Gentrack: Analysis of 2022's Standout ASX Tech Performer

A Utilities and Airports software solution provider at the forefront of seismic shifts in energy and, hopefully, rebounding travel

This is a close look at one of the few small tech companies on the ASX with strong share price growth over 2022, Gentrack.

Gentrack is really a business comprised of two sort of similar businesses. The beauty of their offerings is that they combine technology with services to help their customers get ongoing outcomes.

Gentrack has a Utilities business that provides software based billing solutions to utilities (like electricity and water) and an Airports business that provides airport management solutions.

The Utilities business is right at the forefront of the seismic shifts going on in energy markets right now and the Airports business is well placed for the rebound in global travel.

Summary

Our view: the disruption in energy means there is a strong market need for Gentrack’s utilities business. Their new, cloud based subscription and managed services look to be the right product in the right place at the right time.

Key risks:

Utilities: growth with new regions and partners takes longer and costs more than expected resulting in both slower revenue growth and lower profitability.

Water: Gentrack may find more fragmented water regions harder to tackle due to these customers being smaller than current customers.

Airport: non-Airport customers dilute the offering or are a distraction.

Bull case: market trends in the energy industry force utilities to adopt Gentrack, pulling it quickly into new regions and partnerships. Airports pickup their momentum with COVID lifting.

Bear case: expansion into new regions proves more expensive and time consuming which hits both revenue growth and profitability. Veovo’s work in non-Airport customers distracts the business, hurting growth and profitability.

Core utilities product is experiencing venture style growth in a electricity market ripe for disruption.

Overview: Billing and Analytics for Energy, Water and Airports

Gentrack’s core offering is modern billing software for utilities, like energy and water. This core offering sits at the centre of their broader offering that combines Salesforce and AWS’s cloud infrastructure to provide a solution for utilities to do metering, profitability analysis, pricing and analytics as well as better manage renewables.

Gentrack also offers software to airports, called Veovo. Veovo provides data on passengers, flights and operations so airport operators can understand airport performance and security as well as passenger experience. It can also be used by theme parks and ski resorts.

Gentrack’s utilities platform is used by over 50 utility companies globally and Veovo is used by over 110 airports. Gentrack has almost 600 employees in different locations around the world.

The company was founded in 1989. They listed in 2014 with a valuation of about $189m. They have raised subsequent funds for acquisitions.

Gentrack has acquired four companies along its journey:

Junifer Systems in March 2017 for US$53m

Evolve Analytics in June 2018 for US$30m

Concessionaire Analyzer in April 2017 for US$8m

Blip Systems in April 2017 for US$6m

Evolve and Junifer relate primarily to Gentrack’s energy and utilities offering. Concessionaire and Blip were combined to form the airport and theme park offering, Veovo.

Market: Energy, Water and Airports

Gentrack sells into utilities. This is primarily energy and water but they’ve expanded into more infrastructure like airports.

Gentrack’s strongest near-term opportunity lies in electricity utilities due to trends in the industry that are forcing change. Success here can likely be transferred to water utilities, which has a large, more fragmented market that doesn’t have as strong an impetus for change.

Gentrack’s Airport offering sits somewhat to the side with a relatively smaller but not insignificant market opportunity.

To understand more about Gentrack’s market we need to break down each sector they operate in.

We will break this down into:

Electricity Utilities

Water

Airports

For each of these sectors we will look at how to size and segment it, market trends and current Gentrack’s position in the market.

Electricity Utilities Market

How to Size and Segment This Market

There are around 8,000 electricity utility companies globally that, theoretically, could be potential customers for Gentrack.

This market is fragmented by region due to local requirements like regulation, local energy needs and local energy access as well as simpler requirements like language support.

For Gentrack’s new product in particular, this market can be further segmented, but not necessarily limited, by those that have adopted or are adopting Salesforce.

Market Trend: Growth in Renewables

In electricity utilities there is a growing trend towards renewable energy, the transition to cloud technology and a need to explore alternative business models.

