Crypto adoption, ASX’s first ETF and why DeFi could overtake traditional finance 💲

We explore the growth of DeFi, how it could be more disruptive than bitcoin and what options ASX investors have to get exposure to the space

Although teetering on the edge of the next crypto-winter at the time of writing, cryptocurrencies continued up the adoption curve for institutions and consumers in 2021.

Historically bitcoin has driven the narrative, but the world is waking up to the power of decentralized applications (Dapps) - and we’ve been blown away by the innovation as of late in Decentralized Finance (DeFi).

DeFi is a form of finance that doesn’t rely on intermediaries (i.e. brokers or banks) like it does in traditional finance (TradFi), but instead relies on software running on distributed ledgers.

These transactions are settled in cryptocurrencies, where adoption in Australia is well above the global average - an estimated 18% of Australians own cryptocurrencies versus the global average of 11%.

The Crypto Ecosystem

The aggregate value of the crypto market is currently US$2.2 trillion - marginally bigger than the market capitalisation of the entire ASX (US$1.8 trillion).

Bitcoin is the largest cryptocurrency with an aggregate value of US$929 billion.

Many have heralded the cryptography movement as the coming of the exponential age and there are many unique factors to admire:

Permissionless: anyone can participate, which is why we see higher participation in countries that distrust their banking system like Vietnam and the Philippines

Decentralised: it is not reliant on a single company or authority, but instead a decentralised network of computers making it hard to control (excluding by government sanction)

Trustless: these computers each store the same version of the database and transactions are completed by code (not people) - meaning you don’t need to trust an intermediary

Open Source: the rapid development is largely being driven by open source technologies, where the code, data, and knowledge are building on top of each other leading to unprecedented innovation

Bitcoin was the first successful blockchain implementation in 2008 and crypto has gone through several waves. With each new wave, it extends to new categories and more entrepreneurs and developers enter the space.

2021 saw an explosion in adoption by countries and communities around the world with El Salvador making Bitcoin an official national currency alongside the U.S. dollar.

One thing we’re following closely is the emergence of DeFi.

How DeFi could overtake traditional finance

What makes DeFi disruptive is its application to big economic inefficiencies and problems in the traditional finance system - removing intermediaries and replacing it with software.

While bitcoin is becoming digital gold, DeFi could become a new financial system.

Sounds far fetched - but leading institutions and consumers are rapidly adopting tools and technologies to access the new market.

The role of stablecoins

The enabler of the DeFi ecosystem has been stablecoins - which are digital dollars pegged to real world dollars. They are like tokens for actual fiat-money that has been ‘on-ramped’ into crypto through the traditional system.

The two main ones are:

USDC: managed by a consortium including Coinbase

USDT: managed by Tether and has been investigated for not actually being backed by USD, which some say poses systemic risk to the cryptocurrency ecosystem

By digitizing real dollars into blockchain dollars - money is able move around the world on blockchain rails instead of the traditional finance rails (read: no middlemen, no KYC, instant settlement, ~$0 transaction costs).

This has been like innovation lightning ⚡️.

The DeFi movement really took off in the middle of 2020 – known as DeFi Summer – when a borrowing and lending platform called Compound introduced a governance token which rewarded users for providing liquidity to Compound.

This meant savers could deposit their digital money with compound, receive collateralised loans and earn additional rewards in Compound tokens, while Compound would take the deposits and lend it out to others.

Sounds like traditional banking - until you realize that there is no bank, just software contracts running US$11 billion of dollars between borrowers and lenders at the time of writing 🤯.

The entity behind the contracts is also a Decentralised Autonomous Organization (DAO) - an organization represented by rules encoded as a computer program and controlled by who owns the governance tokens.

The Compound protocol is capitalised at US$2bn and you can put forth new code if you have 100,000 comp tokens(US$20m) which can pass if approved by 400,000 tokens (US$80m).

Lending is just the start of it - there is even more in DeFi going on in decentralized exchanges (DEXs), derivatives, and staking which we won't dive into in this post.

