PayGroup: How sticky payroll provides air-cover to expand margins 💵

We take a closer look at the outlook for PayGroup, a payroll and HCM technology focused on the Asia Pacific market.

Some companies evolve while their market perception lags behind. We see PayGroup as one of these companies.

Listed in 2018, the company’s growth rate and platform-based roll-up is what got us interested, and we believe that their sticky payroll services will provide air-cover for their technology roadmap to expand gross margins over time.

Valued at $50m with an FY22 ARR forecast of $37m, PayGroup has many of the key attributes we filter for:

✅ Product Market Fit: >2,200 customers, 3-year contracts and 99% customer retention

✅ Big Market: $26bn market in Asia-Pacific for payroll and business process outsourcing

✅ Improving Unit Economics: LTV / CAC of 5x, upside from gross margins

✅ Strong Growth: across key metrics of pay-slips, customers and geographies served

✅ Insider Ownership: founders own 25%, with management and board members holding an additional 2%

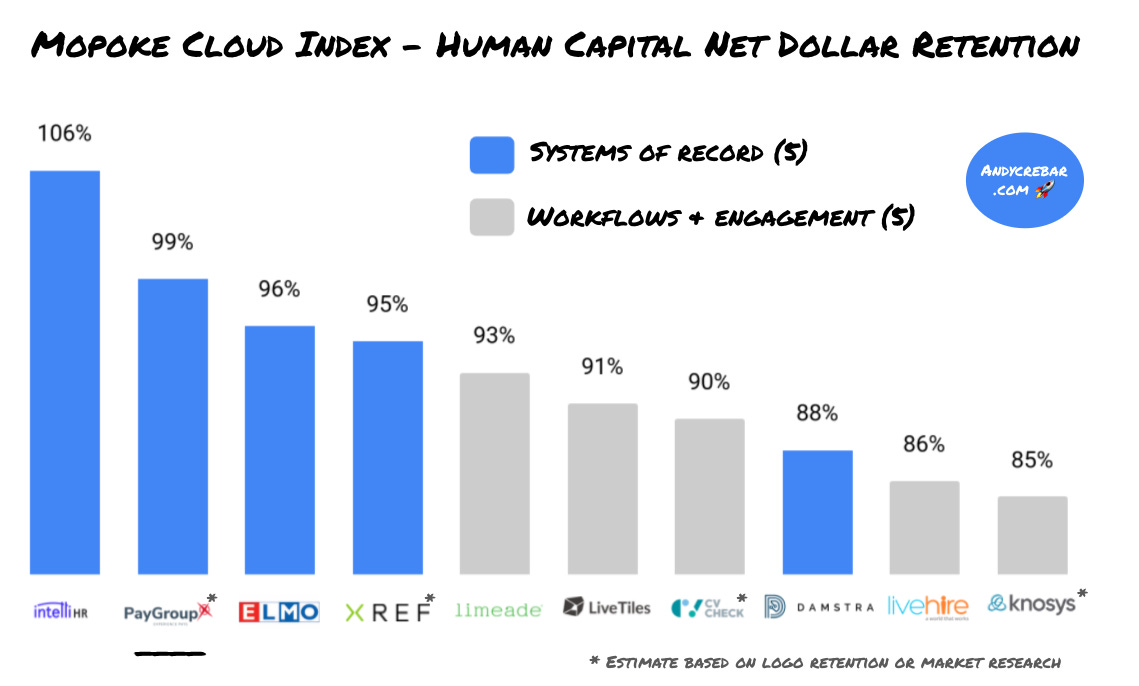

PayGroup is one of ten Human Capital software companies in the Mopoke Cloud Index, which tracks 88 emerging technology leaders on the ASX.

Summary

Our view: PayGroup will continue to grow organically in the Asia Pacific (APAC) market and expand gross margins from technology rationalization and proving out cross-sell. High customer retention will provide air cover and capital for them to execute on this roadmap

What the market is missing: Messy financials from acquisitions since the IPO and valuing PayGroup as a pure services business

Key risks: Lack of liquidity and 30% dilution from recent capital raise has put pressure on the share price. Integration of acquisitions may take longer, cost more and not prove the strategy

Bull case: Builds a dominant position in the APAC market, increases ACVs and margins from bundling products and consolidating product lines

Bear case: Acquisitions and margins fail to deliver leading unit economics to suffer, market position eroded by competition from local players and well funded competitors

First time here? Subscribe so you don’t miss further insights on ASX tech and remember that this is not financial advice 😀.