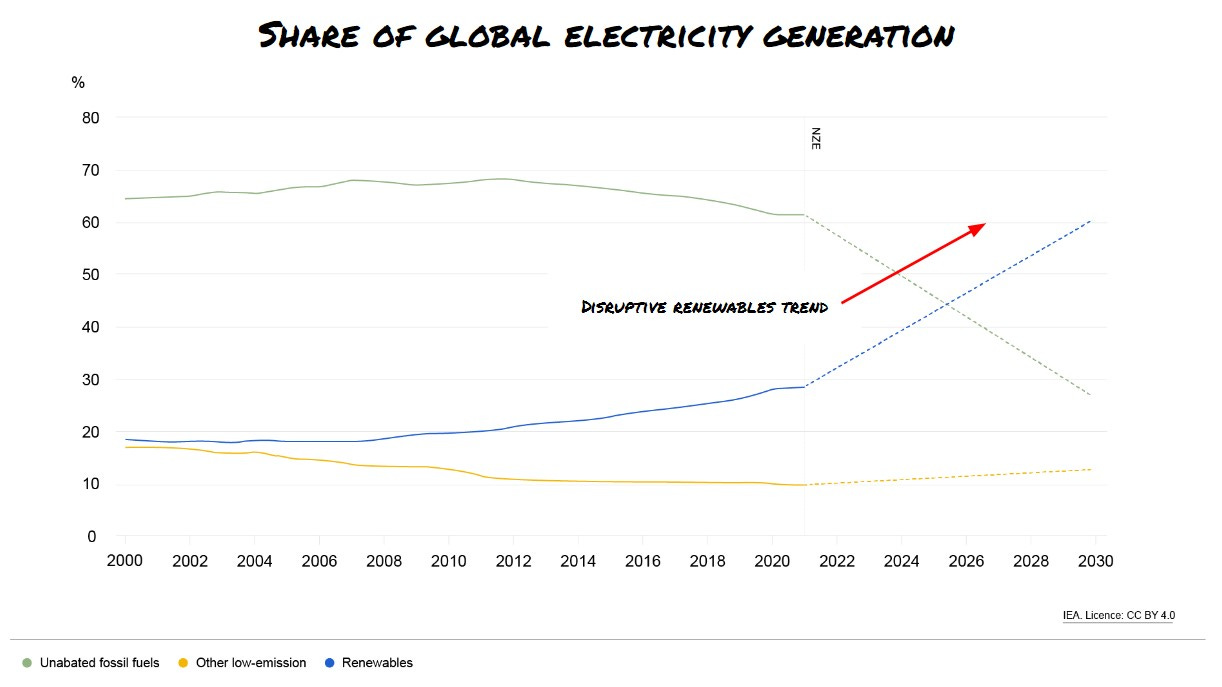

The International Energy Agency’s forecast of global electricity generation by source indicates the sharp trend that the industry is expected to follow towards predominantly renewable energy sources.

