Urbanise: ASX SaaS Looking to Defy History and Turn Profitable

$50m invested with $1.9m at bank, coming off a $2.3m cash loss on $12.6m revenue

We recently acquired FMI, Australia and New Zealand’s leading facilities management software specialist.

There is a competitor listed on the ASX, called Urbanise. So, I just had to dig into Urbanise this week.

Summary

Urbanise is facing an existential moment.

$50m+ has been invested over more than a decade producing a $2.3m loss, $12.6m in revenue, and a 1.9% revenue decline from last year.

Urbanise has $1.9m in cash and is burning up to $0.2m per month. It’s going to try and out grow its burn (get revenue to outpace costs), despite missing forecasts most years historically and the recent revenue decline.

Urbanise has been through a number of iterations in the software it sells, the customer, its leadership, and the market(s) it plays in. But it looks to have settled on strata and facilities management.

We’ll follow the usual format for these deep dives and look at:

About & History

Customer Value Proposition

Market

Product / Solution

Business Model

Competition

Go-to-Market

Finances

About Urbanise

Urbanise was initially called Majitek and it was founded in 2001 by Rob Cumming and Steve Outtrim. Steve Outtrim had seen prior success listing Sausage Software during the dot com boom.

Urbanise was not initially focused on where it has landed today. Under the name Majitek, the company raised $7.5m from Cisco to focus on “[enabling] any device or system connected to a network to be [accessed] on a pay-per-use basis” as well as “innovative services for the real estate industry and others, including transportation, smart-grid, and safety and security”.

As Urbanise the company listed on the ASX and raised ~$20m at $0.50 per share in late 2014. In the prospectus the strategy shifts to cloud-based solutions for the facility management industry.

When Urbanise was listed it had just under $4m revenue and was posting just over $1m in profit. Since listing Urbanise has repeatedly posted losses (despite constant regular cost programs) and missed revenue forecasts (from 2014 to 2017 they kept forecasting ~$9m revenue the following year but didn’t get there until 2019).

In total Urbanise has raised over $50m and its current enterprise value sits around $26m.

CEO Tenure

There has been relatively high CEO turnover, with 3 of the 4 CEOs over the last decade being in the role for less than 3 years. The average ASX200 CEO tenure is over five years.

It is unclear who the CEO was prior to listing, but over 2001 to 2014 it seems to have been the founders, Rob Cumming and/or Steve Outtrim, followed by Bernie Devince (although there could have been others).

The founders and original leaders now appear to have little to no involvement in the day-to-day of the company.

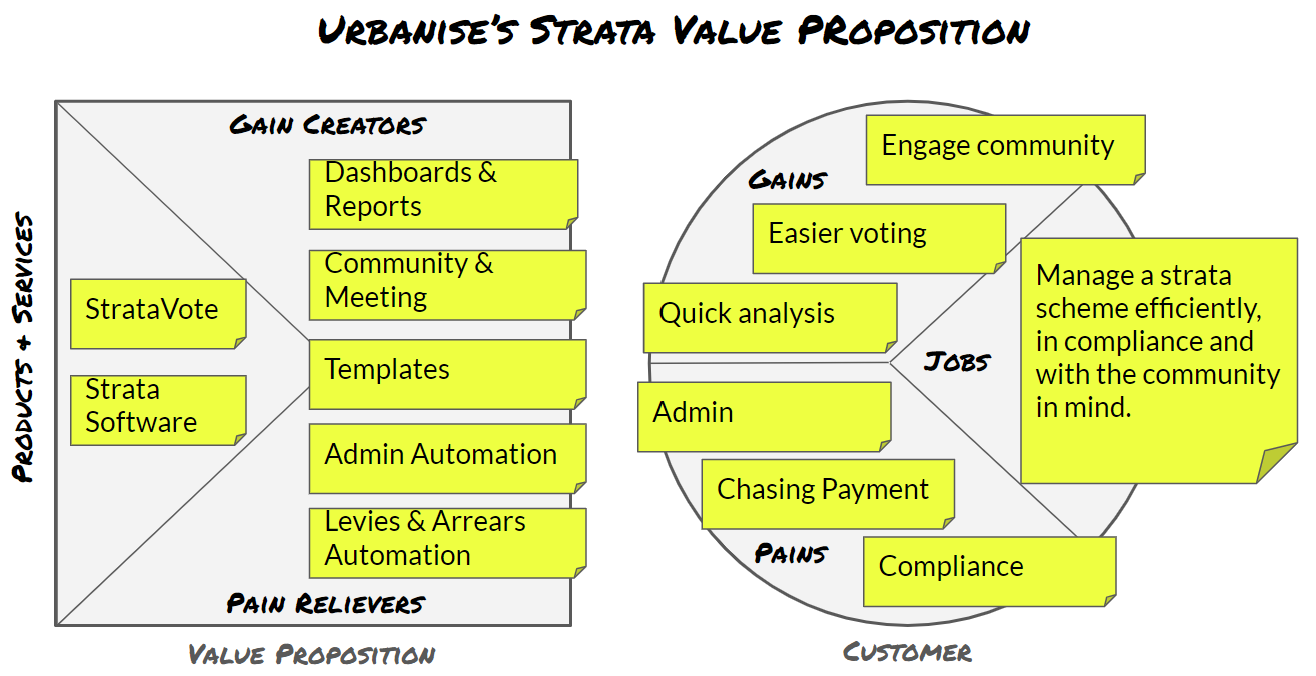

Customer Value Proposition

Urbanise has three primary customer value propositions:

Strata Management

Facilities Management

Strata and Facilities Management

Within each of these there are different types of strata and facilities. For example, a school runs its facilities in a different way to an aged care provider, who runs this differently again to a high rise block of units.

