Telehealth Startup GP2U: Acquired for $11m then sold for $3m in 2 years

Analysis of Doctor Care Anywhere's Tech Spinout

At the height of COVID a booming telehealth business in the UK paid $11 million to acquire an Australian telehealth business with $1.3m in revenue. Just over a year later the acquisition was sold at a 73% discount for $3m.

This is a look at what happened with Doctor Care Anywhere’s acquisition and then subsequent sale of GP2U.

We often look to success stories to illuminate the path to results and returns but there is just as much, if not more, to be learnt by looking at situations that don’t work out.

I’m particularly interested in this one because I have an unusual obsession with spinouts and unloved businesses.

This analysis will cover:

Summary

Timeline

The Acquisition

The Spinout

Review of the Strategic Rationale

Shareholder Returns

Summary

From the outside looking in, DCA bought a business after a special event (COVID) that drove revenue growth beyond normal levels. They acquired primarily based on revenue (“implied transaction value of 2.5x gross revenue”).

Shareholders of DCA ultimately paid the price for debatable impact.

The material price they paid was 7% of their market cap ($11m consideration over total market cap of $117m for FY21 which is July 2020 to June 2021).

The debatable impact can be summed up as:

no gross margin gain in practical terms

slower revenue growth than DCA’s business

taking on additional losses

Yes, they got to access a new market but not with their own technology and cost base. They also ended up in a slightly different market (psychologists rather than GPs).

The lack of impact is underscored by the spinout ultimately transacting for cents on the dollar.

Ultimately, Doctor Care Anywhere shareholders lost money and GP2U’s original shareholders likely did as well.

Please excuse me if some of the numbers are slightly off, I was jumping between GBP and AUD a fair bit. I’ve tried to double check most numbers but ultimately I don’t think any errors of this nature (if any) detract from the overall analysis or insights.

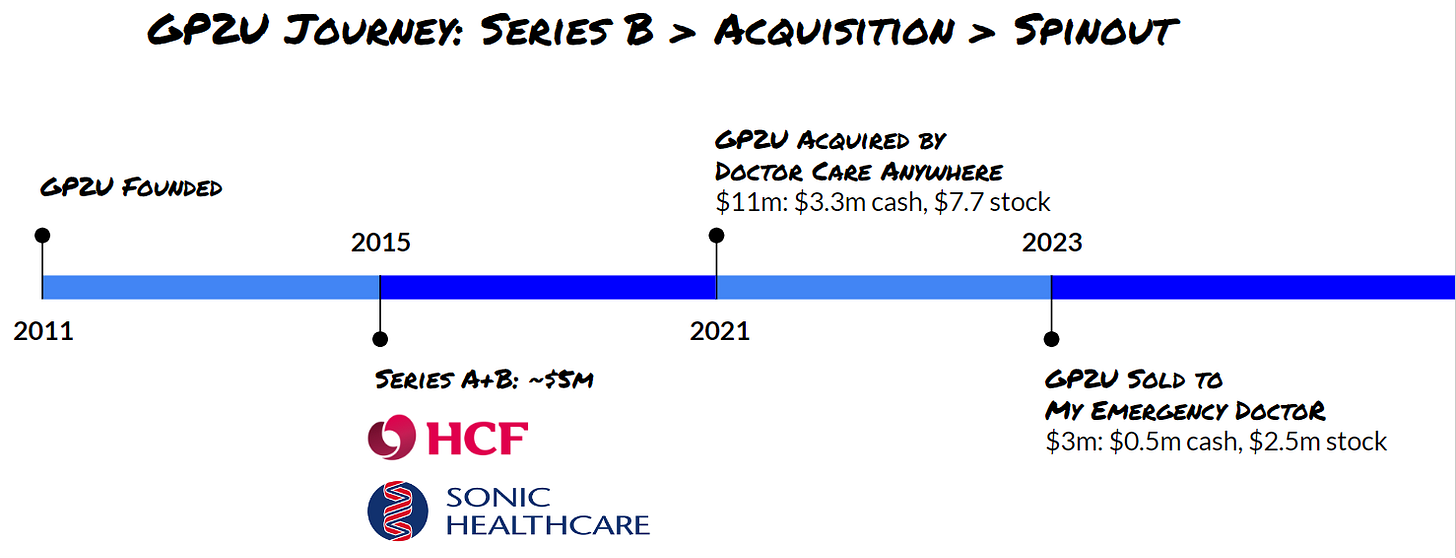

Timeline

There are two timelines here. First there is GP2U:

Then there is Doctor Care Anywhere’s:

The Acquisition

Setting the Scene

It’s 2021. The world has been through a year of the COVID-19 pandemic. In order to avoid the virus many people avoid going out or are required to stay at home by their governments.

At the same time, company stock prices are at all time highs and growing with technology stocks leading the way to higher and higher valuations.

With this backdrop, telehealth breaks through years of slow traction. People are either unable or unwilling to physically visit doctors and doctors are often unwilling to visit patients.