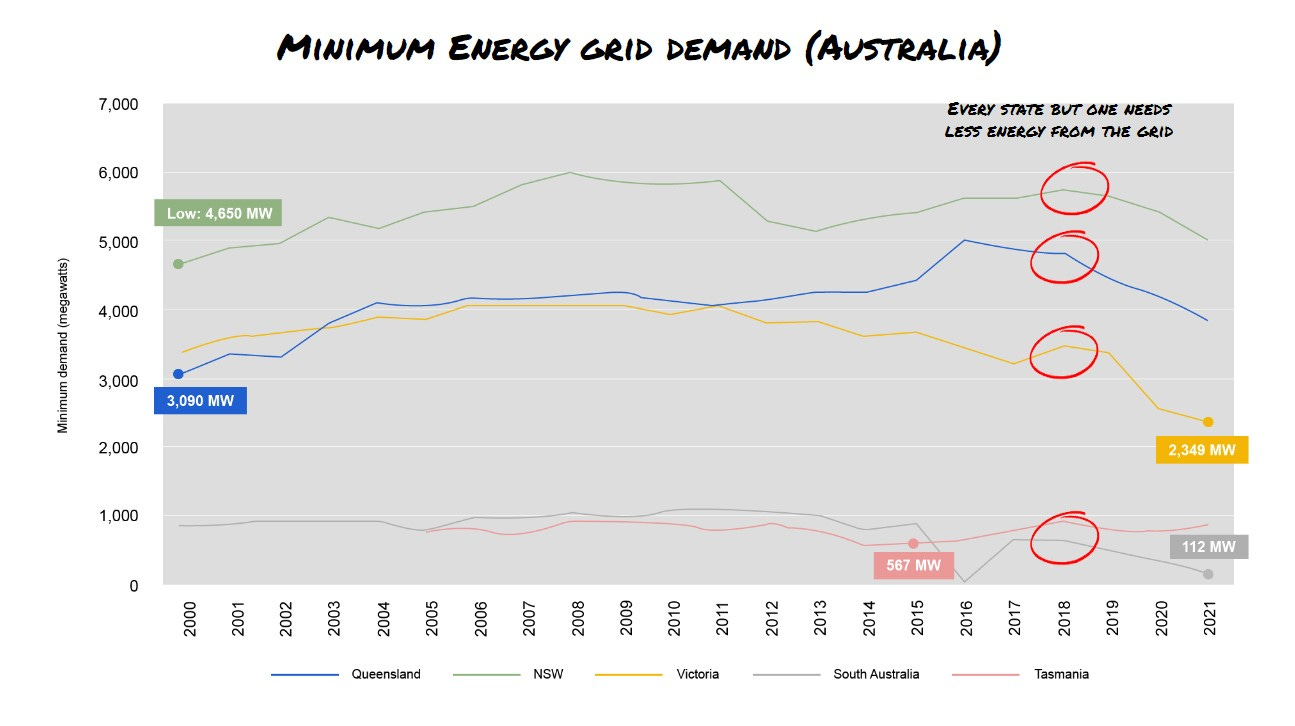

In Australia, for example, rooftop solar’s accelerating growth along with the growth in other renewable energy sources has seen grid demand fall faster than expected. Given Australia’s advanced position relative to other countries on this trend, it’s plausible to believe that other countries will follow suit.

Market Trend: Instability and Alternate Business Models

On top of the trend to renewables, energy utilities are also facing pressure from every angle. These pressures are forcing them to become more adaptable and look for alternative ways to survive and thrive.

An indepth look at the energy market in the United Kingdom gives some insights into this trend.

In 2021 more than 30 energy retailers went bust due to market volatility.

Energy UK, the UK’s regulator, remains concerned more energy retailers are in trouble as recent as December 2022.

Natural gas price increases, significantly low wind generation output, shifts to working from home, regulation, tariffs, and Brexit have all been cited elsewhere as factors at play.

No doubt, increased competition drove competition, pressure on prices and services.

The challenges faced by the UK are not unique globally. These challenges mean that energy companies globally need to be able to respond faster to situations which ultimately means they need technology and solutions to enable them to do so.

Market Trend: Digital Transformation

Like most industries globally, the companies in the utilities industry must continue to improve their technology. And, like most industries, established players are still working to shift from older technology to new technology like cloud-based software.

Gentrack has partnered with the two global leaders, AWS and Salesforce, who have dominant market share in cloud and digital transformation across industries.

Gentrack’s Current Position

These trends all suit Gentrack’s solution and positioning.

Gentrack’s ability to ride out the UK’s energy market meltdown and its major market share in Australia show how well their solution fits the current market and the direction the market is trending.

Gentrack has only begun to scratch the surface of the global market with just 50 customers or less than one percent of the global market.

Their planned growth into Asia and Europe means they can leverage their experience in Australia for both region’s increasingly solar powered and renewable economies.

The Americas is a notably absent market in the short to medium term.

Water Utilities Market

How to Size and Segment This Market

Globally water and wastewater utilities are expected to spend US$55bn in 2030, growing 8.8% annually from where it is today.

There are around 400,000 global water utilities companies.

Different countries and even regions within countries take different approaches to managing water. In France for instance, water is controlled by 37,000 local councils who sometimes set up their own utilities and other times contract to large corporations. Germany has more than 6,200 water utilities.

There are also large global players like Veolia, Suez and others.

Market Trend: Digital Transformation

The water industry is also working to update its technology so that it can provide more modern customer service, inline with what consumers expect, and efficiencies (e.g. around recovering overdue invoices).

