ReadyTech’s M&A Flywheel Drives Compounding Growth

In a market with slow buying cycles, M&A adds customers and increases cross-sell

There are just five mid-cap technology companies on the ASX that have grown revenue and profits each year for the last few years. ReadyTech is one of these companies and, of the five, the company with the highest proportion of revenue from software directly.

So, today’s analysis is a deep dive into ReadyTech because of its ability to compound revenue and profits as a listed software company.

We’ll look at the markets they’re in, the business model, competition, go-to-market, and finances. In short, we’ll cover it all.

Let’s dive in.

Summary

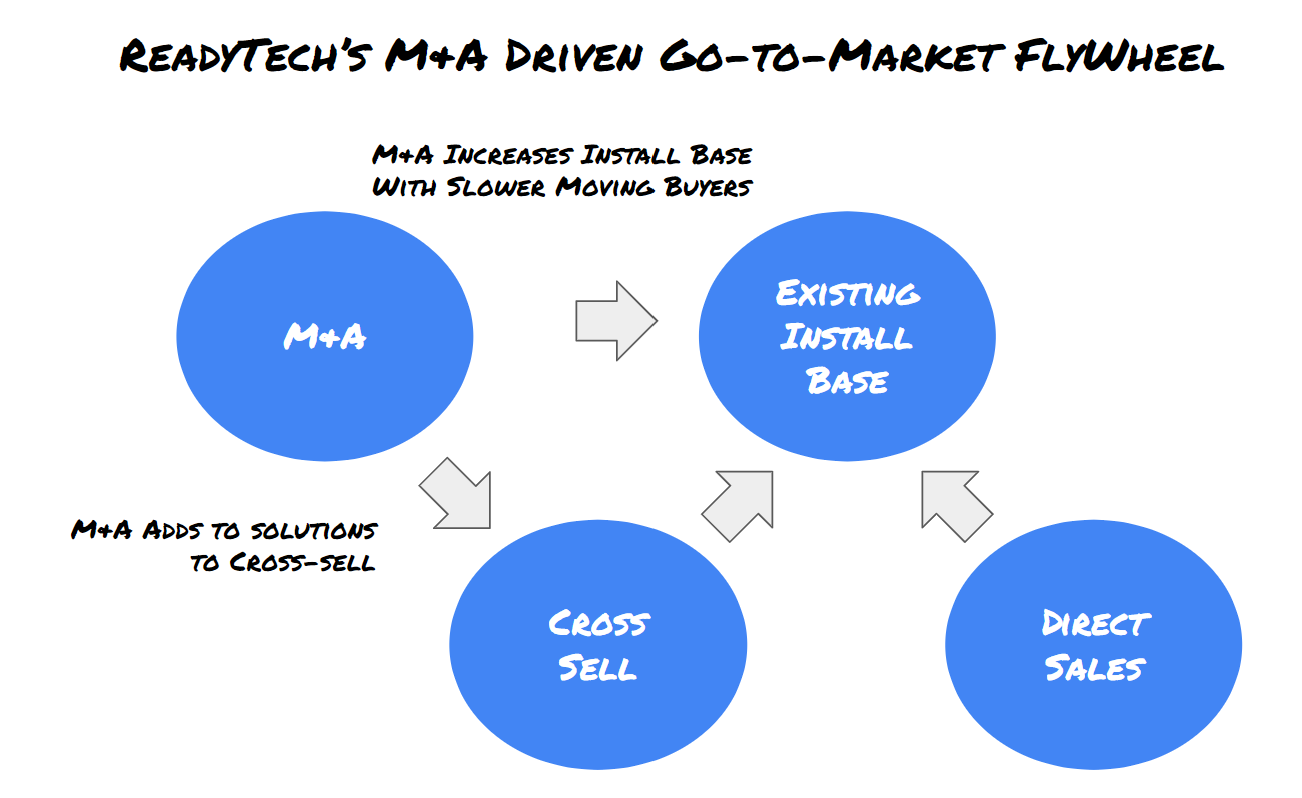

ReadyTech’s long-term, compounding performance is driven by the unique combination of the type of customers ReadyTech serves and ReadyTech’s ability to acquire, connect, and cross-sell.