Doctor Care Anywhere

DCA is a telehealth platform that allows you to get healthcare from a doctor from wherever you are within a few hours. This includes a video consultation, getting prescriptions, access to health information and referrals.

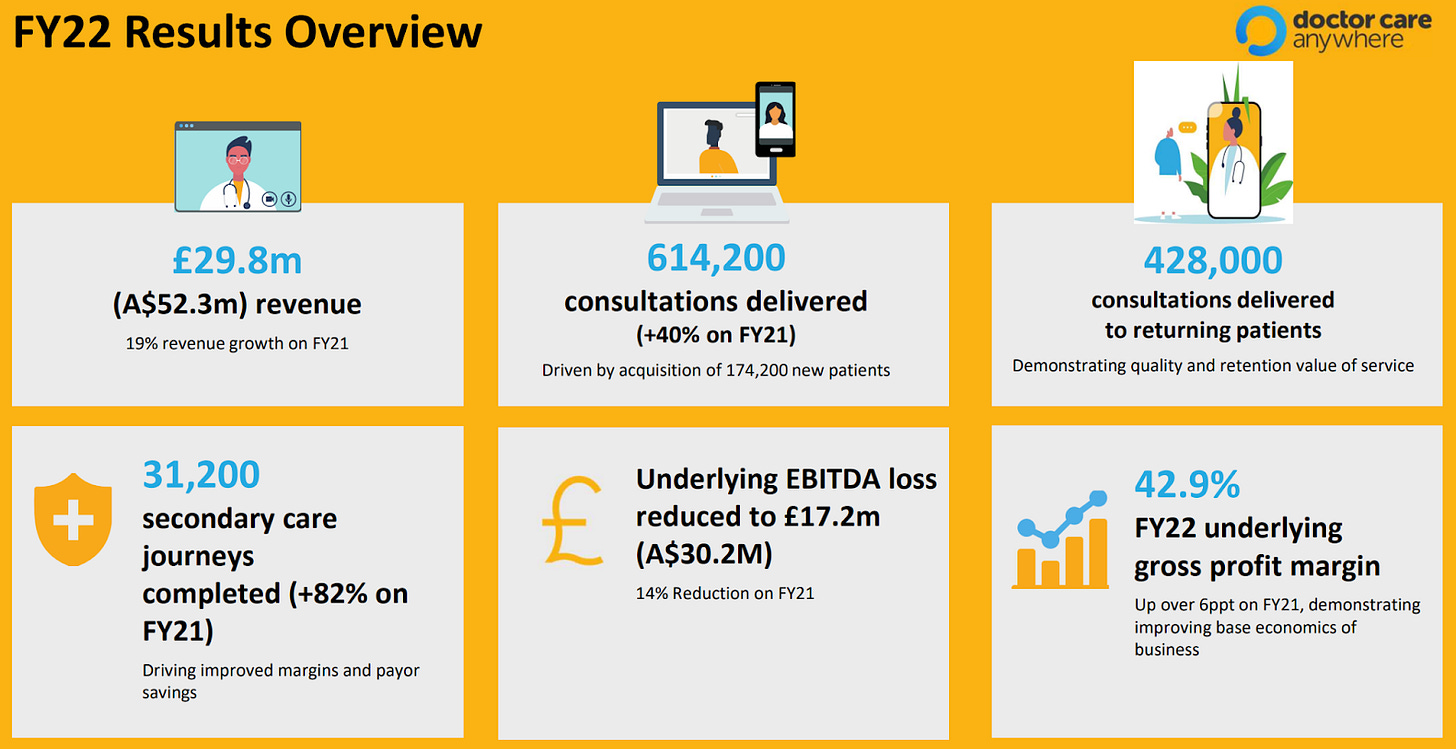

Source: Doctor Care Anywhere Investor Presentation 2022

DCA listed on the ASX in December 2020 with $102m in capital.

In 2021, around the time of the acquisition, DCA’s business is best summarised as follows:

305% growth in consultations, to 214,700 over 2020

Around $46m in revenue, up from around ~$20m (estimate due to timing and currency conversions)

Not profitable, with an EBITDA loss of $38m

100% of revenue from doctors.

In short, COVID had supercharged growth but DCA’s losses were substantial relative to revenue.

GP2U

GP2U is an online medical and psychology practice in Australia. People needing care can do a video consultation with a doctor or psychologist then get prescriptions, pathology requests, specialist referrals and secure provider to provider messaging.

Here’s a quick summary of the business when it was acquired:

35,000 consultations over 12 months to 30 June 2021, up 51.4% over the previous period.

$4.4m in gross revenue for 12 months to 30 June 2021 (up from $2.8 in the prior period).

$1.3m in net revenue (revenue after paying doctors fees for consults).

GP consultations make up 22% of net revenue, psychologists 78%.

Two years of consecutive losses - a loss of $400k reduced down to $100k primarily through the increase in revenue.

On the corporate side:

Founded by Dr James Freeman in 2011.

