Australian Healthcare: Investment Insights from the Financials of 160+ ASX Companies

5 ASX Healthcare Stocks Are 75% of the Sector's Market Cap + More

The Healthcare sector is particularly interesting at the moment with large scale private hospital operator Healthscope facing down administration and significant restructuring.

With reports that the healthcare industry needs structural changes, we thought it would be enlightening to do a Sector Research post analysing healthcare companies listed on the ASX to identify emerging trends, market dynamics, and investment opportunities within the industry.

By examining financial metrics including market capitalization, growth rates, valuation multiples, and profitability indicators across different healthcare sub-sectors, we provide insights into where the Australian healthcare market is today and where it might be heading.

Introduction

The Australian healthcare sector represents a meaningful component of the national economy (9.9%). With an aging population, increasing chronic disease burden, and technological advancements transforming healthcare delivery, understanding the financial performance and market positioning of healthcare companies provides valuable insights into broader industry trends.

This analysis examines data from over 100 ASX-listed healthcare companies spanning multiple sub-sectors including pharmaceuticals, medical devices, healthcare software, diagnostic services, and aged care.

The beauty of using data from public companies is we get a real view of what is happening on the ground.

Methodology

Our analysis utilizes financial data from ASX-listed healthcare companies, including:

Market capitalization

Revenue growth rates (1-year trailing twelve months)

EBITDA growth and margins

Valuation metrics (EV/Sales, P/E ratios)

5-year CAGR total returns

Companies were categorized by healthcare sub-sector to enable cross-segment comparison and identification of sector-specific trends.

Key Findings

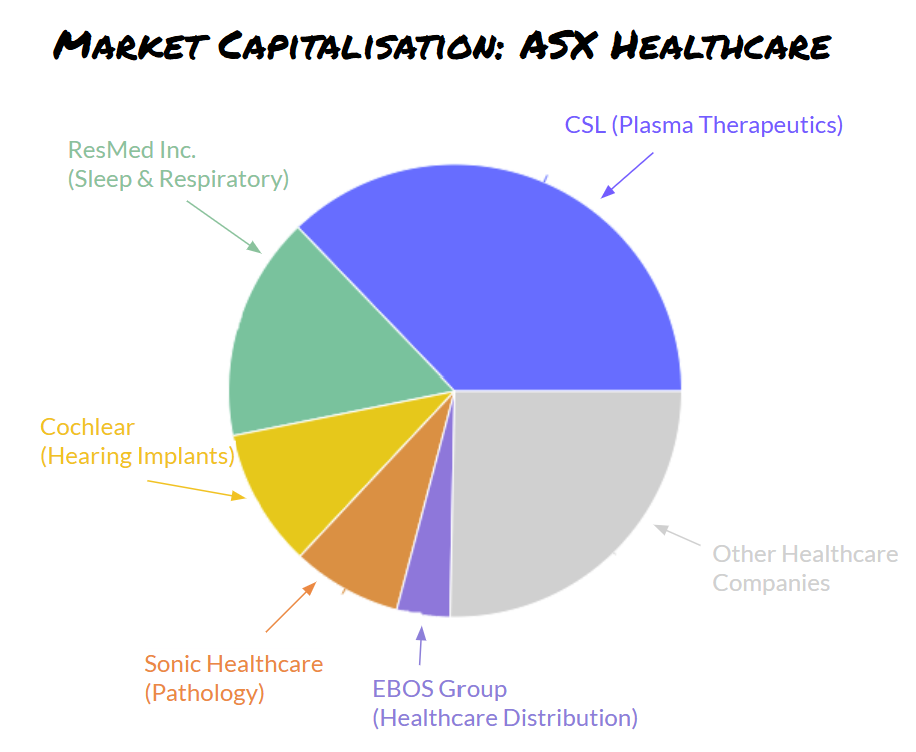

1. Market Capitalization Distribution

The Australian healthcare market shows significant concentration, with a few large players dominating the sector. The top five companies by market cap are:

CSL Limited (Plasma Therapeutics): $79.3 billion

ResMed Inc. (Sleep & Respiratory): $34.1 billion

Cochlear Limited (Hearing Implants): $21.0 billion

Sonic Healthcare Limited (Pathology Services): $16.7 billion

EBOS Group Limited (Healthcare Distribution): $8.1 billion

These five companies account for approximately 75% of the total market capitalization across the analyzed healthcare stocks, indicating high market concentration.