Gentrack’s Current Position

Gentrack has strong market share in Australia and the UK’s water utilities.

The challenge in such a fragmented market is that the cost to sell and serve a small council may outweighs the possible revenue. Alternatively, Gentrack’s solution offering, business model or service may need to change to meet the market.

While spending is expected to grow there doesn’t appear to be as compelling of a need for change as there is in the energy sector.

Airport Market

Gentrack’s subsidiary, Veovo targets airports.

How to Size and Segment This Market

There are around somewhere between 5,000 and 10,000 commercial airports globally that would have enough passenger traffic to be interested in Veovo. This number may even be somewhat smaller.

Veovo’s value proposition requires a level of passenger traffic and revenue that would benefit from its technology.

Of these airports some are their own independent operations, like Sydney Airport, others are part of a group, like Norway’s state-owned Avinor which controls most civil airports in Norway.

The total market for airport software is forecast to be US$4.2 billion.

While airports took a severe hit from COVID they are on the road to recovery and expected to return to pre-pandemic levels in the near future.

Market Trend: Real-time Data

Passengers, air traffic controllers and airlines demand greater access to data.

Passengers, influenced by other apps they can access, want the same level of digital experiences and access to data that they get elsewhere.

Air traffic controllers' access to data helps them work more efficiently and effectively.

Airlines in turn can use this to improve passenger experiences and run more efficiently.

Market Trend: Security

Airlines are under increasing pressure to make their security tighter while simultaneously providing a more seamless check-in experience.

Market Trend: Operational Efficiency

Airports, often held by Governments or financial institutions, are constantly under pressure to provide cost savings or shareholder returns. This drives the need for operational efficiency.

Gentrack Veovo’s Current Position

Veovo has over 120 airports as customers or around ~2% market share.

Veovo has potential beyond Airports so this offering’s market may be much larger given Veovo’s early forays into railways and other similar infrastructure.

Product: a Customer-focused Billing Solution at Its Core

Gentrack’s product is best thought of as a solution; a combination of software, professional services and practices. Some of the software in the solution is owned by Gentrack, other components are supplied by partners like Salesforce and AWS.

The professional services help the customer customise the software, sometimes extend it, integrate it into the customer’s existing technology and run the solution ongoing.

At its core, Gentrack’s solution is a customer-focused billing solution. From this core other capabilities like Data Analytics & AI, Meter Data Services and Profitability Management is made possible.

In comparison to the older systems utilities are used to and likely have, Gentrack offers the ability to move much faster. These old systems can take months to make changes with significant costs attached, which often means they don’t happen. In contrast, Gentrack can overcome this.

Additionally, older systems just weren’t designed to handle the flow of data that is now required. Especially for electricity and water networks that have ever growing data input points from devices, markets and customers.

Veovo’s Airports Product

Veovo’s airport offering is a similar solution, a combination of software and professional services.

The challenge facing Veovo’s roadmap, with the addition of railway stations and theme parks to its customer base, will be balancing investments in better functionality for airports with that of this new segment that will undoubtedly have unique needs. Veovo also runs the risk of complicating or diluting its airline offering.

On Both Products

Land and expand: Both Veovo and Gentrack’s core offering have the ability for a customer to start in one area and then expand. This allows customers to trial in contained areas which can dramatically reduce sales cycles and risk.

Enterprise Sales and Pricing: given the combination of software and services, Gentrack’s solutions are going to start in the tens and hundreds of thousands depending on customer needs.

Business Model: Solutions Sold Through Directly and Through Partners

Across Gentrack’s utilities and airport solutions, their business model is:

Gentrack has a set of base software modules that it has developed and continues to develop

Sales team or a partner directly identifies an opportunity

Customer runs a project to implement Gentrack or Veovo (either in full or as a pilot)

Customer engages ongoing through a subscription and/or managed service

Region by Region Economics

Gentrack needs to approach the market region by region. Each region will require improvements to software to meet local needs, even if just local language support.

