Acquisition Analysis: $35m AI rollup on the ASX

Can the strategy recover $31m in pre-IPO investment?

This week’s acquisition analysis is yet another AI acquisition on the ASX. This time it’s Prophecy acquiring AI supply chain optimisation software provider, Complexica.

This looks like the beginnings of a build-and-buy (mainly buy) rollup of older “AI” or AI-like companies on the ASX.

It’s an all-scrip deal valued at A$13m, but the A$31m investors put into Complexica is going to need a lot of growth out of the combined group to see returns.

I’ll give a brief background on the companies involved and share the terms of the deal itself. Then, I’ll look at how it’s going to improve the financial performance of the buyer and how the acquisition fits their strategy (or not).

Company Backgrounds

Prophecy is an ASX-listed company with two distinct offerings, one in IT/security log analysis and another in contact centre analytics. Prophecy has customers like QBE, Fidelity, Novartis and UPS.

Prophecy did A$22m in FY25 with EBITDA losses of $5m. This is essentially flat compared to FY24; the prior year's results are $22.6m in revenue and $4.6m in losses.

Prophecy is currently trading at A$0.26 with a market cap of A$19.18m (10 September 2025).

Complexica provides supply chain optimisation through software, algorithms and AI to customers like Metcash, CUB, Endevour Group and Asahi. They seem to have a niche in beverages, and they’ve been doing AI since before it was cool (they won an AI award in 2018).

Complexica did A$13m revenue with $2.3m EBITDA in FY25, up slightly from FY24, where revenue was $12.5m and EBITDA was $2.0m. Of note is that they’ve grown their recurring revenue to 58% of revenue for 2024.

Complexica was bootstrapped for 7 years then raised ~$31m across 2021-2023 from MA Financial, Microequities Asset Management, Flinders Ports, Perennial Partners, and Acorn Capital.

The Deal

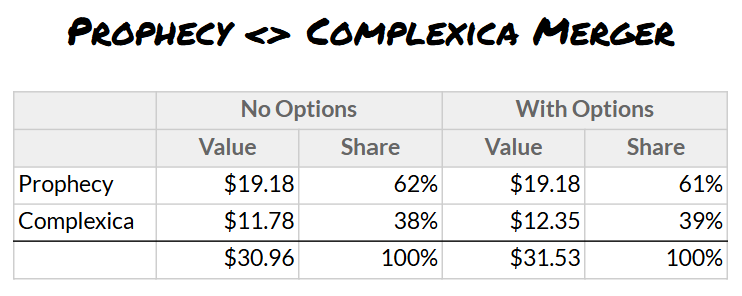

The deal is A$12.35m in Total Consideration. This implies an EBITDA multiple of 5.3x and a revenue multiple of 0.95x. The Total Consideration is mostly shares issued upfront with a small option component.

Let’s look at each component.

The Upfront Equity is ~$11.778m in shares (45.3m shares at $0.26 per share).

The Options are ~$0.57m (2.2m zero exercise price options at $0.26 per share). The Options don’t appear to have any other terms attached to them. Keep in mind that with options, these will be worth more or less depending on the performance of the business.

Strategic & Financial Impact

Strategy

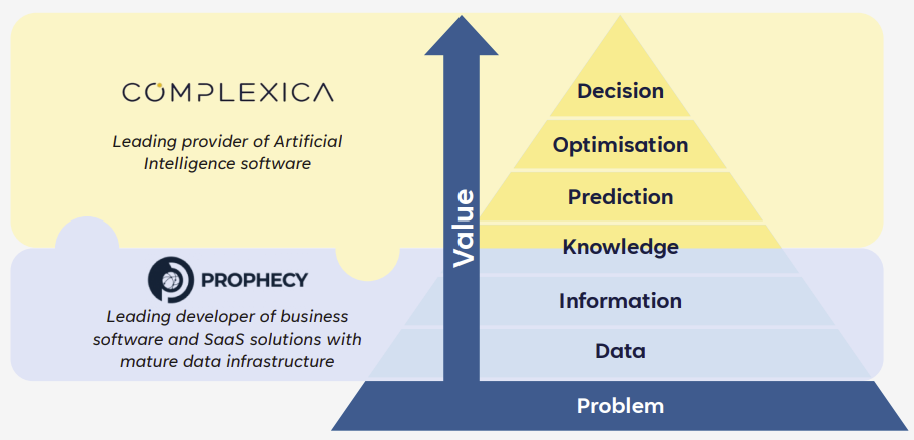

The commercial strategy here seems to be for Complexica to add layers of decision-making intelligence to Prophecy’s data:

The challenge with this is that Complexica sells and services supply chain customers and problems. These are very different to contact centres and different again to IT teams.

At a corporate level, it seems that Complexica’s $31m worth of investors needed an IPO exit, the outcome their investment targetted. Prophecy needed something to pull their share price fortunes out of a persistent, gradual decline and looked to M&A.

More generally, there is a combination of factors that say M&A will become a more significant part of their strategy. The CEO is a former Constellation Software employee, the businesses have a history of executing M&A, and there is a focus on future M&A in their announcement of the merger.

Financials

The merged group will have a combined revenue of $35m and EBITDA of losses of $2.3m to start with, based on the FY25 financials of each business.

Management says they will take $1.7m of costs out of Prophecy. This would bring the losses down to $0.6m, which gets down to breakeven with the planned Complexica cost reductions. This is a little different to management’s “incremental, annualised run rate” EBITDA of $1.8m. It also doesn’t allow for transaction costs or redundancy costs that are likely being normalised out of these numbers.

Neither business appears to be growing substantially, but both have growing recurring revenue streams.

Final Thoughts

AI build and buy: are we seeing the beginnings of an AI-focused rollup on the ASX? It’s an interesting strategy. There are plenty of compounding success stories on the ASX that have executed well on rollups. The slight difference is that the others went for a common customer, whereas this seems to be going for a common technology around AI. The Constellation Software link adds to the intrigue.

Can’t make sense of the cross-sell strategy: Complexica is doing supply chain optimisation, while Prophecy’s solutions are in IT and call centres. I can’t see how decision software for chain supply optimisation at Asahi can easily be repurposed for the IT team at Services Australia. Compare this to Catapult’s acquisition of Perch where they are selling an add-on to customers who have already shown take-up of Perch. Maybe I’m missing something.

Broad language loses me: On first read through, I was really struggling with the overly broad phrases like “AI pure play” and “leading provider of AI software”. But buried deep in the announcement on slide 18, and a look at the websites shows there is specialisation in supply chain optimisation. Being more specific and more specialised like this is a more compelling value proposition in what is a very competitive marketplace.

Merged EBITDA discrepancies: the fact that the planned cost out matches the FY25 EBITDA of both businesses tells me that my merged EBITDA calculation of -$2.3m is probably somewhat accurate.

Further cost out: given the businesses have slower growth, and given the maturity of the businesses, it might be sensible to produce higher profits by taking more costs out.