Overview: dislocated valuation with a strong underlying business

PayGroup started as PayAsia in 2006 when the co-founders saw increasing demand for payroll outsourcing with the emergence of multinational companies into the Asia Pacific region.

There were many local payroll companies, but they were unable to deliver given the complexity of customer operations in the region. PayAsia was formed to service the gap.

Listing on the ASX in May 2018, the company had a shaky start to public life, being their third attempt at an IPO having withdrawn previous listing attempts in 2017 and earlier in 2018. The company would also be suspended by the ASX twice in later 2018 for not meeting listing requirements.

Fast forward three years and PayGroup has:

Built significant scale with FY22 ARR guidance of $37m (versus $7m at IPO)

Demonstrated strong execution on its payroll strategy, processing 7.5m pay-slips a year (more than 20,000 a day!)

Completed five strategic acquisitions to expand its product set and customer base

Built a strong partner program of key international players that’s driving low-cost customer acquisition

Despite these achievements, the share price has languished and trades below their listing price.

Due to the acquisitions being largely scrip based and two additional capital raisings, the total share count has increased 3x and today the company’s enterprise value is around $50m.

Market: $26bn Asia Pacific Payroll and BPO

PayGroup’s plays in the A$26 billion business process outsourcing (BPO) for payroll and human capital management (HCM) software market in the Asia-Pacific region. Roughly half% of PayGroup’s revenues are in Australia and New Zealand, with the rest in Asia.

BPO payroll (70% of revenue) is when a business contracts out payroll to be handled by a third party outside of the company (like PayGroup).

HCM software (30% of revenue) can include payroll itself and is software as a service (SaaS) - the vendor provides the software but the people at the customer do the work.

Both these markets are seeing a lot of change with:

Increasing digitisation and adoption of web-based software

Changing working landscapes through increasing remote work and focus on employee wellbeing

New and changing regulatory environments post pandemic

Importantly for PayGroup, payroll and payments fulfillment is top priority for companies - you can’t get this wrong - and the significant majority of PayGroup’s customers are using their payroll products.

Companies that make payroll mistakes face huge reputational risk and are right up there at the top of red flags for organisations. In Australia, Victoria and Queensland recently became the first states to criminalise wage theft.

Payroll fulfillment is made more difficult for companies that have employees in different countries, multiplying the number of rules and regulations they need to keep track of.

Within the APAC market, PayGroup occupies a niche position as it offers broad coverage of 75 countries in the region. Combined with knowledge of local regulatory environments from doing business in the region for 15 years, this helps them position themselves to support clients growing within APAC.

Product: landing and expand with sticky payroll

PayGroup supports companies of all sizes and can handle the entire company or certain populations in different markets. They have a diverse set of solutions with the average customer paying them A$15,000 a year.

Their product strategy is to land with a core module (such as payroll, workforce management or franchise rostering) and expand the account either through raw headcount growth, new geographies and selling additional modules like timesheets, recruitment or career management.

Through a series of acquisitions, the listed entity today is the holding company for several product offerings. All of these operate in the Human Capital Management domain and are a mix of SwaS or SaaS based platforms.

PayAsia: outsourced payroll and payments for multinational companies like Westpac

Astute One: SaaS workforce management solutions for complex workforces

TalentOz: SaaS HCM software business with payroll modules for Malaysia and India

Payroll HQ: outsourcing payroll and payments that helps a number ASX listed companies

IWS Australia: workforce management and HCM platform for franchises like Laser Clinics

Today these brands support 2,200 customers across a diversified industry base, with strong retention that will provide them a runway to develop their technology and expand margins.

Through these established customer relationships, PayGroup can continue to expand monetization opportunities.

