Whispir: $63m takeover target

Is it worth it?

Whispir is currently the target of a $63m takeover offer from Soprano Design. This was a significant premium at the time of the offer. So what’s all the fuss about?

Whispir helps its customers send SMS, email and other messages through Whispir’s software platform. Soprano does something similar, they call it Communications Platform as a Service or CPaaS.

Let’s take a look at Whispir, independent of the offer. We’ll cover the company’s background, market, competition, product, business model, go-to-market and finances.

Summary

View: Whispir is in a highly competitive, global market where their historical success and future advantage seems to be in reselling through telcos (~60% revenue is from Telstra) rather than global product innovation.

Yet, the company is in a serious financial position as a result of possibly over investing (80% of their recurring software revenue) in product development and innovation, losing revenue and making significant losses depleting cash from $26m to $4m.Key Risks:

Cash: Whispir has $4m cash at bank and burnt $4.9m between January and June 2023. If this burn rate continues Whispir will need to draw more on its debt facility and/or reduce costs further.

Strategic angle and business model: It’s unclear what their differentiation is compared to many other competitors, it looks like helping telcos but they invest and present like innovation is their advantage. The underlying low growth rate of their software reflects the uncertainty around their differentiation. They are also caught between being a software company or SMS provider.

Variability of messaging revenue: there seems to be a mismatch between their variable, transactional messaging revenue and its cost base versus the software platform revenue (although admittedly this is hard to detangle).

Reseller reliance: Whispir is heavily reliant on one reseller (Telstra) for over 60% of revenue in Australia.

Best Case: in the best scenario for Whispir’s business the cost cutting measures they’ve taken combined with minimal growth allows they’re breakeven or somewhat profitable (unclear yet).

Bad Case: in a bad scenario for Whispir, if costs haven’t been properly addressed then they will burn through their cash.

About Whispir

Whispir was founded in 2001 and listed in 2019 with a $47m offering on the ASX.

At the time of writing they have 800 customers mostly in Australia and a few across Asia and the US.

Whispir went through some impressive growth before COVID and then was supercharged by COVID. That growth has fallen away.

Market: Big, Growing and Accelerating with AI

In simple terms, Whispir is in the market of helping businesses send SMS, email and other communications to communicate with customers. They provide some software to make this easier for organisations with a bit of size of structure to do this.

The need for this is only growing and likely to be spurred on by advances in AI that make this type of communication more human-like.

Independent analysts put the market for Whispir’s software platform (a “CPaaS1”) at around $10-12 billion in 2022. Gartner thinks that 95% of global enterprises will be using API-enabled CPaaS solutions by 2025.

The demand is easy to understand because customers increasingly want to interact with businesses by email or text or whatever medium suits them. 9 out of 10 people read the text messages they receive within a few minutes and roughly the same number of people want and prefer to interact with a business by text.

It’s no surprise that Juniper reports that business messaging has been growing. But there is still plenty of room to run with only half of retailers using it and even less businesses overall using it.

But where does Whispir play specifically?

Whispir’s niche within this big market appears to be in CPaaS for Australian and Asian mid-to-large sized organisations.

There is something about Whispir’s local presence that has allowed them to win business in these regions where they could not in the US. This somewhat narrows the market size, but gives some focus.

However, competition is intense and being regionally focused has minimal advantages.

1 Communications Platform as a Service is, or CPaaS, is an application that companies can develop, run and distribute communications. Software that helps organisations design and send SMS, voice or email inline with their business processes.

Competition: From above, below and scale

There are a huge variety of solutions organisations of all sizes can choose from to send and manage communications with customers.

These range from SMS focused providers, to global cross-channel platforms, to some of the big, broad offerings such as CRMs and Call Centre platforms.

CRMs like MailChimp and Hubspot both offer SMS, email and more. In enterprise call centres, many of the players have an SMS, chat and email offering that integrates with the existing workflow. Then there are SMS focused players with significant scale and developer friendly platforms like Twilio and MessageBird. Even AWS has an SMS offering.

These competitors can’t be dismissed easily.

Let’s take a look at Whispir’s latest product demo screenshot compared to what MailChimp and HubSpot provide to their customers.

MailChimp and HubSpot are already deeply embedded in organisations, can be trialled for free (no need for a sales demo) and . These companies wouldn’t consider themselves in the “CPaaS” category but Whispir is competing head on with them without the scale, ease of use, design or access to data.

Whispir’s website would argue they are more omnichannel and fit better into an organisations workflow but it’s hard to make this case against MailChimp, Hubspot, Twilio, MessageBird and their peers for the midmarket and hard to make it against Verint, Genesys, Five9 and their peers in larger companies.