2. Sub-Sector Performance Analysis

High-Growth Sub-Sectors

Several healthcare sub-sectors demonstrate strong revenue growth:

Radiopharmaceuticals: Companies like Telix Pharmaceuticals (55.9% revenue growth) are showing exceptional performance, driven by increasing adoption of targeted radiation products for cancer diagnosis and treatment.

Healthcare Software: Pro Medicus (29.9% revenue growth) exemplifies the strong performance in this sub-sector, reflecting increasing digitization of healthcare services.

Aged Care: Providers like Regis Healthcare (24.8% revenue growth) show solid growth as Australia's aging population drives demand.

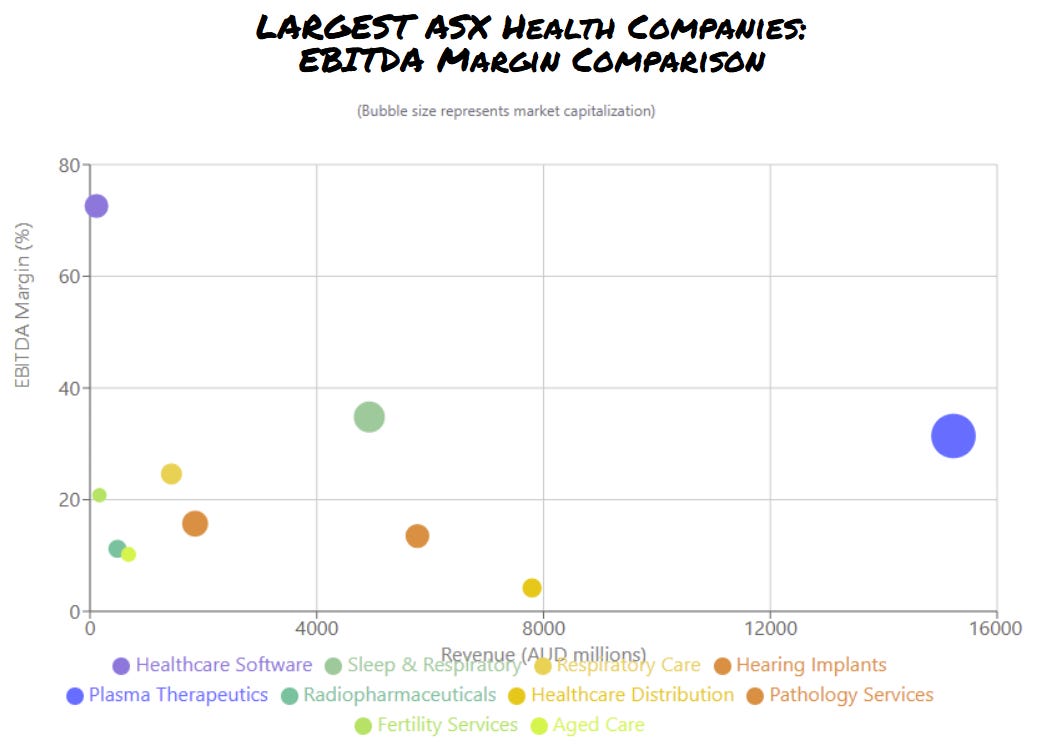

Profitability Leaders

Sub-sectors with the strongest EBITDA margins include:

Healthcare Software: Pro Medicus demonstrates an impressive 72.6% EBITDA/Revenue ratio, highlighting the scalability and high margins of software business models in healthcare.

