Acusensus: Strong AI IPO on the ASX

Road safety technology using AI posts strong growth and international wins

Acusensus has built a beachhead in Australia with long Government contracts won through its leadership in detecting illegal mobile phone use and other road safety issues.

It’s recently proven it can compete internationally with contracts in the UK and USA.

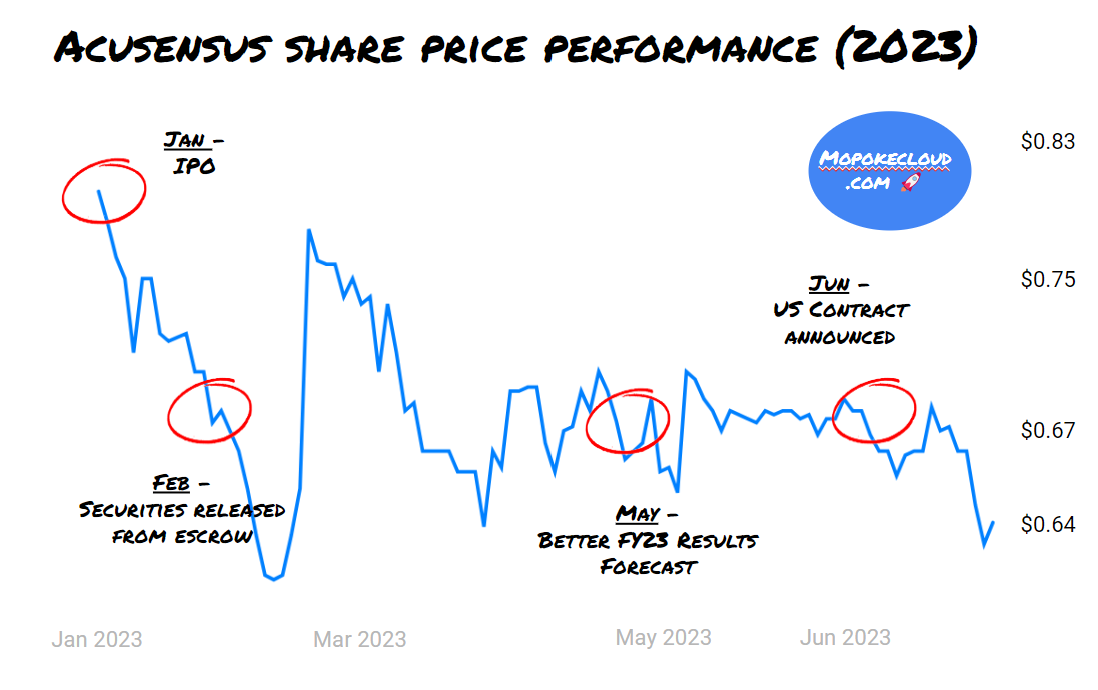

Acusensus has come out of the IPO gate strongly, upgrading guidance in its first 6 months. It’s been able to deliver growth and profits.

Summary

Our View: Acusensus has a window to use its world-leading technology in detecting mobile phone use to establish itself for bigger opportunities in AI-enabled road safety enforcement.

Key Risks:

Customer concentration: Acusensus has a small number of Australian government agencies making up the bulk of its revenue.

Accessibility of AI: AI is becoming more and more accessible to ‘traditional’ technology developers, meaning it is only going to get easier for incumbents providing existing road safety services to catch up.

Slow, costly sales cycles: selling into government, particularly to tenders, is a slow and expensive process. Significant investments in business development generally need to be made well in advance of revenue.

Bull Case: their technology advantage allows them to fasttrack a typically long, tedious and expensive sales cycle to government agencies.

Bear Case: a typically slow sales cycle combined with more accessible AI services means the high number of speed detection incumbents catch up to make growth a challenge.

Overview

Acusensus provides a technology-driven solution to law enforcement agencies to detect road safety issues such as illegal mobile phone use while driving, speeding and seatbelt use.

Acusensus has 5 multi-year contracts with government agencies. Acusensus has over 72 employees primarily located in Melbourne but with a few in other Australian states as well as the US.

Acusensus was founded in 2018 and went through the Melbourne University Accelerator. They listed on the ASX in January 2023, raising around $20m. Prior to listing, the company had raised approximately $18.8 million.

Market: Road Safety Agencies

Acusensus sells into the market for road safety, with a strong focus currently on enforcement. Acusensus’s unique point of difference is detecting mobile phone usage.

The total addressable market is global, taking in any country or locality with vehicles and mobile phones that wants to enforce road safety.

