or lacking clear international growth opportunities.

This included filtering out 7 of the 10 biggest decliners (but catching 3 of them).

When things go wrong: losing PMF and growth

There were three software companies that looked great at a high level in 2018:

✅ Product-market fit

✅ Growing > 20% year on year

✅ Global market opportunities

…. but lost 65% - 75% of their market capitalization. 😔

Looking closer at each of these companies highlights the importance of not only having product-market-fit and strong growth, but keeping it!

Pureprofile’s (PPL.ASX) product market fit was impacted from a failed acquisition and subsequently lost its growth profile, however has begun to show renewed growth with new leadership.

Backstory: the media intelligence provider grew revenues from $22m in FY15 to $63m in FY17 supported by the acquisition of Cohort Group for $25 million, which was one of Australia’s leading performance marketing companies at the time

How it played out: Unfortunately the acquisition turned out to be fraught with issues with PureProfile suggesting it was misled as it wrote off the carrying value of the business a couple years later

What’s interesting: The business appears to have reached a turning point with new CEO Martin Filz and increasing focus on software revenues, and is actually one of the cheapest technology companies in the Mopoke Cloud Index trading at 1.5x NTM revenue.

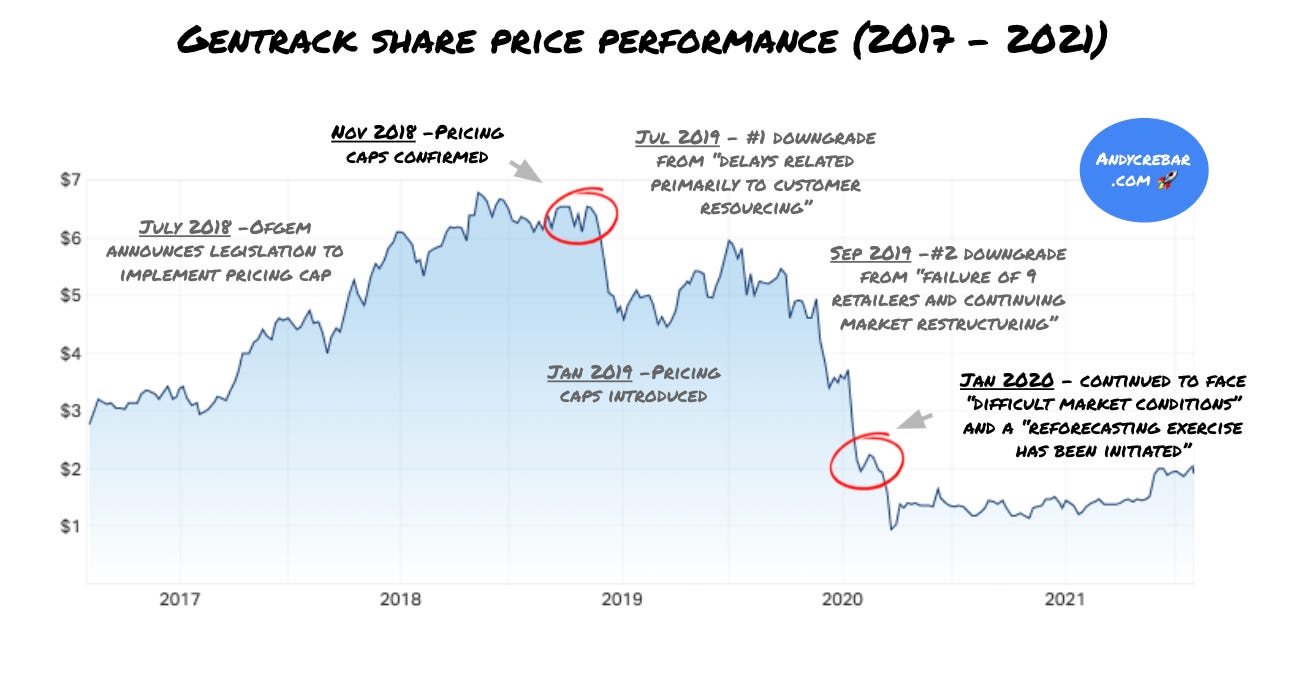

Gentrack’s (GTK.ASX) product market fit was impacted from changing market regulation in the UK, with a new strategy set to reinvigorate growth.

Backstory: the utility software company was a market darling when it IPO’d in 2014 at a $200m market cap, and saw strong growth in the UK supporting challenger brands to take share from the established incumbents in the utility space

How it played out: Investor excitement continued after they made some UK acquisitions with the business’ valuation reaching $600m in mid-2018…... then the UK government imposed caps on utility pricing which killed many of the challenger brands (i.e. Gentrack’s customers)

What’s interesting: Investors and management were slow to react to the impact of these changes which saw a 12 month lag in an accurate assessment of the situation. Gentrack recently held an investor strategy day with a need to prove out a repeatable M&A program for growth. Larger utility billing player Hansen Technologies has done this well, although was recently left at the altar by BGH Capital.

LiveTiles (LVT.ASX) saw a deceleration in revenue growth and changes in investor expectations, and was subsequently re-rated by the market

Backstory: the intranet and digital workplace software company was growing revenue at 250% a year in 2018, with management setting a goal of reaching $100m in ARR by June 2021

How it played out: Due to COVID-19 and other impacts, the business saw a deceleration in its revenue growth rate to 30%, achieving $63m in ARR in June 2021

Key Learning: Although the business has done well with ARR doubling in the three years since 2018, the endurance of revenue growth hasn’t met expectations and market subsequently re-rated the business from 13x to 4x NTM Revenue - wiping out 70% of the company value

While Pureprofile, Gentrack and LiveTiles lost the majority of their value from 2018, business is a full contact sport and these learnings highlight the importance of understanding the many variables that make a company successful.

The Mopoke Cloud Index can be helpful to prioritize research, capture more of the winners and less of the losers - but acquisitions strategies, regulation of customer end-markets and investor expectations are rarely constant, and changes can have significant influence on a company’s trajectory.

Interested in staying up to date?

Thanks for reading! This covers the end of our series on framing the companies that we’ll be covering in the newsletter.

As we quick retro we have:

Shown the mixed results of ASX-listed technology companies since 2018

Introduced a prioritization framework for emerging technology leaders on the ASX

Back tested the filters to show where they work, and where they don’t

In our next edition, we’ll be diving deeper into key metrics for evaluating individual ASX technology companies and benchmarking the peer groups in the Mopoke Cloud Index.

We’d love your feedback so that the newsletter can continue to grow, and if you have a question or data set you’re interested in ASX tech - ask us here.

Last thing - we take care to ensure this content is accurate, however market data can be tricky and constantly changing so it's likely an unintended error or two slipped through – let me know here.