For example, the February 2023 announcement of a reduced EBITDA in order to invest in “strategic R&D and sales” for Singapore and EMEA shows the region by region go-to-market approach that Gentrack needs to take with its core utilities product. For reference the investment is around NZ$3.25m (3% of $108.2m).

Developing a region can also take time. For example, Singapore has been a strategic focus of Gentrack for some time now with a mention back in the FY19 annual report.

However, once the first customer is onboard in a region the marginal cost to serve the next one should be lower in that region.

The airport solution appears to have less of a requirement for this based on market structure and that it has already been sold to airports in a variety of countries already.

Go-to-market: Direct Region by Region and Through Partners

Gentrack’s go-to-market for utilities is to go directly and through partners. Partners are essential to scale under this business model.

Utilities

Direct

Gentrack is setup to grow globally, directly in all regions except the Americas.

Direct sales, given the revenue and lifetime value of a customer is in the millions, likely requires experienced enterprise sales professionals with experience in software and/or utilities.

[image of global map with marker in UK, marker in Singapore, markers in Melbourne and Auckland. Then do arrows to show them selling into new markets from UK to EMEA, arrows from Singapore to Asia]

Partners

Partners will allow Gentrack to . While this might reduce the project fees Gentrack makes per customer, it will allow the more valuable recurring revenue to increase more scalably.

Gentrack has already partnered with market leaders:

AWS has global reach with a large sales organisation that is proven to generate business for partners. Gentrack’s unique market focus will likely make it a key partner for AWS in utilities.

Salesforce, like AWS, has global reach and a large sales organisation that can generate business for partners, especially specialists. The only challenge with Salesforce for Gentrack is that it has somewhat competitive offerings like its Energy & Utilities Industry Cloud. This is either great or introduces some uncertainty around how the partnership will perform in terms of new business.

Accenture, Infosys and Big Systems Integrators: these large, multinational professional services companies have existing relationships with most large organisations and are (debatably) able to perform the surrounding digital and technology transformation that would go alongside Gentrack’s work.

Utilities Specialists: Gentrack has also partnered with utilities specialists like Merkle to sell and deliver their offering.

Airports

Veovo’s go-to-market is simpler. It sells directly to airports and others through its own people that it has people positioned around the world.

Competition

Utilities

Competition in the utilities market can be split into high level groups:

Legacy: the incumbent providers with technology that is somewhat dated and hard to make fit modern requirements or the speed of modern technology. Their advantage is that utility companies are likely already using them.

Cloud Platforms: the cloud platforms are the general platforms used across industries to deliver cloud-based software and customer experience solutions. They are both competitors and possible collaborators. Utility companies can work directly with the cloud platforms to deliver the solutions utility companies need. Some, like Salesforce, even have industry focused solutions for energy and utilities.

Consulting:

Vertical Software: companies focusing their software centred solutions on the utilities industry.

Here are some examples:

In the larger utilities and energy Gentrack’s primary competition will be with Legacy, Cloud Platforms and Professional Services.

In the regions with more fragmented utilities markets, particularly in water, it will be the Vertical Software that will challenge Gentrack. Particularly because some of the competitors look to have business models and products better suited to making smaller sales to smaller organisations.

Veovo

Veovo’s competition in airports is primarily the goliath that is Amadeus alongside a number of relatively smaller players like GoCivix and INFORM Software.

Amadeus has somewhat of a stranglehold on the airline industry and other forms of transport like rail due to its core booking and travel management systems. Having this core set of data means Amadeus can create problems for new entrants (if they require the data).

However, Veovo is presenting the industry with a fresh, faster moving alternative that does not appear to rely too heavily if at all on data from others (like Amadeus).