Here is a great articulation of the problem: sending or reading a text takes your eyes off the road for 5 seconds. At 55 mph, that's like driving the length of an entire football field with your eyes closed.

However, the serviceable market for Acusensus is currently constrained by two key factors:

High touch, direct sale: multi-year contracts at the price Acusensus charges with Government agencies typically require high touch, some in person sales with an understanding of the local environment.

On the ground service delivery: Acusensus’s solution currently requires physical equipment on site and the management of that equipment by trained people.

These constraints reduce the market to Acusensus’s plan and operating locations of Australia and New Zealand, North America, UK, Europe.

Even with this reduction in the serviceable market, in each of these markets there is almost complete restriction of mobile phones while driving in some form with only a few exceptions.

Acusensus does have plans to sell through partnerships and there is an early partnership with Ador in India, AECOM in the UK and Westat in the US but these are still in the early stages. This will help remove one of their serviceable market constraints.

It’s also key to note that Acusensus does more than phone use detection and also covers speed and seatbelt use amongst other road safety issues. While the analysis below focuses on enforcing phone use because it’s Acusensus’s door opener, it is essentially the same market for Acusensus’s broader solutions which is the market for road safety enforcement.

North America (US , Canada)

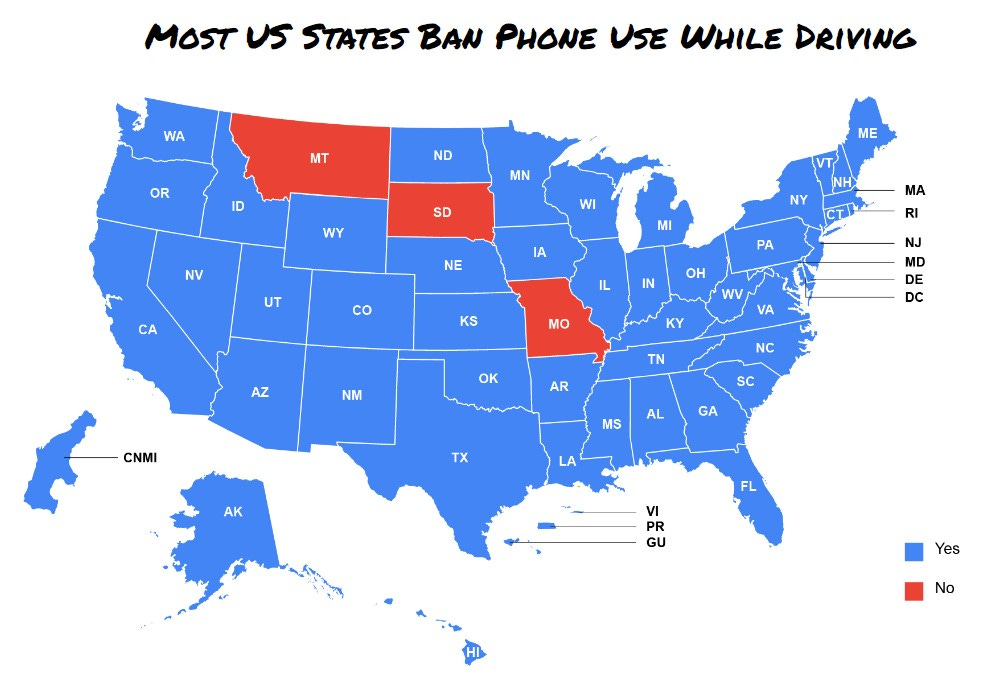

In the United States, almost every state (45) bans the use of mobile phones while driving, the laws are made by each state.

Distracted driving, particularly with cell phones involved, is seen as a major issue. In April there was a big federal push around distracted driving.

Of the 3 states that do not ban mobile phone use while driving, 1 bans it as a secondary offence - another offence needed to have occurred for it to apply - and 2 (Missouri, Montana) just don’t ban it at all.

In Canada, all states and territories (13) ban or restrict cell phone use.

So there are a total of 56 regions in North America that Acusensus can target. Beyond this there are likely more local bodies or organisations that are also a target.

United Kingdom

Acusensus has run successful, country first trials of mobile phone use detection underway with England’s national highway authority.

In the UK it is illegal to hold or use a device while driving. The laws are then enforced by police and localities (like councils). There are 45 territorial police forces and 317 councils.

The buyer, in Acusensus’s view, could be either the police force, the local transport authority, council or road manager (e.g. the National Highway Authority).