Product

The ultimate Job-to-be-Done is to send an SMS but in a mid-to-large organisation this isn’t always so straightforward.

You need:

The ability to send communications (SMS, email, etc)

Integration with your existing systems and workflows

Approvals so the organisation is comfortable with what is sent

Reporting so the organisation can see how it is going

Communication so an organisation can reply and engage in a conversation with customers

Reliability so that organisations can rely on their messages being sent and received (this gets difficult at scale).

Additionally, if a reseller is involved there are probably parts of the platform that make it attractive to a reseller.

Whispir also supports payments and geofencing.

Customer Value Proposition

Whispir’s core customer value proposition seems to be about taking the pain out of sending SMS and other communications for organisations with some scale that need structure.

Business Model: Communications driven by a software platform sold to mid-to-large organisations

Whispir is selling communications (e.g. SMS, calls) bundled with a software platform to make it easier for their customers to communicate how they need to.

They go to market directly with a sales force and resell through partners. One partner, which appears to be Telstra, makes up the bulk (60-68%) of their total revenue.

Their customer list and their “request a demo” approach to selling indicates they are geared towards mid size or larger organisations (if you’re going to sell to smaller organisations then you need to have self-service sign up (like Mailchimp or Twilio)).

Occasionally it looks like they need to provide professional services to help a customer install and configure their solution but this is not a major part of the business at less than 2% of revenue.

To earn revenue they also incur some costs. These costs are the hosting infrastructure and the carrier fees (costs of SMS and calls). Their financial reports don’t separate these out. There is also likely some cost of professional services people but this will be negligible (1-3%).

Price Point

With $12m revenue and 800 customers, the average platform subscription per year is about $15,000. Given they have insurers on 3 year contracts, it’s likely that their best contracts are something like $100,000 to $500,000 per year for the platform.

Go-to-market: Sell directly and resell

Whispir sells directly through a sales force. They use “Client Executives” - business development folks to work with prospects and clients to build new relationships and grow revenue.

Whispir also sells through resellers. It’s less of a “resellers” plural though and more of a “reseller” singular, Telstra. They do appear to be working with others to grow this part of their business.

Finances: in a nose dive but might be ok now

The standout in Whispir’s finances is that their cash reduced from $26m to $4m as a result of revenue reducing by 24% from $70m to $53m without any changes to costs.

Cash is a problem

Costs have now been cut but Whispir burnt $4.9m across January 2023 to June 2023 and they only have $4m cash at bank. If revenue doesn’t grow or declines then Whispir will be out of cash and into debt.

Whispir has access to a debt facility of $7m, but debt has to be paid back and it’s hard to payback loans from negative cashflow if you want to survive.

In short they need to (and potentially already have) cut costs so that they don’t burn $4.9m across July to December in 2023.

There aren’t really any other assets they can draw on.

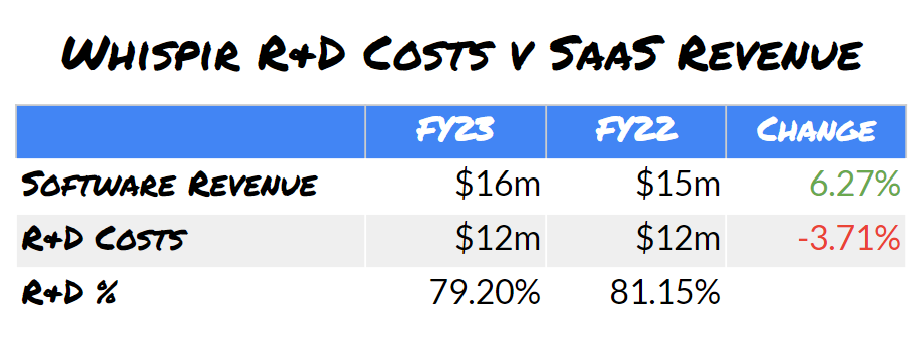

R&D Costs versus SaaS Revenue

Whispir is investing heavily in product development relative to their revenue from their software.

The software itself seems fairly stable but the transactional message (i.e. SMS) revenue is nowhere near as stable (as seen from the previous year).

No churn but also lots of churn

Whispir reports that they had “Net Revenue Retention of 103%” in the opening letter of their annual report which is hard to wrap your head around given the 24% decline in top line revenue. But after some consideration it would seem that they are referring to their SaaS revenue.

SaaS grew, as you can see from the table above but Annual Contract Value did not (underscored by the CEO missing this component of the incentive plan).

An alternate measure is needed for Whispir here. Net Revenue Retention of just the SaaS doesn’t make sense unless the business is going to be geared around SaaS (R&D and sales in the right proportion in respect of this revenue) or separated into two businesses. But that seems hard and a combined measure more appropriate.