Two of these product up-sells were highlighted in their recent quarterly update and together are now generating $1.6m of annual revenue:

Superannuation: launch in February 2022 for Australian payroll clients

Payments: managing cross-border and domestic payments for corporate clients

Business Model: increasing depth and breadth through acquisitions

The BPO and HCM software business is simple to understand - companies pay a fee for third party vendors to manage the process (either with people and software, or just software).

Underlying this though, we think the market is underestimating scale economics and switching costs in PayGroup’s business model.

1.Building scale across products and geographies

When fixed costs need to be covered, scale can be defensible and allows companies to differentiate, win more customers and build pricing power

PayGroup has been rapidly acquiring customers organically and through acquisition, as well as coverage across 75 countries

Recognised by Gartner for Multicounty Payroll Solutions in 2018, 2019, 2020 and 2021

With more markets and products to sell into, they are spreading their fixed cost infrastructure over many customers

2. Increasing switching costs

Building portfolios of products that customers can use increases product stickiness - it’s much harder for a company to migrate vendors when they are using multiple different tools or processes from that vendor

A strategy that SAP executed to build a US$150bn company was accumulating dozens of products and then selling into their established base, making it very difficult for companies to leave

This is especially true when they are mission critical functions like payroll - companies won’t normally switch unless something is broken, it’s not worth the hassle

That said, high retention products are a double edged sword when companies only need one of them - making it harder to grow organically as need companies to ‘rip and replace’ their existing solutions

Comparing retention across the Human Capital companies in the Mopoke Cloud Index highlights the stickinesses of platforms (like payroll and human resource information systems).

PayGroup has the second highest net dollar retention in the peer group, highlighting the mission critical nature of payroll - companies don't normally leave PayGroup.

An example of scale and switching costs for PayGroup is when they can win a customer in one country, expand in the region and offer new products.

They did this with Westpac a few years ago, starting in Singapore and now processing their payroll in six additional countries throughout the region and using additional products like time off and leave management.

If Westpac wants to switch this part of their payroll system, they either need to find another company with the breadth of PayGroup’s offering in APAC, or run the risk of having to implement multiple different systems.

High customer retention coupled with this ‘land and expand’ strategy provides time and air cover for PayGroup to invest in their technology roadmap - focused on reducing implementation times, enhancing customer and driving margin expansion.

To do this, they’ve assembled a team from the world's biggest payroll company, ADP.

Mark Samlal - CEO, and previously led sales at ADP Asia

Jerome Gouvernel - Chief Product Officer, and Ex-CTO and VP product at ADP

Franck Neron-Bancel - Chief Strategy Officer, Ex-Senior Vice President of Strategic Accounts at ADP

Chris Brunton - Chief Operating Officer, ex-CIO at ADP

If the business is growing, customers are not going anywhere, and experienced operators have time and capital to invest in strong underlying infrastructure - we believe PayGroup can continue to expand margins and improve underlying unit economics.

Unit Economics: 5x LTV to CAC, with improving margins

PayGroup’s unit economics are a make-up of revenue, the cost to serve the customer, customer acquisition costs (CAC) and the product investment to keep them happy.

We looked at their unit economics through four frameworks:

Lifetime contribution margin = $75k

CAC = $15k (based on Q3 FY21 results)

CAC payback = 24 months

LTV / CAC = 5x

#1. Customer lifetime contribution margin of $75,000

Like most recurring revenue businesses, PayGroup’s headline metric is ARR - which represents the signed annualised contracted revenue (exit statutory revenue + yet to be implemented revenue). The company’s recognised revenue for the year has broadly followed the ARR at the start of the year.

Average Contract Value: $15,000 (across a wide variety of 2,200 customers)

Gross Margins: only 50% today (or $7,500 per average customer)

Customer retention rate: 99%

The retention rate would imply an average customer lifetime of 100 years, which would be difficult to stand on in today’s fast moving software markets. Assuming a ten year life would put the lifetime contribution margin at $75,000 ($7,500 gross margin x 10 years).

#2. Customer Acquisition costs (CAC) of $15,000

PayGroup doesn’t break out Sales and Marketing expenses, however given the sales focus of the company we would expect it to be as high as 100% of ARR (approx. $15,000).