Europe

The use of hand held devices while driving is also illegal in most European Union countries. Sweden, one of the last holdouts, banned its use while driving in 2018.

Research in the European Union found that mobile phone safety offences outnumbered other safety issues like driving without a seatbelt.

Australia and New Zealand

Australia and New Zealand are Acusensus’s home market where Acusensus has successfully secured contracts with 50% of Australia’s states and territories (NSW, WA, ACT and QLD) and within these relationships there is scope to expand further.

Here is a breakdown of Acusensus’s market share:

Rest of the World

Globally, according to the World Health Organization, road safety issues are most prevalent in low and middle-income countries where 90% of road traffic deaths occur.

Road safety issues cost most countries 3% of their gross domestic product.

The key issues the WHO sees are (bold are those relevant to Acusensus):

Speeding

Driving under the influence

Nonuse of helmets, seatbelts and child restraints

Distracted driving (e.g. phone use)

Unsafe road infrastructure

Unsafe vehicles

Inadequate post-crash care

Inadequate law enforcement of traffic laws

Product: All in one solution for enforcing road safety

Acusensus offers a solution that is a combination of equipment, services and technology to law enforcement so that they can detect road safety infringements.

Acusensus’s technology is the centrepiece, allowing Acusensus to detect a variety of road safety issues like mobile phone use, no seatbelts, speeding and more.

Acusensus makes this technology easy for its customers to use by managing and operating the equipment on their behalf.

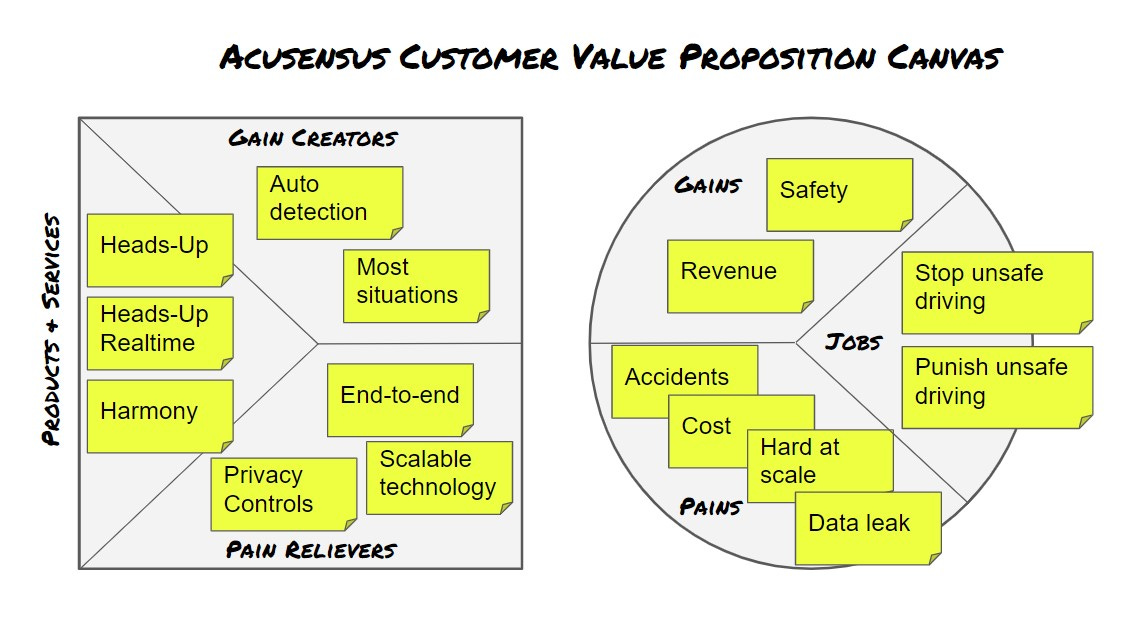

Customer Value Proposition

A common way for technology teams to look at their product and their customer is through the Customer Value Proposition canvas. Here is one for Acusensus with “law enforcement” generally as the customer:

Acusensus’s customer, and therefore customer value proposition, in reality is a little more nuanced than this because potential customers, globally, even if you focus on “law enforcement” encompasses:

Police

Road and transport management authorities

Local or municipal authorities (like a council, shire or town)

Each of these will have their own unique needs and pains, that differ subtly but will affect their desire for the product and its use which then affects product’s success and roadmap.

Technology

Acusensus’s technology stack spans across hardware and software. The key parts appear to be:

Camera: this appears to be quite a specific type of camera to suit road safety scenarios.