Raised Series A funding of $2.2m in 2015 from Sonic Healthcare (a listed company) and Medical One founder Dr Andrew Pascoe.

2015 a CEO was hired (it’s likely equity was part of the compensation)

Raised a Series B in January 2016 from HCF (a private health insurer) for 15%. Amount undisclosed.

GP2U’s Position

GP2U had some strong revenue growth thanks to COVID and appeared to be on the path to profitability. However, as a standalone business their revenue levels and lack of profitability leaves little margin for error.

GP2U had $4-5m invested into it. The output from this investment was ultimately a $500,000 loss over the two years between July 2019 to June 2021 and likely similar or larger losses from 2015 when the investment was made.

If you assume $400,000 losses each year since the investment then you’re looking at over $2m in losses. Likely the total capital used was larger as upfront investments would have been made in technology.

This means there was likely less than $2m of cash on the balance sheet of the business. They may have had runway to keep going but, if the investment in technology was significant ($1m-$2m) in the years we don’t have public visibility on then there may have been pressure on cash flow.

Acquisition Terms

The key terms for DCA’s acquisition of GP2U in September 2021 were:

$3.3m in cash on completion (upfront)

$7.7m in shares at $0.73 per share

No deferred or earn out consideration

The shares were subject to 12 months escrow, meaning GP2U shareholders could not sell their shares for at least 12 months (roughly September 2022).

The share price on 1 October 2022 was around $0.07 so GP2U and never recovered at the time of DCA delisting around April 2023 with a share price of around $0.05.

The Spinout

GP2U was spun out of DCA in July 2023 and sold to My Emergency Doctor. The key terms of the sale were $3m in total consideration, made up of:

$2.5m shares in My Emergency Doctor

$0.5m in cash

So, what happened?

Macro Context

By late 2022 and early 2023 unprofitable technology and growth stocks had started to see significant declines in valuation and COVID no longer posed the threat it once had.

These macro pressures combined to mean telehealth had fallen out of favour. People were back visiting their doctors and no longer forced into consultations by video.

DCA

DCA entered 2023 posting meaningful growth in consultations and revenue, while managing to reduce losses. They had some issues they state as needing to be addressed, ranging from leadership to technology platform stability.

They also wanted to focus on the UK market.

A slide from an early 2023 investor update provides a good overview of their performance:

Review of Strategic Rationale

When DCA acquired GP2U it’s key reasons were:

Entry into the Australian market

GP2U’s rapid growth

Accretive gross margin

Additional growth for GP2U only requires “modest” investment

Operating costs are immaterial to DCA

DCA also saw that it could bring “strategic benefits” to GP2U by acquiring it:

Better run telehealth services at scale

Better improve corporate relationships

Use DCA’s [better] technology platform

Cross sell services

Let’s take a look at each of these.

The point worth further commentary is the accretive gross margin. Had DCA been able to add the gross margin and remove all of GP2U’s operating costs then this gross margin would be truly accretive. However, DCA in effect bought -$100,000 in accretive gross margin because the GP2U cost base was required to gain the gross margin. They weren’t able to just port across all customers and administration to their own operating base and technology.

DCA was doctors, GP2U was mostly psychologists

DCA was a business doing telehealth for doctors appointments while GP2U was primarily a business doing telehealth for psychologists. Yes, GP2U has some revenue from doctors but at the time of acquisition this was only $286,000 for the prior 12 months.

While GP and psychology telehealth looks similar the details likely make it quite different product offerings, businesses and business models to run well at scale.

An update from DCA in early 2023 gives no mention of psychologists in the company’s strategic focus.

Results for Shareholders

Ultimately it’s all about shareholders (or should be). Let’s look at how GP2U’s shareholders fared through this and then look at what this meant for DCA shareholders.

GP2U Shareholders

GP2U’s prior valuation (at their 2016 Series B) was most likely somewhere between $8m and $15m.

The cap table would have looked something like this:

At the time of acquisition GP2U’s shareholders, especially the founder(s), Sonic Health Care and Dr Pascoe would have received an on paper uplift given the acquisition price of $11m. However, it’s likely that the $3.3m cash consideration recovered the capital injected by investors with the remaining share based component as the upside.

The total eventual cash consideration, if the GP2U shareholders cashed out immediately after the escrow period, would be:

If there were no mechanisms like preference shares to ensure investors received their money first then the cash received would be:

Either way, the investors are under water. The founder(s) or earlier investors may or may not have done well.

DCA Shareholders

At the time of acquisition DCA’s share price was around $0.73 with a market capitalisation of $117m. At the time of spinout DCA’s share price was around $0.07 with market capitalisation of around $23m.

DCA shareholders received just 15% of the cash and 32% of the equity they paid with. They likely incurred losses in the GP2U business while they owned it as well as transaction costs on the acquisition and spinout. Taken together, these additional costs most certainly wiped out the cash received and likely ate into the equity gains.

It’s hard to see any other value DCA shareholders derived from this.