In Q3 FY21, they spent $2.7m in staff costs and acquired 115 customers (albeit a lower value cohort)

Assuming 60% of staff costs is sales and marketing implies $15k per customer.

#3. CAC Payback of 24 months

With a CAC of $15,000 and $7,500 margin per customer, PayGroup operates today at a 24 month payback.

This is longer than we’d expect for a company with PayGroup’s ACVs, but aligned with software IPOs in the US market, where the median implied payback was 25 months in 2020.

#4. LTV / CAC - currently 5x, with upside from gross margins

At 50% gross margins, the business is lowest in the Mopoke Cloud Index Human Capital peer group.

There's room for improvement on the gross margins which will drop straight to the bottom line and given the established (and stable) revenue base, this will be significant.

Looking further down the income statement at the composition of the acquired businesses also suggest PayGroup should be able to expand EBITDA margins from today’s 18%.

PayAsia (33% of ARR): operated at 15% EBITDA margins at IPO when it was ⅓ of current size

Astute Payroll (33% of ARR): operates at 22% EBITDA margin

IWS (20% ARR): operates at 20% EBITDA margins

Coming from a low gross margin base of 50%, coupled with experienced management and continued capital investment ($5m in the last two years) - we expect to see gross margins continue to creep up in time and support better unit economics.

Go-to-Market: direct sales with growing partnerships pipeline

Selling and supporting payroll systems requires people to be involved - companies with 20+ people need help in researching, evaluating, buying and implementing solutions, and involves multiple stakeholders to navigate.

Aligned with this, PayGroup has two go-to-market engines for growth:

Direct Sales (80% of sales): when a PayGroup representative supports a prospect directly through the buying journey and builds their trust with PayGroup.

Global Partner Program (20% of sales): currently six American and European companies where PayGroup delivers solutions across Asia and Middle East where they have no coverage of and vice versa.

The global partner program has been a great source of low cost organic growth and it appears to be ramping up. This also helps brand valued as the partner’s clients know it is PayGroup behind the scenes.

PayGroup signed $13.7m of new sales in FY21 (includes both direct sales and GPP). These are 3 year contracts as standard, so equates to $4.5m of ARR.

PayGroup has also had a strong start to FY22 as well, signing $9.6m in new contracts in 1H (+78% vs pcp) - equating to $3.2m of ARR.

Competition: APAC fragmented, competing mainly with Ceridian and ADP

The BPO Payroll and HCM market globally is highly fragmented.

The top 10 HCM software vendors account for 45% of the market and local markets are served by smaller players within countries catering to country specific requirements.

Thematically, big players are losing share to new cloud-based software companies, but customers are slow to make changes given the complexity of changes and risk of errors in such a critical piece of company infrastructure.

In the Asian market, PayGroup’s key competitors are ADP, Humanica and Ceridian - who have been doubling down in the region and also pursuing platform rationalisation.

Ownership: 25% owned by co-founders

The original share registry has expanded significantly since their IPO, with 25% held by the founders and another 30% held through shareholders from their acquisitions they were given script in their sale to PayGroup.

The key shareholders are:

Mark Samlal (Co-founder and Managing Director) 19%

Lawrence Pushpam (Co-founder of PayAsia, Chief Sales Officer) 6%

Marcus Webb (Founder of Astute Payroll) 5%

Salter Brothers Emerging Companies 5%

Some of the recent selling pressure may be the overhang of some shareholders from PayGroup’s acquisitions however we believe that their patience will be rewarded over time.

Valuation: growing cash flow, discount to acquisitions and peer groups

#1. Crossing a cash flow inflection point

PayGroup recently reached a cash flow inflection point - generating $2.4m of operating cash flow in FY21, however capitalises their software R&D (which we don’t like) so is cash flow neutral when taking out the $2.5m of development costs.