Camera Support Hardware: there is a variety of hardware required just to run a camera that is sending data back for analysis. Hardware like solar panels, batteries, computers and data connectivity devices.

Camera Management Software: software that manages the camera and sends data back to home base. This may also do analysis on the device to do some preprocessing before sending back to Acusensus’s Cloud.

Data Ingestion: a service for receiving and storing the data that is received from camera’s (which is a material amount of data).

Data Recognition Engine: a service capable of automatically detecting road safety issues.

Manual Management: apps to allow internal manual checkers, apps to allow customers to see what they need (users, managers, admins).

Customer Apps: apps to allow customers to see what they need.

Note: this stack hasn’t been verified with Acusensus (yet).

This technology stack raises a few questions:

Can their technology be sold as a Software-as-a-Service subscription to other safety camera operators?

What proportion of detection is fully AI? What portion is checked by humans? This will keep reducing over time as they learn plus gain more and more data.

The current fast pace of AI and accessibility of services raises the risk that competitors may be able to fast follow.

Business Model: End-to-End Solution Sold to Government Agencies

Acusensus provides an end-to-end managed solution as well as some of the components in that solution in an enterprise sales motion. They are primarily targeting multi-year agreements with what are in reality or essence government agencies.

This entails a business model with some key components:

Sales motion that requires high touch, even when through partners.

Equipment (e.g. cars, signage or camera hardware) to service contracts.

Technology research and development to further automate and enhance detection (in order to stay ahead of competition and reduce operating costs)

People to manually manage the equipment

People to manually help with detection (algorithms don’t catch everything and require verification and training)

Customer relationship management to help customers use the solution and also to help ensure renewals

Go-to-Market: Sell Directly + Emerging Partner Channel

Acusensus’s success to date has been driven by selling directly to Government agencies, specifically Australian government agencies.

There is early success selling through a partner, AECOM, in the UK. This represents an opportunity for Acusensus and also a challenge. Building a partner channel is a new go-to-market channel for them.

Competition:

There are two ways to view competition for Acusensus.

Road Safety Enforcement: road safety organisations employing various techniques and technology to enforce road safety.

Alternative Prevention: this is where the issue itself is dealt with further upstream.

Let’s explore Alternative Prevention first. For the various road safety issues Acusensus provides solutions for, it is possible that alternatives may be introduce that solve the problem before it occurs. For mobile phone use, for example, it is conceivable that phone manufacturers or car manufacturers implement solutions to stop people from using their phone in distracted driver situations. Similarly, car manufacturers could implement technology to prevent a car from moving if the seatbelts are not fastened.

There are real examples of this. AT&T Drive Mode activates when a car reaches a certain speed and prevents text messages. Apple’s Do Not Disturb While Driving mode blocks incoming calls and texts when the phone detects the user is driving.

These (a) aren’t or won’t be adopted by everyone, (b) will take some time to be widespread enough to meaningfully negate the need for Road Safety Enforcement and (c) there will still be people that workaround it.

Reality is that these alternative prevention solutions will help solve the problem but don’t remove the need for enforcement solutions. Add in that Governments are unlikely to remove or reduce their regulations around road safety (they have increased rather than decreased historically) and there is a clear, continuing need globally for Road Safety Enforcement.

Road Safety Enforcement Competition

The competition for road safety enforcement can be divided loosely into different categories. Detection of:

Mobile Use

Seatbelt Use

Speed Limits

License Plates

In mobile use detection, Acusensus is globally pioneering the field. There is one other public trial from 2019 in the Netherlands and another from Saudi Arabia.

In seatbelts, Acusenus provides a comprehensive solution but they are up against focused competition. There are also publicly available algorithms for others to implement this, including a seat belt detection algorithm available for anyone to easily deploy on the Microsoft Azure Marketplace.

In speed detection, there is significant competition. This includes the former employer of the Acusensus CEO, Redflex.

In license plate recognition, or Automatic Number Plate Recognition (ANPR), you’ve got everything from large multinationals selling end-to-end solutions and specialist hardware through (i.e. Motorola) to established businesses with a scalable business models to service the globe (e.g. Plate Recognizer).

The competitive challenge for Acusensus is whether their lead can be capitalised on faster than the other players can replicate the technology advantage. Given the relatively slow sales cycle of government agencies and a government tendency towards lower risk existing suppliers, this is a key challenge.