Financials

The key areas of Gentrack’s financials we will look at are:

Revenue

Growth and the Rule of 40

Significantly declining profitability

Revenue

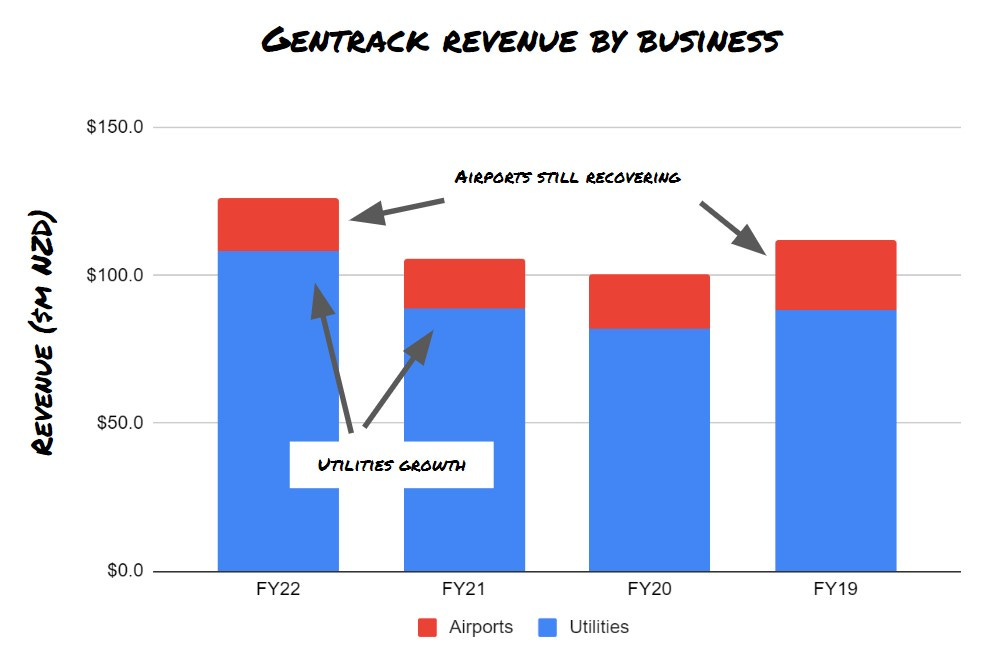

The Utilities offering is experiencing strong revenue growth while Veovo, the airports focused business, is still recovering.

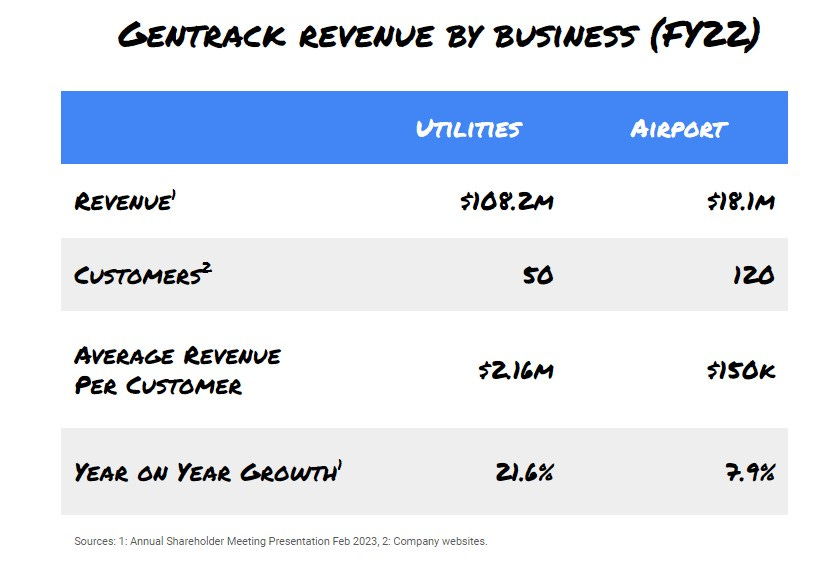

Gentrack’s revenue per customer is in the millions for utilities and low hundreds of thousands for airports.

It’s worth noting the difference in customer value between the businesses, which will lead to different types of sales teams, different cultures, different processes and more.

Gentrack’s financials don’t separate out Veovo recurring and Utilities recurring revenue so the average recurring revenue per customer is unclear. Utilities revenue also appears to have one-off charges that would distort the average revenue per customer, such as the c.$25m one-off revenue noted in the FY23 guidance.