Sleep & Respiratory: ResMed maintains strong profitability with 34.8% EBITDA margins, benefiting from recurring revenue streams through device sales and consumables.

Hearing Implants: Cochlear shows solid profitability at 17.3% EBITDA margin, leveraging its market leadership position.

3. Valuation Insights

Valuation metrics reveal significant variation across healthcare sub-sectors:

Healthcare Software commands high multiples with Pro Medicus trading at 101.1x EV/Sales and 190.1x forward P/E, reflecting investor optimism about high-margin, scalable business models with recurring revenue.

Radiopharmaceuticals companies like Telix trade at 7.1x EV/Sales, indicating investor confidence in the growth potential of precision medicine.

Traditional healthcare providers (hospitals, pathology, aged care) typically trade at lower multiples (1-3x EV/Sales), reflecting their more mature, capital-intensive business models.

4. Long-Term Returns Analysis

The 5-year CAGR total returns show divergent performance across companies:

Top performers: Telix Pharmaceuticals (84.5%), Pro Medicus (68.8%), and Cryosite (65.4%) have delivered exceptional returns, indicating strong market validation of their business models.

Underperformers: Several companies in the medical cannabis and early-stage biotech spaces show negative 5-year CAGRs, highlighting the risks in these segments.

5. Emerging Healthcare Trends

The financial data reveals several key trends shaping the Australian healthcare landscape:

a) Precision Medicine Acceleration

Companies focused on personalized and targeted therapies are showing strong growth and attracting premium valuations. Radiopharmaceuticals (Telix), genetic testing, and advanced diagnostics companies are gaining traction as healthcare moves toward more precise, patient-specific approaches.

b) Digital Health Transformation

Healthcare software and digital health companies like Pro Medicus demonstrate the market's recognition of technology's transformative potential in healthcare. Their high growth rates and premium valuations reflect expectations that technology will continue reshaping healthcare delivery models.

c) Consolidation in Traditional Healthcare

Established segments like pathology (Sonic Healthcare), imaging diagnostics, and hospital operators show lower growth rates but maintain significant market share. These sectors appear ripe for consolidation as scale becomes increasingly important for profitability.

d) Emerging Therapies Face Challenges

The data shows mixed results for companies developing novel therapeutics. While some demonstrate promising growth, many smaller biotechnology companies focused on areas like medical cannabis, psychedelics, and early-stage drug development show negative returns, highlighting the challenges of commercializing innovative therapies.

Limitations

Some of the limitations of this research are:

Concentration: concentration of market capitalisation in a small number of companies leads to a few insights that would ideally have information from more companies (e.g. there are software companies trading at lower multiples but Pro Medicus’s well-deserved dominance somewhat obscures this in this research)

Company stage: breaking out early-stage biotech companies may change the analysis but we didn’t segment the list by company stage.

Conclusion

The Australian healthcare sector presents a diverse landscape with varying growth, profitability, and valuation characteristics across sub-sectors. The financial data indicates a market that rewards companies demonstrating technological differentiation, scalable business models, and alignment with demographic trends like the aging population.

The most promising segments appear to be those at the intersection of healthcare and technology, particularly in precision medicine, diagnostics, and healthcare software. These companies show superior growth rates, stronger profitability, and command premium valuations from investors.

Meanwhile, traditional healthcare providers continue to provide essential services but face margin pressures and consolidation forces. The pharmaceutical and biotechnology spaces show significant variation in performance, with companies developing novel, targeted therapies outperforming more traditional approaches.

For investors and industry participants, these trends suggest focusing on companies that leverage technology to improve healthcare outcomes, increase efficiency, or enable precision medicine approaches. The Australian healthcare sector's future appears increasingly driven by innovation, digitization, and personalization, with financial markets already recognizing and rewarding companies aligned with these trends.

what do you think about Sigma health care or chemist warehouse?