The Strata software targets strata and property managers:

The Facilities (or FM) software targets facilities managers:

The combined value proposition lets Urbanise expand contract value with most larger strata customers but is unlikely to be relevant for facilities managers without strata needs or smaller strata managers that don’t have need software to manage their facilities.

Market

The sweet spot for Urbanise is strata managers that need facilities management as well. This is a subset of all strata managers.

Urbanise can also tackle each market separately with it’s different software offerings.

Then they target these markets in multiple regions across the world:

AU/NZ

Middle East

Parts of Asia

Going after multiple regions imposes some costs on the business. The compliance and finance features, for example, will need to be developed and updated in line with local regulation for each region they target.

It was challenging getting strata and facilities management market data for each region with the exception of AU/NZ strata managers (there are ~372,000 of them). If we loosely extrapolate the AU/NZ data then the number of strata managers across the regions Urbanise targets is measured in the millions.

Urbanise estimates its market opportunity to be up to $355m.

Product / Solution

Urbanise’s primary product lines are the Strata and Facilities Management products. Within Strata there are add-on products for managing a strata community.

The products:

Urbanise Strata

Urbanise FM

Strataware

My Strata Community

Urbanise’s products appear to be for organisations that want a more customised solution. The Colliers contract, for example, was $500,000 of license fees and Urbanise incurred “costs to develop their [Colliers’] platform” which means Urbanise does development for some of their customers. There is also $1.2m in bad debts related to customers in the Middle East. Compare this to, say, Microsoft Teams where you can configure the software but Microsoft won’t do development just for you.

Business Model

Urbanise follows your typical Software-as-a-Service business model, that mostly sells into larger organisations:

Competition

Depending on how you look at it, Urbanise either competes in a market of strata that requires facilities management or it competes in strata management, facilities management and property/facilities service providers.

Urbanise’s website and reports point towards the company’s view as the latter.

In this case, Urbanise is competing on multiple fronts:

General ERP: big, broad systems that do it all (Urbanise provides custom solutions)

Property/Facilities Service Providers: software solutions for providers to property and facilities managers (Urbanise states this is a target for them, e.g. 60% of Facilties revenue comes from outsourcers)

Strata/Property Management Specialists: software for strata and property. Many solutions cover beyond strata, and help with property management as well (Urbanise doesn’t cover property management).

Facilities Management Specialists: software that specialises in facilities management (Urbanise sells its facilities management product as a standalone offering).

Go-to-Market

Urbanise’s go-to-market is fairly typical of a software company that sells into businesses, particularly larger ones.

The Partnerships seem mostly built around Strata and include Ace Strata Franchise and Stratavote.

Finances

Cash is a problem

Urbanise had a cash balance of $1.9m as at 30 June 2024. Urbanise has a history of material losses through most of its life over the last decade as a public company.

The loss for the 12 months to June 2024 was $3.46m with $2.3m in cash out over the period. This translates to ~$194,000 in cash burn per month. This gives Urbanise 9.8 months runway without any drastic changes or growth.

There is or was a cost reduction program in place that is referenced as being initiated in October 2023. It’s unclear what the status of this is.

Bad debts

Urbanise has late receipts of $1.2m and debtors of $3.9m. This is somewhat unusual, in particular the late receipts, for a software-as-a-service company where software is usually billed in advance. This may be linked to the custom development done around their solution for some customers.

Neither Growth or Profits

Urbanise is producing losses and no revenue growth to show for it. This leaves Urbanise in a precarious position for potential investors as well as for itself financially. The revenue growth isn’t enough to out pace costs soon enough (within their runway of 9 months) so they face a brick wall unless they cut costs to get to profit.

The report argues they will bridge the cash gap through revenue growth, but Urbanise has a history of not meeting revenue forecasts so its not clear if this will be hit.

Key Insights

What insights or lessons can we draw from Urbanise:

Low cash, losses is problematic: the low cash balance in relation to expenses puts the company in a tough spot. It needs to grow fast quickly, which has not happened historically or it needs to cut costs to give it more time.

Coming down market might be hard: Urbanise looks like it is geared towards larger customers and contracts. It is hard to come down market from here because sales incentives, team incentives, product dynamics, setup costs and more all constrain you so that smaller contracts are harder to fulfil. This isn’t necessarily a bad thing, rather a constraint to be aware of.

Split focus competitively: Urbanise is head on with a variety of competitors, all competing with different angles. Can Urbanise keep competing with a split focus? Or does Urbanise need to use its unique position across strata and facilities to focus on something more integrated?

Good investigation into background detail. I think you have called this correctly. If the business hadn’t hit a home run or established a viable base in over 20 years, it’s unlikely to do so in a short time like 9 months - particularly when there is no obvious catalyst. I’m thinking this is a bleed out scenario.