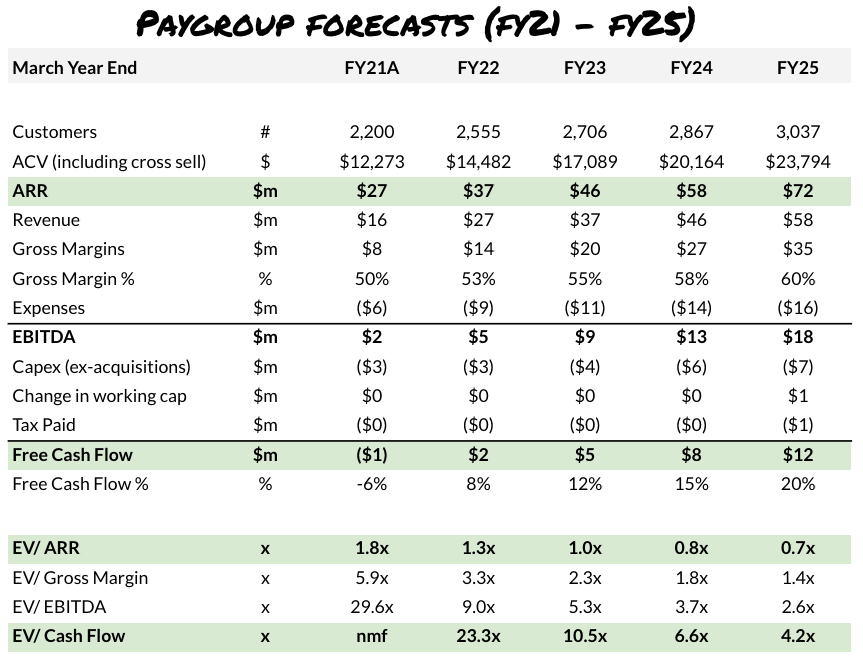

Below are our forecasts of the current business - this excludes the further acquisitions which we expect (likely in newer verticals such as the ‘gig economy’) and we expect continued investment in their technology to harmonise the platforms.

The two most important assumptions for the business are ARR growth, and gross margins. We think Mark and team can continue to expand both of these, which bodes well for Free Cash Flow.

#2. Look-through valuation of Acquisitions

PayGroup has acquired a little over half its revenue through acquisitions (largely with scrip) while their stock has traded down into lower multiples.

At current share prices, the market is implying that these acquisitions have destroyed value - which we don’t think is true because the acquisitions have strategic value and brought scale to the company in both geographies or HCM modules.

For the five acquisitions:

Total purchase price of $27m in aggregate ($23m stock and $4m cash)

Acquired revenues (at time of acquisition) of $15m

Weighted average revenue multiple of 1.9x

Given the stock has traded down from the stock issuance prices to $0.45 per share, the value today of these acquisitions is $19m - so an implied value of 1.3x revenue.

#2. Dislocated from peer group

Five of the twelve companies in the Human Capital peer group of the Mopoke Cloud Index are using acquisition strategies to drive growth.

The winning acquisition strategies are going to be from those that have a platform - being a critical piece of infrastructure or system of record - and can then layer on value added services over time. This is what PayGroup is doing - their bolt on acquisitions gives them a significant customer and product set to underpin their future growth.

There are two key groups which we think are relevant for comparative valuations:

Human Capital Platforms on the ASX: the five platform companies in the Human Capital index

US Payroll Peers: Payroll companies are much better represented on the US exchanges, which companies trade for >10x for growth businesses (i.e. >20%) and between 5x - 7x for declining revenue business (ADP, Paychex)

PayGroup is the lowest valuation of these two peer groups, despite having the 4th strongest growth rate. The size of PayGroup likely justifies a material discount versus these other peers, however if PayGroup can continue its strong growth - this should unwind over time.

What's next for PayGroup?

While the business had a shaky start to its ASX journey, PayGroup has evolved and built material scale as a payroll and HCM platform in the APAC market.

We think investors are under-appreciating the stickiness of PayGroup’s payroll solution and their ability to execute on their technology roadmap to expand gross margins. We’re following the progress closely in ARR and technology development.

Congratulations to Mark and the team on their success so far.

Thanks for reading!

We’d love your feedback so that the newsletter can continue to grow and improve and if you have a question or data set you’re interested in ASX tech - ask us here.

Last thing - we take care to ensure this content is accurate, however market data can be tricky and constantly changing so it's likely an unintended error or two slipped through – send an email to andy@andycrebar.com.