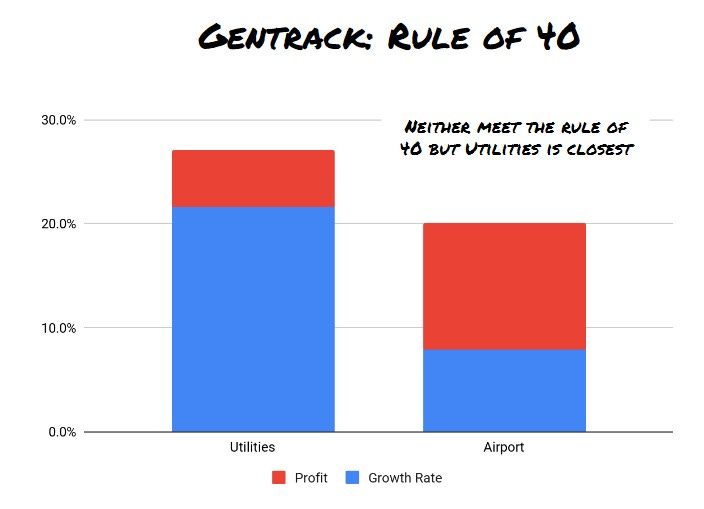

Growth and the Rule of 40

The 20% growth rate of the utilities offering, if it can be maintained, puts the business in a high growth situation. To put this growth rate in perspective 20% growth continued over 5 years would see the business triple its revenue and reach almost $300m turnover annually. Compare this to, say, a 10% growth rate and the business doesn’t even double in revenue over 5 years.

The airports offering, purely from the angle of growth rate, is an entirely different category of business. It’s much slower growth unless its forays into other industries or the recovery of the airport sector can help drive the growth rate back to the ~20% mark seen pre-COVID.

Another way to look at this is with the Rule of 40. The Rule of 40 is a quick rule of thumb to see if a decently sized software business is getting the balance of growth, investment and operations right.

Neither Utilities or Airports meet the rule of 40 but utilities is close. Utilities either needs to grow faster or produce higher profits to put it on the same league as success stories like Salesforce, Splunk and Oracle.

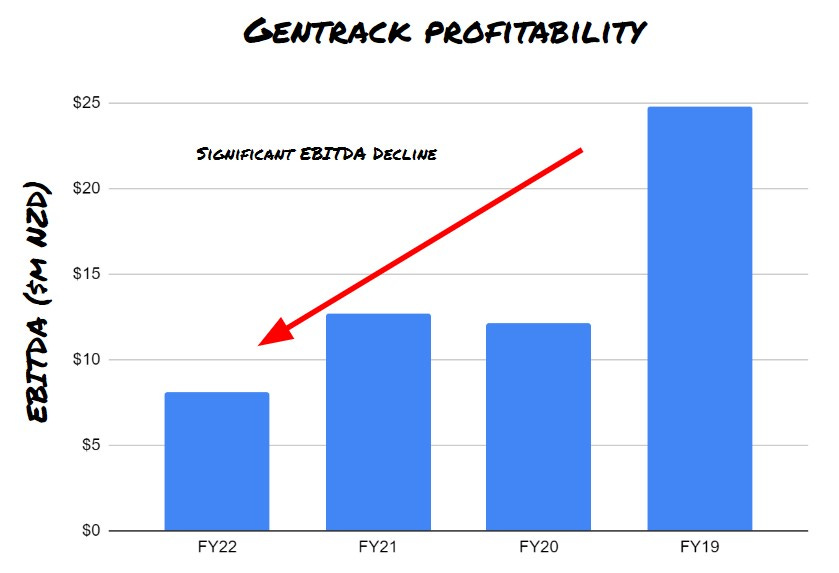

Significant Profitability Decline

Gentrack’s net profitability has declined significantly. Going from 12% of revenue in FY2021 to almost half that, at 6.41% of revenue in FY22.

This is attributed to investing in more R&D and sales. This decline is somewhat of a trend over time.

This trend matters in today's world with a focus on profitability.

Real quality deep dive. Good work Scott.

I must admit I'm still a in little bit of disbelief on the massive re-rating they had in December with the release of the annual report. Results were certainly good, but I didn't think they blew it out the water. Credit to the team still for delivering in a difficult environment and keeping the forward momentum with consistency.

Well done on a solid write-up mate.