Financials

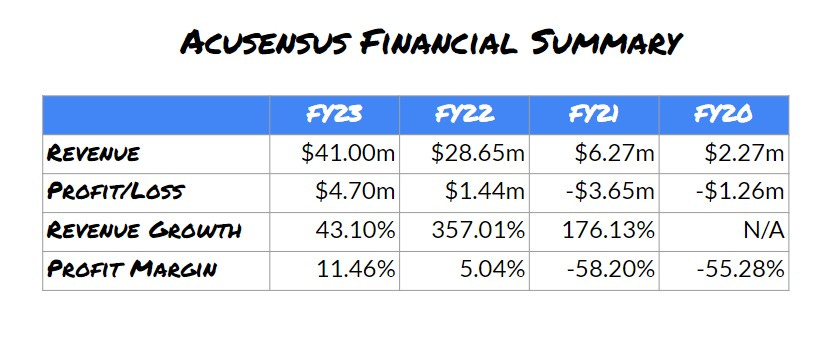

Acusensus has posted strong revenue growth from winning large government contracts on a small starting revenue base.

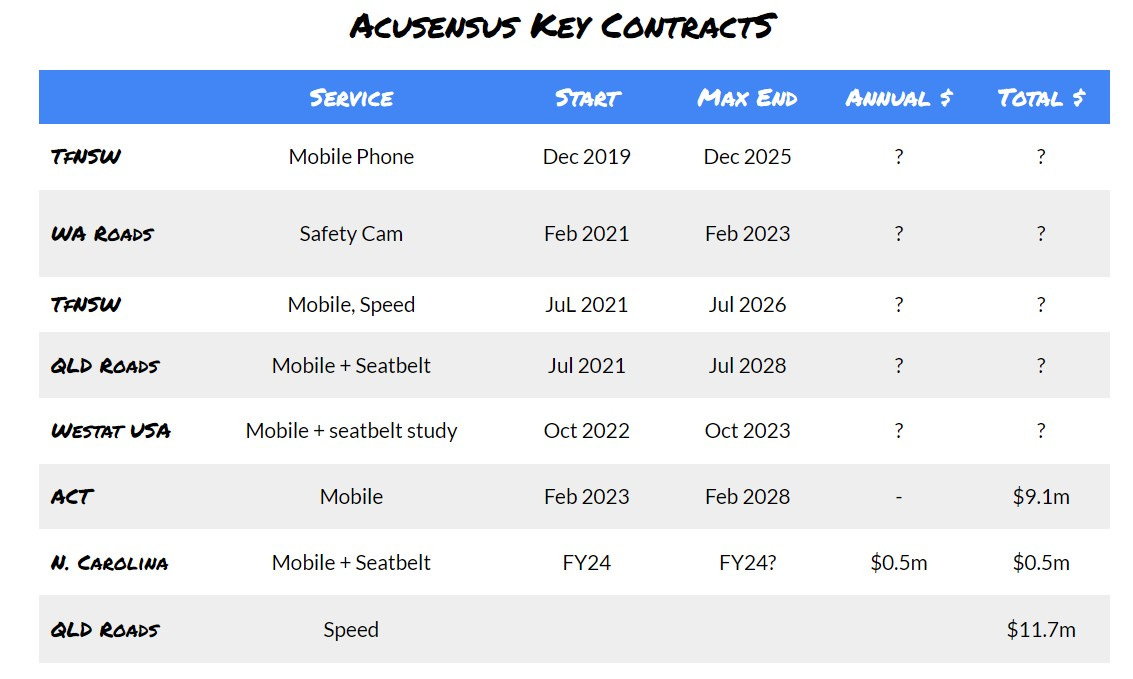

These relatively large customer contracts are worth closer analysis. They are at the heart of Acusensus’ financials.

They have under pin the short term financial results of the business.

Many of them still have years to run (see table below)

New contracts are incremental, adding to this revenue base. However, new contracts also require additional investments in equipment.

There is customer concentration risk with the bulk of revenue coming from 3-5 key contracts.

Growth and the Rule of 40

A key question is how growth will track in the future. The growth to date has been significant thanks to the large contracts we’ve discussed already. It’s hard to replicate tripling the size of your business every year and new contracts.

Acusensus either needs a lot of contracts the size of North Carolina ($0.5m over one year) or a smaller number of ACT size contracts ($9.1m or ~$1.8 if annualised) to continue growth like it is expecting to experience in FY23.

I always like to use the Rule of 40 to quickly see if a company is getting the balance right between growth and profit. With growth expected to be over 40% for FY23, Acusnesus finds itself already in the sweet spot. It’s ability to be profitable only adds to this.