ReadyTech serves government and government-like customers directly and in a connected way across community stakeholders. This type of customer takes time to win due to procurement processes and the relatively slower speed at which these types of organisations make decisions. But, once you’re in with this type of customer, they’re often eager to do more with you (if you deliver) because it makes their lives easier.

ReadyTech has used M&A to get more access to this type of customer faster and add solutions to cross-sell into their existing customer base.

It’s a compounding combination that serves them well.

About ReadyTech

ReadyTech was founded in 1997 by Marc Washbourne and Ken Sheppard. Sheppard handed over the reins to Washbourne early on in the business. ReadyTech was bootstrapped for five years.

“We were self-funded, so we had to be profitable from day one,” Washbourne tells Forbes. “We bootstrapped the company for five years before we crossed the chasm and achieved scale. It was tough. What got us through was dogged determination and the patience that came from having a long-term view.”

The determination paid off. Pemba Capital invested in June 2016, then upped its share to 32% prior to listing on the ASX in April 2019.

ReadyTech has made over 15 acquisitions over its lifetime, including Avaxa for $2.2m, Open Windows for $14.3m, PhoenixHris for $3.3m and IT Vision for $23m.

Business Model

ReadyTech’s business model focuses on providing a range of software-based solutions for a specific community industry, primarily vocational education, recruitment, and employment.

I use the word community because they focus on the different people in the community within a wider industry.

It’s unique and interesting in the sense that ReadyTech has acquired and built solutions not just for one specific customer but for all the various customers within part of the community industry.

The community industries they focus on are:

Education & Work Pathways

Workforce Solutions

Government & Justice

For example, they have solutions for registered training organisations to manage students, including tracking and assessing students. They have a solution for helping a student get employed, trained, and supported on the job. The same solution also helps the training organisation and employer manage funding and the administration of this process.

ReadyTech has mastered M&A to help them add solutions for the communities they currently serve and add communities they can target.

Market

ReadyTech is pursuing different but related markets in each of the community industries they serve. ReadyTech estimates its total addressable market as $970m+, divided as follows:

Collectively, ReadyTech’s markets share these attributes:

Heavily Regulated: each of the markets ReadyTech operates in is heavily regulated and consists primarily of government or quasi-government organisations.

Similar buying cycle: For the most part, the types of organisations they deal with across the marketsshare a similar buying cycle. Universities procure in a similar way to TAFEs, which is comparativeagain to councils, courts, and tribunals.

Multiple Stakeholders: ReadyTech’s solutions or combination of solutions allows them to solve for the challenges across a value chain in a community, and not necessarily for just one stakeholder. In many of these situations, this is necessary. Yet, it’s notable for ReadyTech because many organisations often try to avoid this.

Competition

This analysis of competition looks at ReadyTech broadly rather than any specific ReadyTech solution because ReadyTech has such a wide range of solutions. overing each solution in detail is beyond the scope of this analysis.

ReadyTech is competing against generalists like Salesforce, SAP, and Microsoft Dynamics, as well as specialists who provide solutions for specific problems that ReadyTech’s target customers might have.

Go-to-market

ReadyTech acquires new customers and new contracts through:

Direct Sales: selling into new accounts with a sales force.

Existing Install Base: upsell and cross-sell, as well as additional revenue through increased usage. This matters to these regulated industries and larger organisations.

M&A: they acquire new companies to gain access to more contracts that they can further upsell and cross-sell into.

Finances

With ReadyTech’s use of M&A to drive growth in mind, their balance sheet and free cash flow matter because they give them the ability to make further acquisitions. These acquisitions add to EBITDA and growth.

The table below shows how ReadyTech’s available cash and net cash flow could be used to finance an acquisition over the next year:

Nice write-up. Worth digging further into this one I think.

Very well articulated Scott. Continuous sticky income is worth the wait at the decision stage and as you point out, they are brilliant advocates for additional services and other quasi allied organisations. One needs to focus on the ‘lifetime value of the client + their referral ability’ when analysing costs of client acquisition. Not many investors take this compounding effect into account. And f course, it works in reverse, goodwill can very easily become bad will.