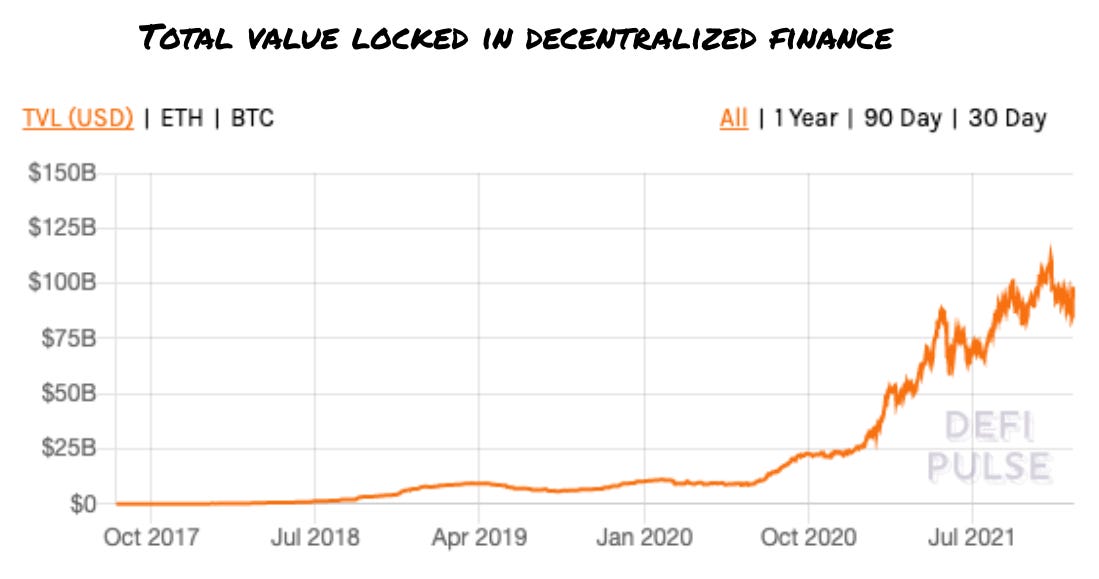

Total value locked over $100 billion

The key measure of DeFi activity is Total Value Locked (TVL), which is the total value of assets locked in smart contracts and protocols (like Compound) at a particular time.

It’s not a perfect measure for DeFi’s success, but it's the best proxy we have and is simply ‘how much money is in the DeFi ecosystem’.

From less than US$5 billion at the beginning of 2020, TVL has increased to over US$100 billion today.

DeFi funds have also seen rapid growth by moving liquidity around the system to generate returns. As DeFi funds run on blockchain rails, every trade can be tracked on the distributed ledgers.

Enzyme has built a platform that shows asset-manager performance, so you get transparency of every trade and how they're actually performing in this new market.

How to get exposure to DeFi?

The best way is to try it for yourself - get a Metamask wallet, buy some ETH and start playing around with different Dapps.

If that's not your thing - there is the Crypto Innovators ETF which is “.... an equity index that provides focused exposure to companies that are building the future of the crypto-asset-enabled decentralized economy.”

It’s not DeFi, but probably the best proxy available for ASX investors.

Here is the make-up as at December 15, 2021.

There are many innovative companies in this mix and four holdings make up 44% of the ETF:

Silvergate (13%): a traditional financial institution that provides USD loans to crypto miners using their Bitcoin deposits as collateral

Galaxy Digital (12%): becoming the Goldman Sachs of the crypto-world

Coinbase (10%): a Centralized Exchange for crypto assets where people can buy and sell through a centralized entity (versus a software protocol on a Decentralized Exchange (DEXs) like Uniswap)

Microstrategy (9%): a traditional software-as-a-service business that has 114k Bitcoins in its Treasury (~US$6bn)

The rest of the portfolio is less exciting and split between:

Some traditional financial services players: that let you buy crypto (Paypal, Robinhood)

Bitcoin miners: which like traditional gold miners will have most of their success tied to the price of the underlying asset they are mining (i..e the price of Bitcoin)

Given the amount of growth and innovation in the space, it’s only a matter of time until there is more DeFi spillover into traditional equity markets - but most public equity market investors will be limited to the names above or ETFs for the time being.

What do we expect in the future?

Having grown from US$5bn to US$100bn over the last 12 months, we believe DeFi is here to stay and will continue to take share of the traditional finance system.

Most of the explosive growth is happening in private markets, and there are a number of challenges the industry needs to overcome before we’d expect to see more on the ASX.

Tooling: Like the early internet, the tools to invest and participate in DeFi are hard to use and you need to be fairly technical

Regulation: growth of the TVL has caught government attention, which will likely gather regulatory steam as money keeps moving into the borderless-nature of DeFi

New Risk: the two main advantages of DeFi (higher interest rates and instant settlement) often ignore the smart contract risks they introduce. There’s no deposit insurance of these funds and some contracts have been exploited by hackers and lost millions of dollars

Scalability: the industry’s main layer one protocol (Ethereum) is facing significant network congestion which results in high fees and makes it almost uneconomic for small transactions. ETH2 may change this and there is growing investment in layer twos, and new layer ones (i.e. Solana)

With the amount of talent being pulled into the space and the opportunity of solving big economic inefficiencies in the traditional finance system - DeFi has a long way to run to reach mass adoption and is going to be a big wave.

We’re excited to be paddling out. 🏄♂️

Interested in staying up to date?

Thanks for reading. Up next - we’re going to share an annual wrap and of 2021 and our ASX technology predictions for 2022.

We’d also love your input so that the newsletter can continue to improve - share your feedback or send an email to andy@andycrebar.com.